Life Insurance Cover Funeral Costs

Yes it can and in fact I think its a terrific tool. Both provide a lump-sum benefit although funeral cover provides a smaller amount.

Guide To Buying Life Insurance For Parents Elderly Burial No Exam Lincoln Heritage Life Insurance Cost Life Insurance Quotes Affordable Life Insurance

If you want to avoid your loved ones being burdened with funeral and burial costs when youve passed on then you will need a plan.

Life insurance cover funeral costs. Only pays you enough to cover the cost of your funeral. Pays you between 100000 and 15 million which can be used to clear any debts you. No medical required or health questions asked.

Most types of life insurance will cover these costs as well. They can choose to pay for your funeral with it but its not automatically set up to pay for your funeral unless in addition to your life insurance you have also taken out additional funeral cover. If your income and needs support it.

Does life insurance cover funeral costs. A life insurance policy is designed to help your family cover the cost of funeral expenses and other costs such as capital gains legal fees and estate taxes as well as even small cash gifts for beneficiaries upon your death. College now has a very expensive price tag and should be factored in.

After two years of cover theres an early payout available for terminal illness to help you get your affairs in order. Premiums beginning from 919 a month 1 - depending on your age and the plan you choose. A traditional life insurance policy like term or whole life can also cover your funeral costs.

Its a good option if you dont qualify for a traditional life insurance policy have a lot of debt or can only afford a small amount of coverage. You generally make monthly payments from the time you buy the plan to the time you die so if you live for a long time you could end up. By Natasha Cornelius Oct 3 2018 InsuranceLife 3 comments.

Funeral and burial fees may be as much as 15000. Funeral burial expenses This is what most people think of when they hear life insurance. Where you live will likely affect the cost of your funeral.

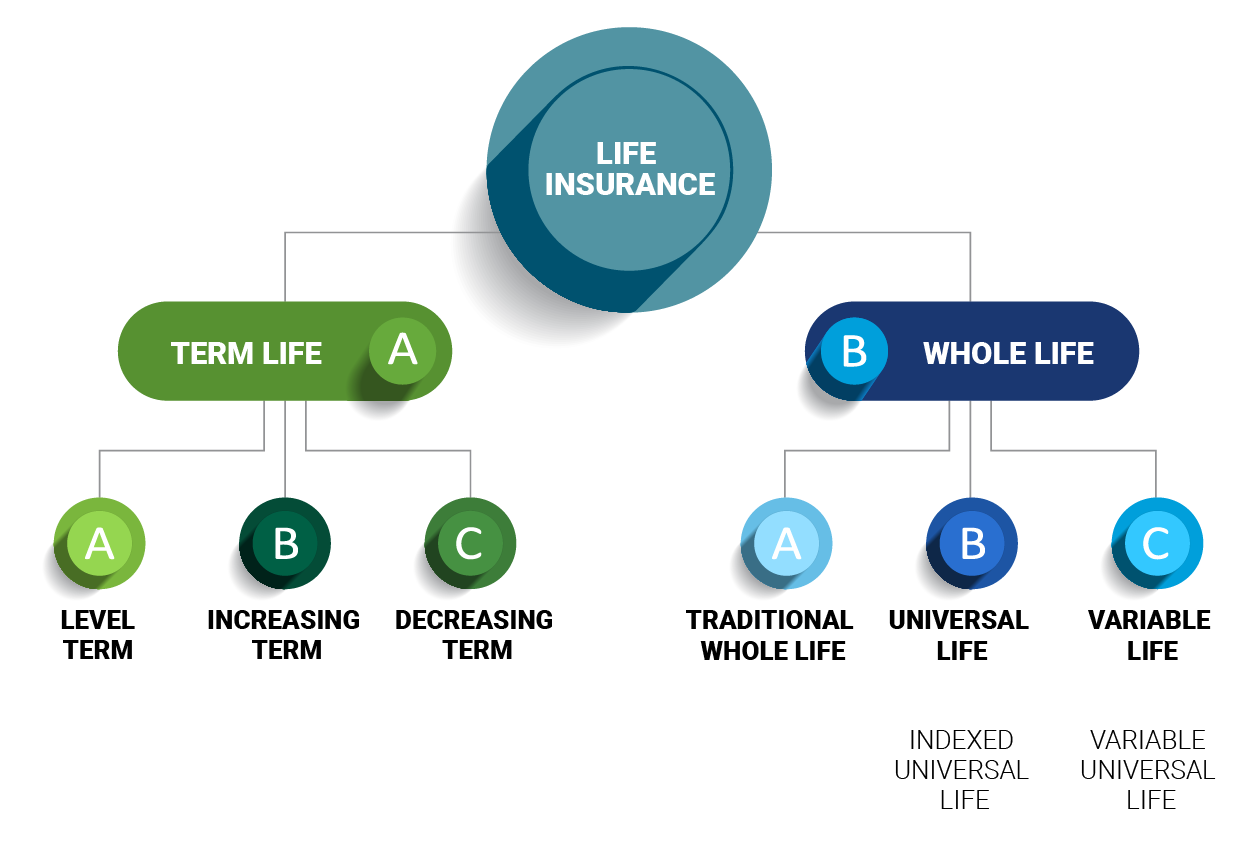

When people think about life insurance term coverage is what usually comes to mind. You must have a policy that is in effect at the time of death and since none of us knows when that will be it is best to buy permanent insurance vs term insurance. Over-50s life insurance plans pay out a lump sum when you die which can be used to cover funeral costs.

It is usually a low-cost option that can provide peace of mind for you and your loved ones. However with a term-level insurance policy its likely you will die after the policy expires or if its a decreasing term policy die when the payout isnt high enough to cover the significant expenses of a. Pearl Funeral Plan.

The remainder of. 2025 a month is based on the maximum term of 25 years with a total cost of 607626. There are companies that sell small final expense policies or you can even use a larger policy.

Term life insurance Term life insurance provides coverage for a set number of years. How Does Whole Life Insurance Work. If the policy is not assignable families will be unable to use life insurance to cover funeral costs.

Purchasing a life insurance policy will help your loved ones cover your funeral expenses. Burial insurance which is also called funeral insurance or final expense insurance is a type of whole life insurance read. Can Life Insurance Cover Funeral Costs.

Everything included in the Amber Funeral Plan. But depending on the type of life insurance you have it might not cover everything. Funeral Cover is a simple insurance policy with guaranteed underwriting acceptance.

On average funerals cost 8000 to 10000. Life Insurance Can Cover Funeral Costs About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features 2021 Google LLC. Funeral cover as part of your life insurance chosen by 17 of people who made provisions When you take out a life insurance policy you might want to ensure the sum insured will cover your funeral.

How Much Is Term Life Insurance if I Just Want to Cover Funeral Expenses for Myself. You can choose up to 30000 of cover which can be used to pay for your funeral expenses or other associated costs putting your mind at ease. If youve chosen a decreasing term life insurance policy for example with the main aim of paying off any outstanding debts there might not be enough left to cover the whole cost of your funeral as well.

Guaranteed acceptance if youre aged 50-80. Whole life insurance. Does life insurance cover funeral or burial costs.

This is in large part because insurance companies can take at least 6 to 8 weeks to process a claim. Your loved ones can use part of a life insurance payout to cover the cost of your funeral. That helps cover the costs of an individuals final arrangements such as the memorial service casket or urn and burial or cremation.

When comparing life insurance vs funeral insurance the costs and benefits should be closely examined. You should create a robust plan for your family that includes your last wishes and a financial safety net. Use an Advance Funding Company.

If you passed away during that. Yes life insurance is a very good way to cover funeral costs. Burial insurance also called final expense insurance or funeral insurance can cover the costs associated with medical bills or a funeral to ease the financial burden on your family.

The main difference is that life insurance provides your dependents with long-term financial security while funeral insurance takes care of the short-term burial expenses. Typically this is long after the funeral has taken place. A quality wood-effect coffin.

The SunLife Guaranteed Funeral Plan is an insurance policy which guarantees to pay for your chosen funeral services provided by Dignity. If you have a life insurance policy when you die your dependents will receive a lump sum payment. With several policy options and riders to choose from its more customizable than a final expense policy.

College tuition-This could be for you or your children and does not have to be at the present time. This type of coverage provides income protection for a period of time when your family is most vulnerable.

A Simple Plan To Cover Funeral Costs More Guaranteed Acceptance Instant Approvals Get A In 2020 Funeral Costs Final Expense Insurance Funeral Expenses

Fact The Average Funeral Costs Between 7 000 And 20 000 Life Insurance Can Help Your Family With This Expense Funeral Costs Life Insurance Facts Funeral

Does Life Insurance Cover Funeral Expenses Funeral Insurance For Seniors Funeral Expenses Funeral Life Insurance

How To Pick The Best Life Insurance Company Https Www Liveinfographic Com I How Best Life Insurance Companies Life Insurance Companies Life Insurance Quotes

Get Best 2020 Burial Insurance Quotes Life Insurance Types Life Insurance Policy Life Insurance For Seniors

Why Buy Life Insurance Infographic Usaa Life Insurance Comparison Life And Health Insurance Life Insurance

Funeral Expense Life Insurance Funeral Costs Funeral Funeral Expenses

Whole And Standard Life Insurance Quotes Life Insurance Quotes Insurance Quotes Life Insurance Companies

The Decline Of Life Insurance Is A Mystery Life Insurance Premium Life Insurance Policy Life Insurance Companies

Funerals Can Be Expensive For Your Loved Ones Luckily For You If They Are Properly Insured Their Life Insur Funeral Costs Life Insurance Policy Life Insurance

Pin On Cheap Life Insurance For Seniors

2019 Final Expense Life Insurance Guide Quotes Costs For Seniors Lincoln Heritage Final Expense Insurance Final Expense Life Insurance Marketing

Pin By Jenorris On Best Luxury Cars Funeral Costs Funeral Final Expense Insurance

Best Funeral Cover For Over 85 Funeral Insurance For The Elderly Life Insurance Policy Life Insurance For Seniors Mortgage Protection Insurance

Infographic Average Funeral Costs Seguros Casas De Un Piso Construccion De Viviendas

Funeral Insurance Infographics How Much Does A Funeral Cost In Canada Funeral Costs Life Insurance Cost Whole Life Insurance

Why Clients Buy Life Insurance Infographic Seguro De Vida Seguros Neuromarketing

Helping To Cover Funeral Costs With Life Insurance Funeral Costs Estate Planning Checklist Funeral Planning Checklist

Posting Komentar untuk "Life Insurance Cover Funeral Costs"