Kentucky Car Insurance Coverage

Kentucky requires the following required auto insurance coverage. It may surprise you to find out that classic car insurance costs much less than regular car insurance.

Cheap Car Insurance Rates In Louisville Ky

Your Kentucky insurance policy must at least contain liability insurance and no-fault insurance which are made up of three coverages.

Kentucky car insurance coverage. 25000 per person 50000 per accident. Penalties for failure to carry current insurance on a registered car in Kentucky include immediate registration revocation a fine between 500 and 1000 andor up to 90 days in jail. The state of Kentucky requires all vehicle owners to carry car insurance.

Bodily injury liability coverage and property damage liability coverage. In Kentucky a comprehensive policy with a 1000 deductible costs 1884 77 more than liability-only car insurance. Kentucky car insurance policies generally are renewed on a biannual or annual basis.

Consider including additional coverage to provide you with added protection. Better car insurance comes with a price. Kentucky car insurance requires a minimum of 255025 for bodily injury and property damage and 10000 in PIP coverage.

Kentucky car insurance minimum requirements. The average auto insurance price in Kentucky is 2050 per year more than the nationwide average by 437. Drivers in Kentucky are required by law to carry a minimum of 25000 bodily injury liability insurance per person per accident and 50000 bodily injury for all persons involved in a single accident.

For a comprehensive policy with a 500 deductible you can expect to pay 94 more than for basic liability-only coverage. Minimum Car Insurance Coverage in Kentucky. Bodily Injury to Others.

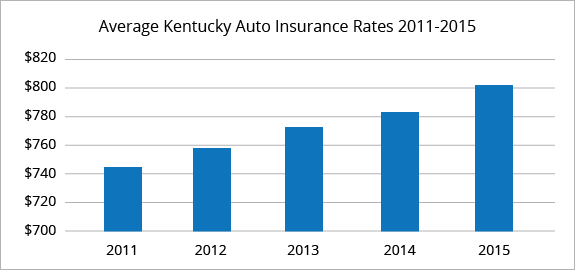

Car insurance policies are expensive in Kentucky. The minimum amount of Kentucky auto insurance coverage is 250005000010000. In 2014 Kentucky drivers paid an average of 91749 per year for a car insurance policy.

Have a look at some of the most commonly available options offered by most insurers. If you own or operate a vehicle insurance coverage is a must. Kentucky mandates that all vehicle insurance policies include PIP coverage with the exception of motorcycle insurance policies.

Property Damage Liability Coverage. In the event of a covered accident your limits for bodily injury are 25000 per person with a total maximum of 50000 per incident. 5 rows Kentucky is on the higher end for car insurance rates High accident statistics make road rules.

4 rows Types of auto insurance coverage in Kentucky. The state also requires 10000 property damage liability and 10000 personal injury protection. Kentucky requires that drivers have liability insurance.

Free Car Insurance Comparison. Bodily injury property damage and personal injury protection. Kentucky also requires drivers to carry personal injury protection.

The annual rates for a classic car policy generally run between 200 and 600 per year unless your car has a very high value while regular car insurance usually runs over 1000 each year. In addition the vehicle owner as well as the vehicle driver are subject to a fine of 50000 to 100000 up to 90 days in jail or both. Here is what that means for Kentuckians.

Kentucky car insurance has many coverages - so its important to research the options see what KY requires and what coverages are optional and how each can protect you in the vent of an accident or other loss. As with most states in order to register and drive your car in Kentucky the Commonwealth requires that you have a minimum level of certain types of auto insurance coverage. Kentucky drivers must have two types of auto liability coverage on their car insurance policies.

Heres a rundown of the main types of auto. 25000 per person 50000 per accident. First Insurance Group has relationship with multiple car insurance carriers.

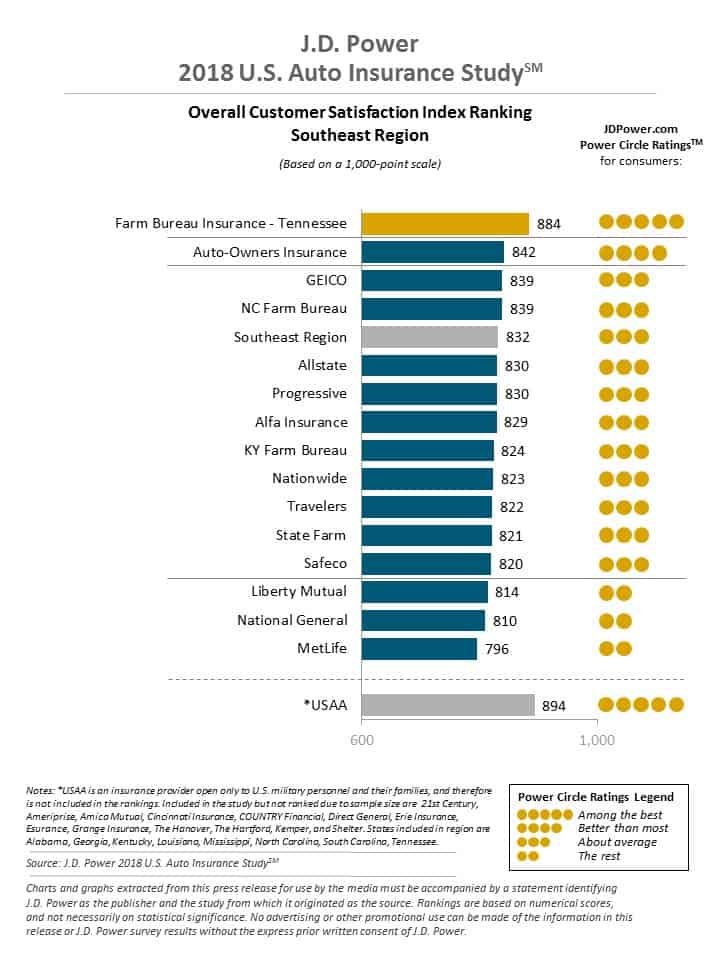

Kentuckys average cost of auto insurance is 931 for minimum coverage and 1710 for full coverage. Kentuckys car insurance is still cheaper than the national average of 98177 per year. However Kentucky has relatively expensive insurance and ranks near the bottom on the most affordable car insurance rates in the United States at number 40.

Kentucky No-Fault Car Insurance Rules and Requirements An in-depth look at Kentuckys choice no-fault car insurance system the kinds of coverage required in the state and more. At a minimum your policy must include liability insurance to cover third-party injuries or property damage if you cause an accident and personal injury protection to cover injuries to you and your passengers regardless of fault. Kentucky law sets minimum liability coverage limits of 255025 or a single limit of 60000.

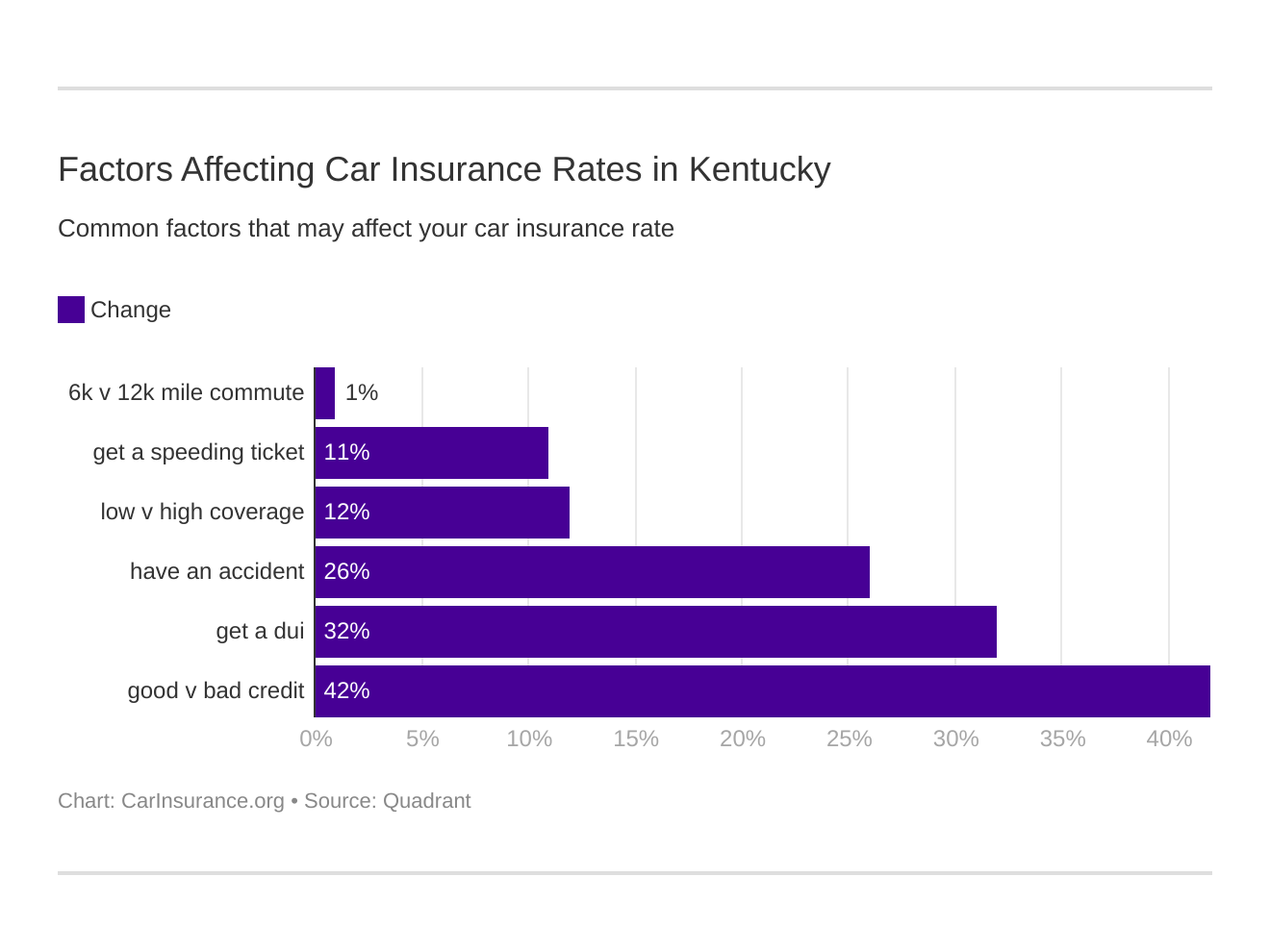

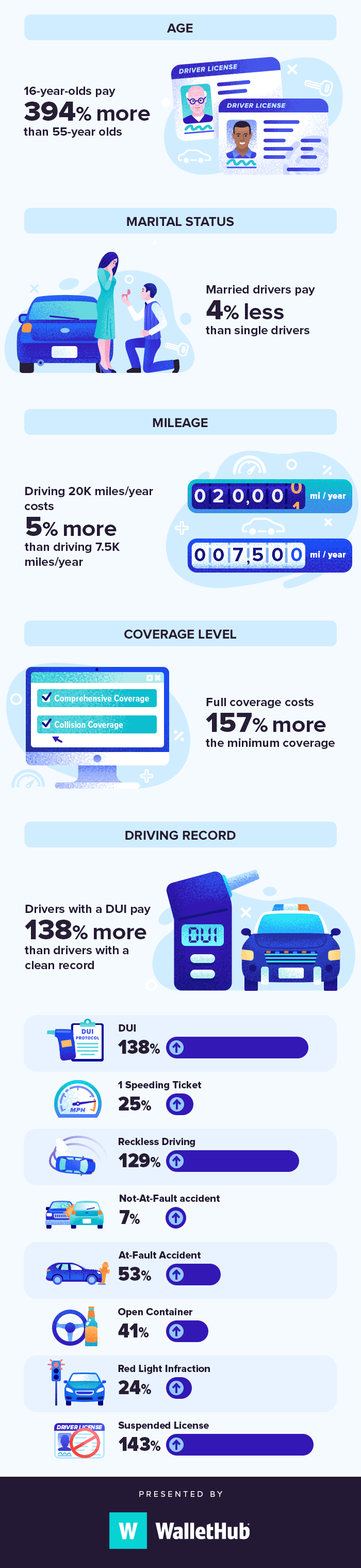

Car insurance premiums consider a number of details such as the insured partys driving record credit history gender age and. Bodily Injury Liability Coverage. The average KY car insurance rates are 77month.

Under this coverage up to 10000 is provided per person for lost wages. The average 12-month car insurance premium in Kentucky is around 800 depending on the chosen coverage. Your car insurance premiums are affected by factors other than the state in which you live.

An owner may not operate a vehicle in Kentucky until insurance has been obtained. But you dont need to settle for boilerplate liability coverage. Optional car insurance coverage in Kentucky While liability and PIP coverages are all that is required by Kentucky law there are many other great options available to add further protection.

Kentucky is a Choice No Fault Car Insurance State Minimum Liability Car Insurance Requirements in Kentucky More Information on Kentucky Auto Insurance Rules. If the average income per year is 33237 this means drivers are paying about 276 of their income on car insurance alone. Except for the opt-out alternative discussed below Kentuckys no-fault law requires all motor vehicles except motorcycles to carry personal injury protection PIP coverage.

25000 per person 50000 per accident. It also covers up to 10000 for damage to another persons property. According to the statute an owner who fails to maintain insurance on his vehicle shall have his vehicle registration revoked.

The Kentucky Car Insurance Requirements and Minimums. Kentucky roads are filled with adventure and danger. This insurance coverage pays up to 10000 per person per accident for injury-related expenses regardless of who was deemed to be at fault for the accident.

How Kentucky Personal Injury Protection Pip Car Insurance Works Valuepenguin

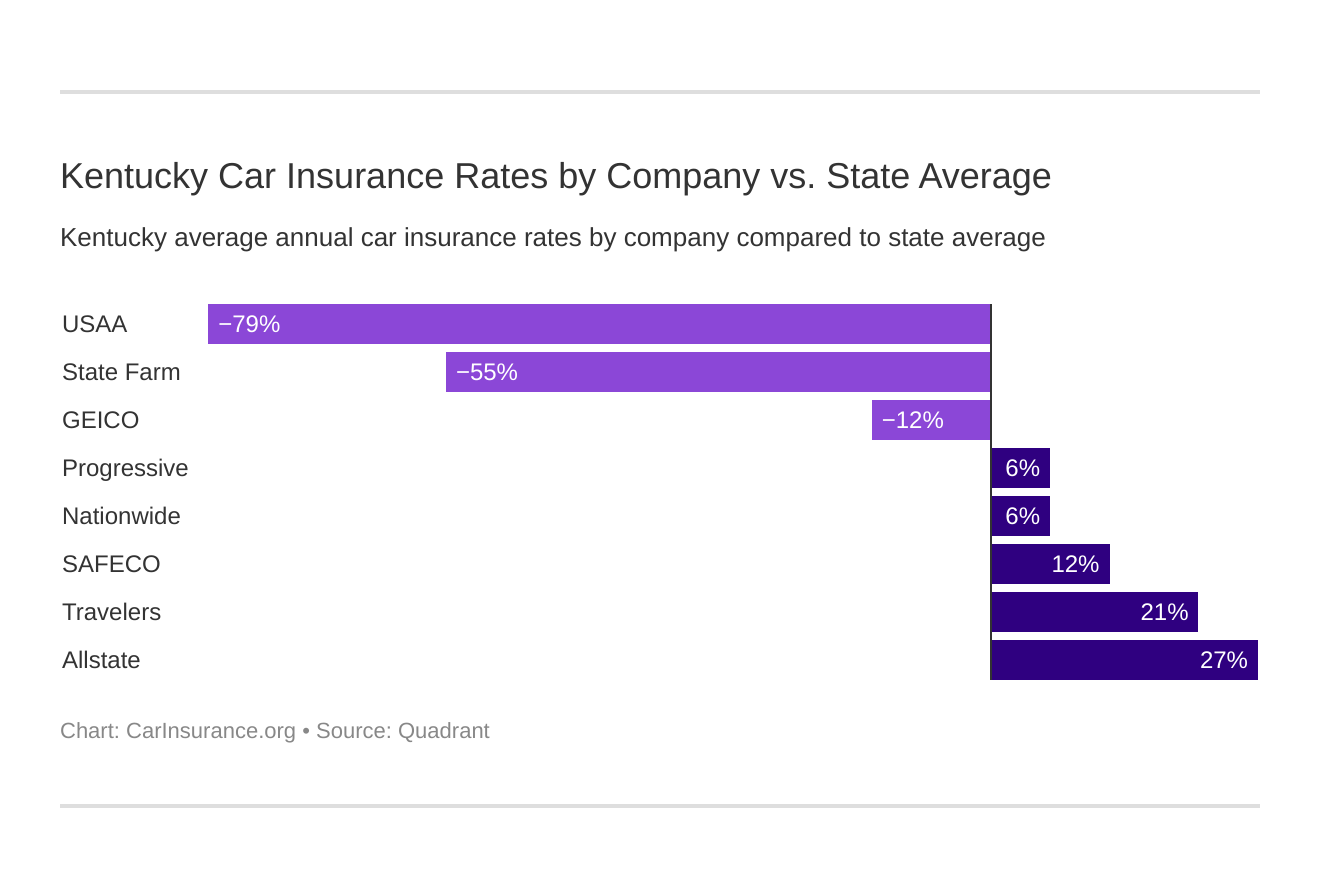

Kentucky Car Insurance Rates Companies Carinsurance Org

Cheapest Car Insurance In Kentucky Ky Dick Watts Insurance Inc

Who Has The Cheapest Auto Insurance Quotes In Kentucky Valuepenguin

Allstate Insurance Agents In Louisville Ky

Is Kentucky A No Fault State What To Know About Choice No Fault Laws

Kentucky Car Insurance Rates Companies Carinsurance Org

Cheapest Car Insurance In Kentucky For 2021

Understanding Auto Insurance Types And Limits In Kentucky

Kentucky Farm Bureau Insurance Rates Consumer Ratings

Kentucky Car Insurance Rates Companies Carinsurance Org

Car Insurance In Kentucky Ky Root Insurance

What Is No Fault Insurance And How Does It Work Quotewizard

Best Car Insurance Rates In Louisville Ky Quotewizard

Cheapest Car Insurance In Kentucky For 2021

Best Cheap Car Insurance In Kentucky 2021 Forbes Advisor

Wfgconnects Com Conniebarker Life And Health Insurance Insurance Sales Life Insurance Policy

Kentucky Farm Bureau Car Insurance Sep 2021 Review Finder Com

Full Coverage Car Insurance Cost Of 2021 Insurance Com

Posting Komentar untuk "Kentucky Car Insurance Coverage"