Health Coverage Short Gap Exemption

Health coverage is considered unaffordable exceeded 824 of household income for the 2020 taxable year Families self-only coverage combined cost is unaffordable. The information that follows is for tax years prior to 2019.

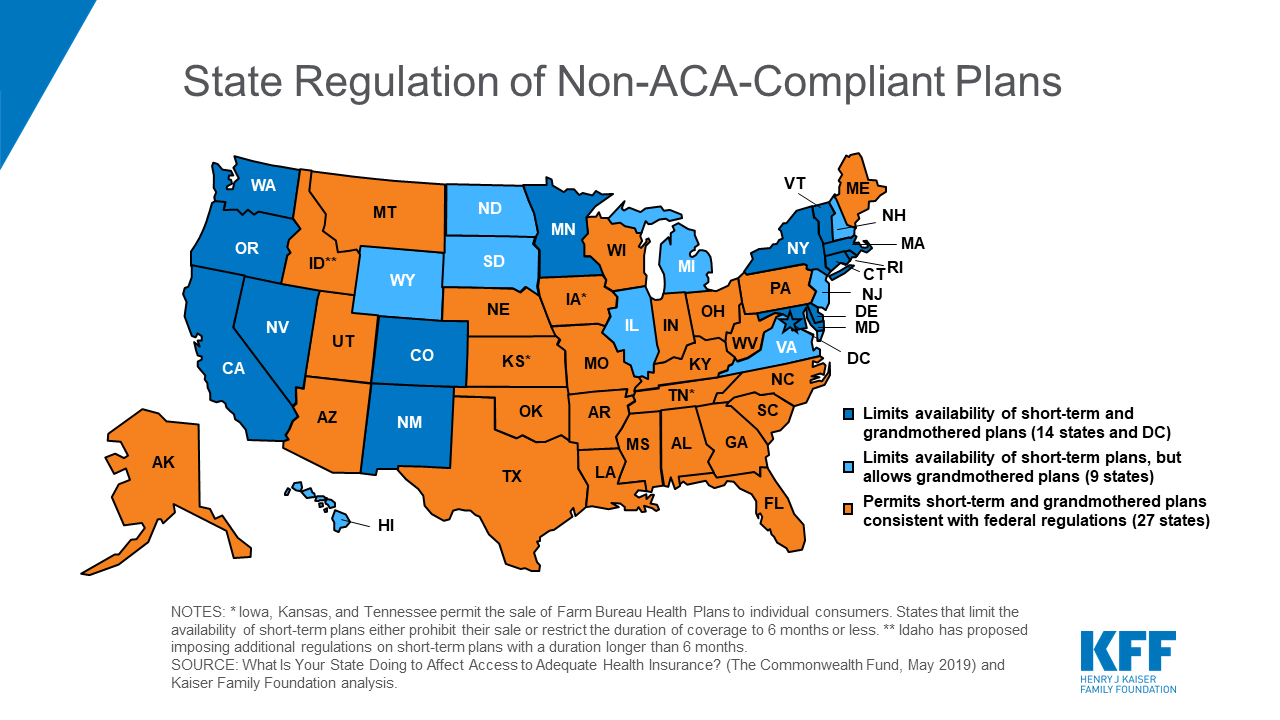

Short Term Health Insurance Availability In Your State Healthinsurance Org

You can claim your exemption for a short gap in health coverage on your tax return when you file.

Health coverage short gap exemption. Individual has a short coverage gap. Health insurance coverage is considered unaffordable. For this exemption it will be Short Coverage Gap which is code B.

Income is below the tax filing threshold. Some products that help pay for medical services learn about the short gap exemption for the 2018 plan year. Under ObamaCare you are allowed one short coverage gap exemption which covers less than three months in a row without coverage each year.

If anyone else on your tax return qualifies you can claim this exemption for them too when you file your taxes. Moving forward you are only allowed three. Individual is not lawfully present in the US.

How to Claim a Short Gap in Coverage You can claim your exemption for a short gap in health coverage on your tax return when you file. Youll simply select the exemption that applies to you and enter the corresponding code. If you have a coverage gap of 3 months or more you are not exempt for any of those months.

In other words you are exempt for two full months but need to have coverage for at least one day of the third month. If the gap includes January on screen 8965 more information is needed because IRS guidelines specify that any months for which coverage was not present in the prior year are also counted in the three months for a current year coverage exemption. Health coverage is unaffordable based on actual income reported on your state income tax return when filing taxes.

If you have. What if i bought a 2018 you can buy qualifying health coverage directly from an. For this exemption it will be Short Coverage Gap.

This one is called short gap exemption. Income Below the Filing Threshold Coverage Considered Unaffordable Short Coverage Gap Citizens Living Abroad Certain Noncitizens Members of a Healthcare Sharing Ministry Minimum Essential Health Coverage. Anyone with a gap in health coverage of no more than 2 consecutive months can claim this exemption.

Form 8962 - Health Coverage Exemptions was retired starting with tax year 2019. The process is fast and easy. Short coverage gap code B.

Even after paying thousands for private health insurance you can still be slugged with large costs if you go to hospital. You have suffered a hardship that makes you unable to obtain coverage as defined in final regulations issued by the Department of Health and Human Services. Examples of some of the exemptions that may only be requested by filing Form 8965 with their 2014 federal return.

A short coverage gap of three consecutive months or less. As long as you enrolled in a Marketplace in 2014 you are allowed up to four consecutive months January February March and April without coverage for 2014 only. Coverage Treasurygov Get All.

In general a gap in coverage that lasts less than three months qualifies as a short coverage gap and not subject to a penalty. Coverage Gap Exemptions. In Drake Tax a short gap in coverage is calculated automatically from the 8965 entries unless the gap includes January.

The process is fast and easy. The process is fast and easy. How to Claim a Short Gap in Coverage You can claim your exemption for a short gap in health coverage on your tax return when you file.

The Coverage Exemption Reasons are. One of the exemptions from the ACAs individual mandate penalty is for people who have a short gap in ACA coverage. Exemption Information If You Had A Short Gap In Health.

Youre not eligible for the 2020 short gap exemption for January because you didnt have coverage for three consecutive months - from November 2019 through January 2020. Subscribe to get email or text updates with important deadline reminders useful tips and other information about your health insurance. If you get covered by January 1st you can use that coverage gap exemption at another point in the year.

Short coverage gap of 3 consecutive months or less. Short coverage gap no insurance for less than three months in 2017. If you have more than one short coverage gap during a year the short coverage gap exemption only applies to the first gap.

TaxAct reports exemptions on your return with a special code. Here is what you need to know about this exemption. These Coverage Exemptions if applicable may be used to reduce your Shared Responsibility Payment.

Household income is below the filing threshold. Youll simply select the exemption that applies to you and enter the corresponding code. For this exemption it will be Short.

If not think gap health insurance. See question 21 for more information on claiming hardship exemptions. According to the IRS regulations see page 53654 theres no penalty as long as thecontinuous period without minimum essential coverage is less than three full calendar months and is the first short coverage gap in the individuals taxable year emphasis mine.

Beyond the short coverage gap exemption there are other important coverage gap. If you have been uninsured for a limited period of time you may qualify for a short gap insurance exemption from the obligation to have health coverage. How to Claim a Short Gap in Coverage.

Youll simply select the exemption that applies to you and enter the corresponding code. You went without coverage for less than three consecutive months during the year. A taxpayer generally can claim a coverage exemption for the taxpayer or another member of the tax household for each month of a gap in coverage of less than 3 consecutive months.

Exemptions Claimed on State Tax Return Exemptions Processed by Covered California. Cost of the lowest-cost Bronze plan through Covered California or the lowest cost employer-sponsored employee-only plan is more than 827 percent of income in 2021 on the tax return or 809 percent in 2022. If you qualify you can claim this exemption for the dependents you claim on your tax return.

TaxAct reports a specific code on Form 8965 for the following exemptions. Unaffordable premiums when the minimum amount you must pay is more than 816 percent of your household income. Form 8965 Health Coverage Exemptions.

Term Of The Day Co Insurance This Is Your Share Of The Costs Of A Service That Is Covered By Your Health Plan Co Insurance Health Plan Understanding Yourself

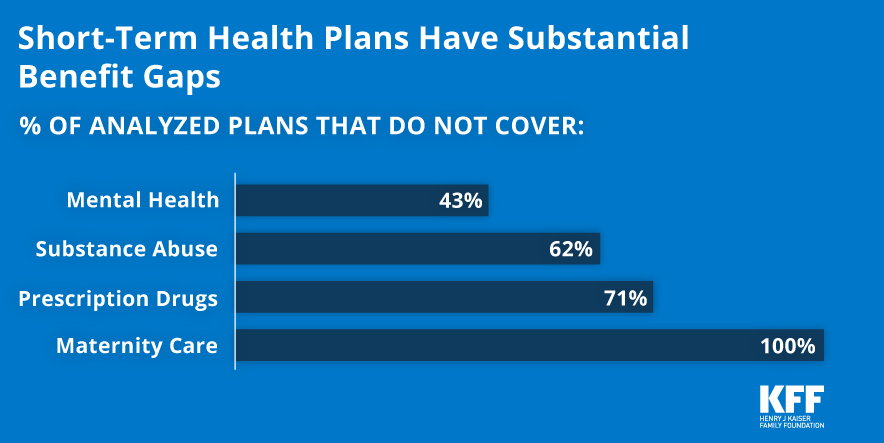

Understanding Short Term Limited Duration Health Insurance Kff

What Is An Off Exchange Health Insurance Plan Healthinsurance Org

Process Once An Employee Notifies The Employer Of Their Intent For Taking Fmla Leave Family Medical Leave Act Medical Assistant Program Medical Leave

Short Term Health Plans In California Health For California

Employee Short Term Disability Std Claims Are Significantly Connected To Fmla Leaves Hr Hris Human Resources Humor Human Resources Career Human Resources

Short Term Health Plans In California Health For California

8 Tips To Recruit And Retain Passive Candidates Recruitment Services Healthcare Recruiting Recruitment Consultancy

Short Term Health Insurance The Basics Infographic Health Insurance Health Insurance Plans Medical Insurance

Short Term Health Insurance Availability In Your State Healthinsurance Org

Charlotte Stone Luke Sandal Sandals Me Too Shoes Only Shoes

The Difference Between Short Term Disability And Fmla Patriot Software Medical Social Work Disability Human Resources

State Actions To Improve The Affordability Of Health Insurance In The Individual Market Kff

Pin By Alyssammalto On Block B Nice Personality Pretty Legs Age Gap

Short Term Health Plans In California Health For California

Explaining Health Care Reform Questions About Health Insurance Subsidies Kff

Career Planning Human Resources Career Employment Law Career Planning

So Long To Limits On Short Term Plans Healthinsurance Org

Posting Komentar untuk "Health Coverage Short Gap Exemption"