Crop Insurance Coverage In India

Improvements were made based on the area approach linked with short-term crop credit. The idea of crop insurance in India was mooted about 3 decades ago when a Sub-Committee on Land Policy Agricultural Labour and Insurance inter alia had recommended a national scheme of cattle and crop insurance with agriculturist the village or the district and the nation collectively contributing to its successful operation.

Pin By Dalia Rodriguez On Financial Life Insurance Marketing Insurance Marketing Life Insurance

Initially it did expand the coverage but since then it has seen a downward slide one of the key reasons.

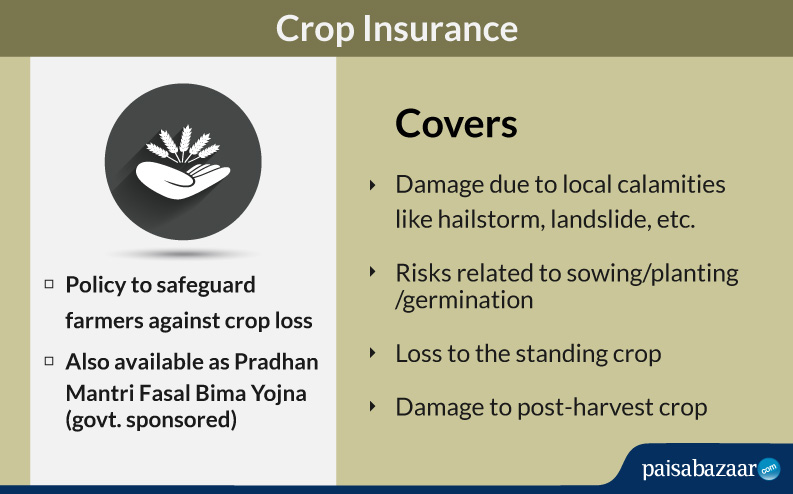

Crop insurance coverage in india. INDIAN CONTEXT OF AGRICULTURE INSURANCE Multi-peril crop insurance MPCI as a comprehensive cover offers almost full indemnity in the event of losses and hence is offered in most middle-income countries which requires farm-level underwriting and loss assessment making it costly to administer scaling up is difficult up in a country like India. The data on crop insurance have to be consolidated and published for analysis and policy formulation. It was discussed in 1947 by the Central Legislature and in 1950 two pilot scheme were circulated among States for adoption.

It is pertinent to note that the crop insurance component was proposed as a scheme for stabilising the net farm income and was based on the value of the crop rather than its quantity. And the index-based livestock insur- ance program in. This Service is not to be quoted as the source of the information as it is based on the sources indicated at the endin the text.

Four insurance schemes are being implemented namely by the government to support farmers. And while the emergence of weather-based insurance as an alternative. In 2016 India overhauled crop insurance to expand its coverage of farmers and farm areas.

The idea of Crop Insurance in India in existence for more than a century took decades to solidify into concrete workable schemes. The government of India started offering widespread crop in insurance in 1985 with the Comprehensive Crop Insurance Scheme. Crop Insurance in India.

Crop insurance schemes in India. Some of the insurance companies offering crop insurance in India are. Weather-based crop insurance scheme in India in which more than one million farmers are currently insured.

Handbook Life Health Motor Property Travel Intermediaries Life Insurance Riders Householders Shopkeepers Package Grievance Redressal System Insurance Surveyors and Loss Assessors Introduction to Insurance Employment Opportunities in Insurance Sector Handbook on Insurance Crop Insurance. Tata AIG General Insurance Reliance General Insurance IFFCO-Tokio General Insurance Bajaj Allianz General Insurance SBI General Insurance. The CCIS has been replaced by the National Agriculture Insurance Scheme.

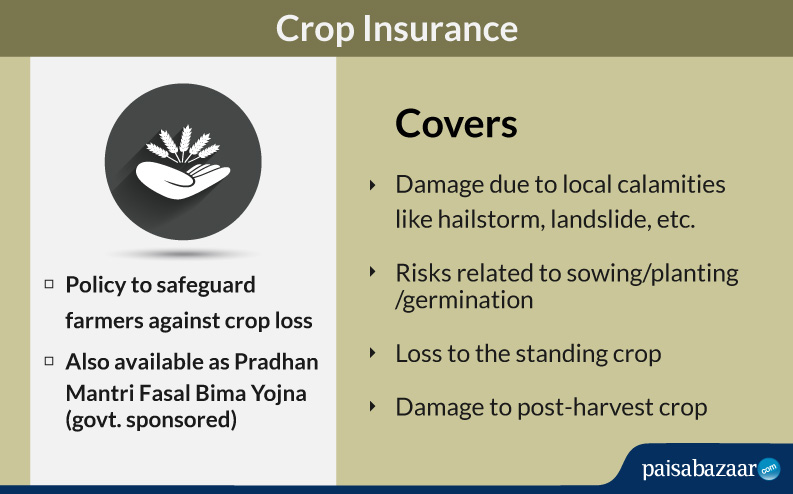

Pradhan Mantri Fasal Bima Yojana PMFBY aims at covering the losses suffered by farmers due to reduction in crop yield as estimated by the local appropriate government authorities. Comprehensive crop insurance in India started in 1985 under CCIS and NAIS came into existence in rabi 1999-2000. Pilot Unified Package insurance scheme UPIS 45 districts.

Under CCIS a total of 763 lakh farmers were covered between kharif 1985 and kharif 1999 while till rabi 2004-05 a total of 62438 lakh farmers have been provided insurance cover during the 11 seasons of NAIS. Home Handbook Crop Insurance. The Government aims to provide crop insurance for PMFBY to 50 of the total cropped area during 2018-19.

At the time all the major crop production was covered by a scheme All-Risk Comprehensive Crop Insurance Scheme CCIS. Crop insurance in india The reference material is for personal use of the Members in the discharge of their Parliamentary duties and is not for publication. Approach In 1985 the Comprehensive Crop Insurance Scheme was implemented for 15 years.

Unfortunately only 28 of the gross cropped area in India is under insurance coverage despite of highly subsidized insurance package under the flagship program of Pradhan Mantri Fasal Bima Yojana. An evaluation of the crop insurance programme in India through the multi-peril yieldbased National Agricultural Insurance Scheme reveals that while it has done well on equity grounds the coverage and indemnity payments are biased towards a few regions and crops and there are delays in settlement of claims. Crop insurance was introduced in India in the year 1985 when the seventh five year plan was announced.

Only after independence in 1947 crop insurance received concrete attention. IRDA - Crop Insurance. Currently in India we have two main crop insurance schemes namely the Pradhan Mantri Fasal Bhim Yojana PMFBY and the Revised Weather-Based Insurance Coverage Scheme RWBICS.

In this paper we examine few behavioral insights which explain the low adoption of insurance. The NAIS is considered to be an improvement over the CCIS but it has simply replaced one flawed scheme with another slightly less flawed one. The scheme also covers pre sowing losses post-harvest losses due to cyclonic.

In order to reduce the hardship of such farmers the Government of India thought it fit to introduce Crop Insurance Schemes since 1973. Pradhan Mantri Fasal Bima Yojana PMFBY is one such initiative of crop insurance launched by the Government of India which is a comprehensive scheme of insurance coverage against crop failures. Scenario of Crop Insurance in India.

Changes and Challenges RESHMY NAIR_ An evaluation of the crop insurance programme in India through the multi-peril yield based National Agricultural Insurance Scheme reveals that while it has done well on equity grounds the coverage and indemnity payments are biased towards a few regions and crops and there are delays in. Pradhan Mantri Fasal Bima Yojana PMFBY Weather based Crop Insurance Scheme WBCIS Coconut Palm insurance scheme CPIS and. Its successor the National Agricultural Insurance Scheme was implemented to increase the coverage of.

Life Cycle Crop Insurance Insurance Policy Life Insurance Companies

Crop Insurance Scheme May Cover 25 Lakh Farmers The Hindu

Independent Consumer Reviews For Axa Intact Auto Insurance Https Tools Insureye Com Pct Rating Aut Umbrella Insurance Car Insurance Auto Insurance Quotes

Rebooting Economy 53 Why Crop Insurance Is Losing Traction In India Businesstoday

Find Best Crop Insurance Plans With Maximum Benefits Crop Insurance Insurance Policy Crop Protection

Basics Of Crop Insurance Proag Crop Insurance Insurance What Is Crop

How To Improve Crop Insurance Coverage The Hindu Businessline

The Modi Years Do Farmers Have Better Access To Crop Insurance

Crop Insurance Need Or Necessity Crop Insurance Insurance Risk Management

Pin On Learning About Investments

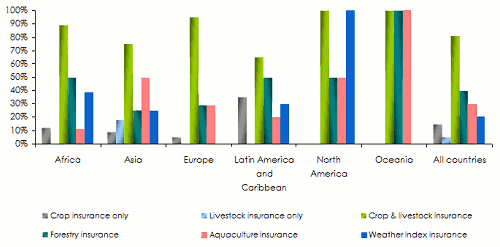

Agricultural Insurance Products And Schemes

India S Crop Insurance Schemes Field Goals The Actuary

Compare Life Insurance From Top Insurance Companies In India And Save Premium On Buy Online Best Life Insurance Marketing Life Insurance Life Insurance Policy

Benefits Of Health Insurance Explained By Mr Best Awarenessfreehai Health Insurance Coverage Health Insurance Understanding

Agriculture Business Agri Farming Crop Insurance Agriculture Business Crop Protection

Rebooting Economy 53 Why Crop Insurance Is Losing Traction In India Businesstoday

Rebooting Economy 53 Why Crop Insurance Is Losing Traction In India Businesstoday

Crop Insurance Coverage Claim Renewal

Posting Komentar untuk "Crop Insurance Coverage In India"