What Does Catastrophic Coverage Mean In Insurance

They cover three primary care visits each year which may include annual check-ups vaccinations some birth control some prescription drugs and other health screenings. Catastrophe insurance provides coverage in the event of catastrophic events.

Catastrophic Ground Cover Collapse Vs Sinkhole Coverage Explained

Health Insurance Comparison and Offer.

What does catastrophic coverage mean in insurance. Youll pay most of your medical costs out of pocket until you reach it. There are several different types of catastrophic coverage available. Whens the next stage.

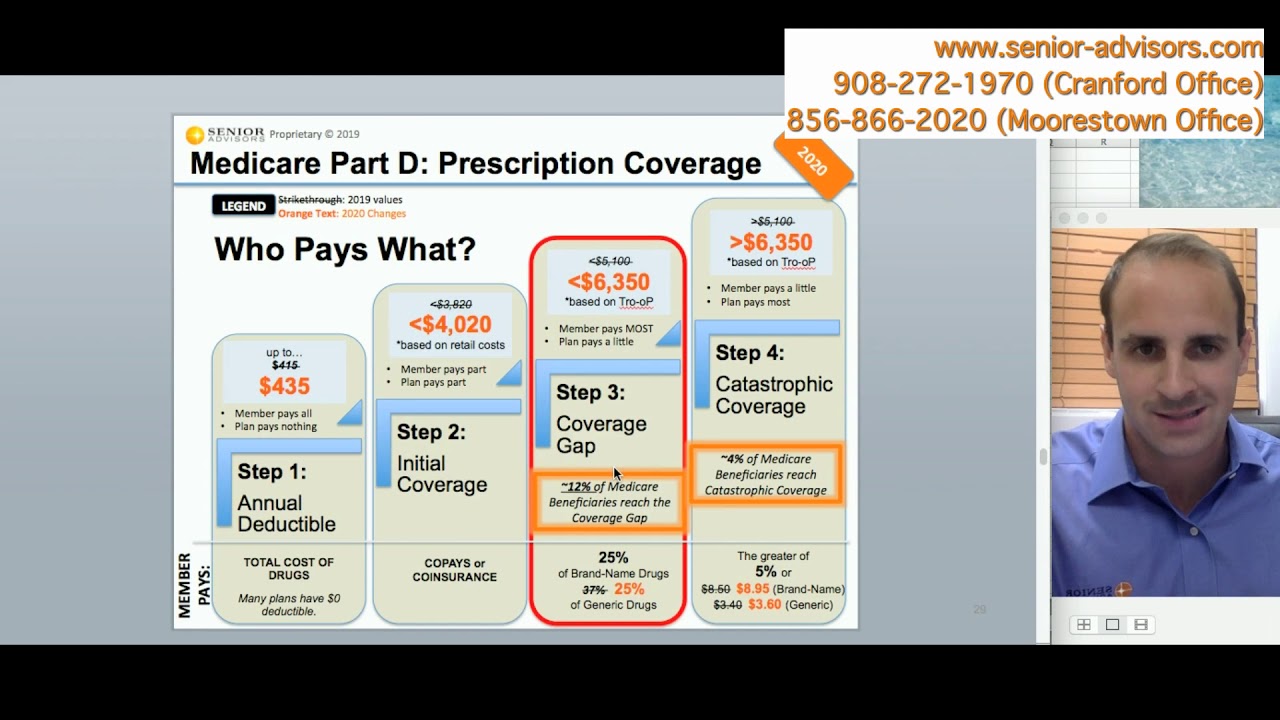

Medicare Part D Catastrophic Coverage. Catastrophic coverage continues until the end of the year. Medicares catastrophic drug insurance can be a catastrophe for consumers Economy.

Services that are not covered. Catastrophic coverage is a form of insurance which is specifically designed to cover catastrophes. Non-Clinical jobs with health insurers are fairly numerous.

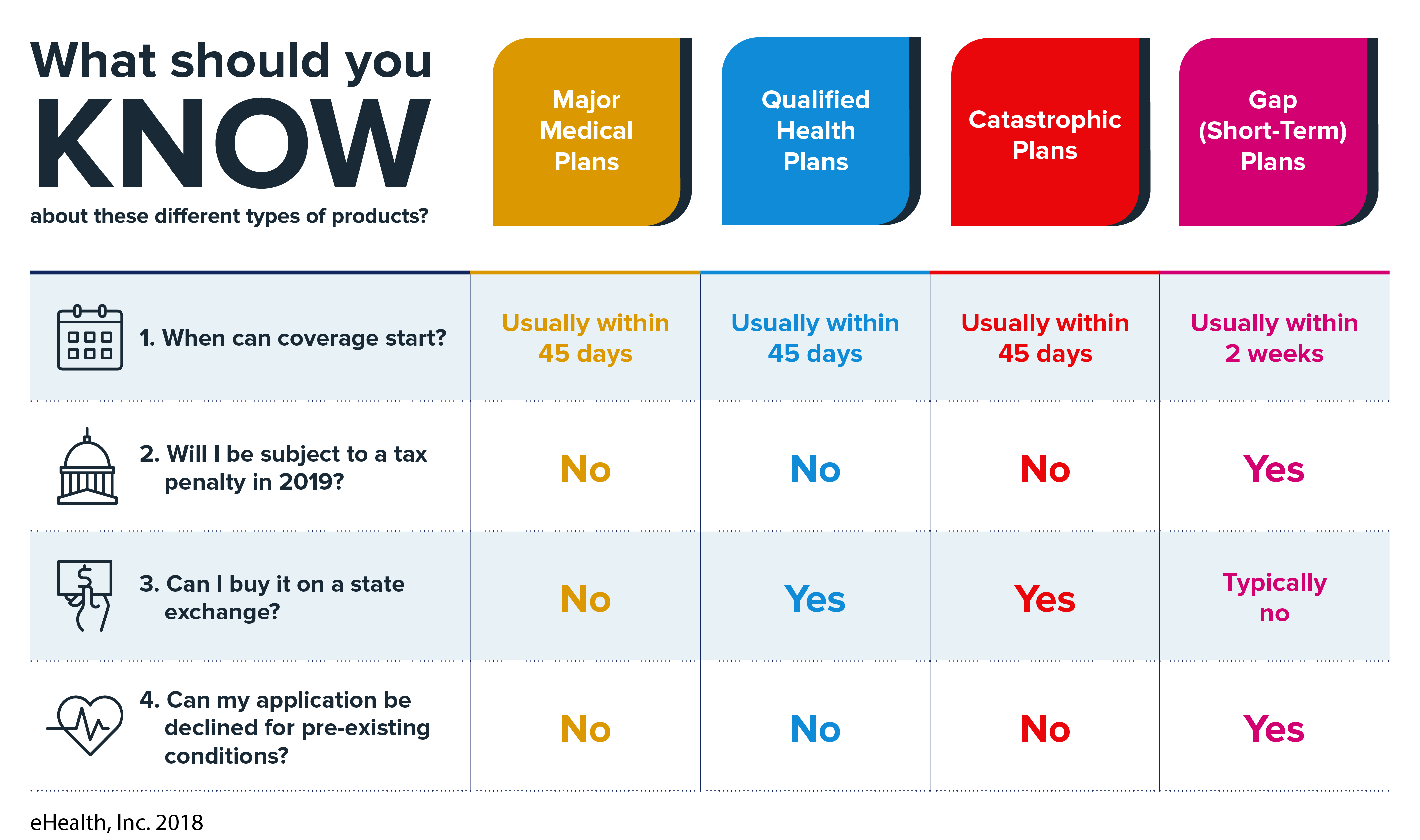

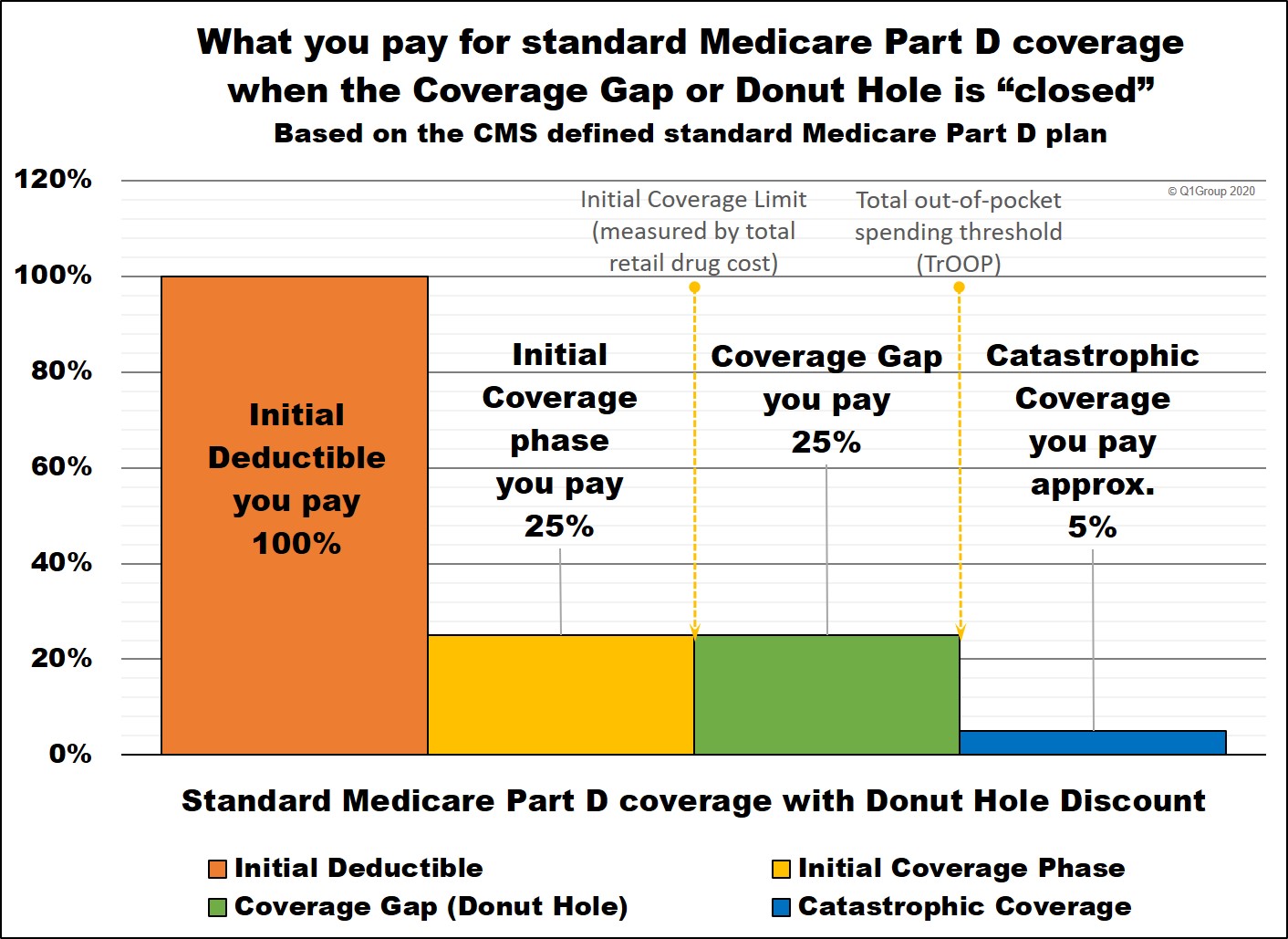

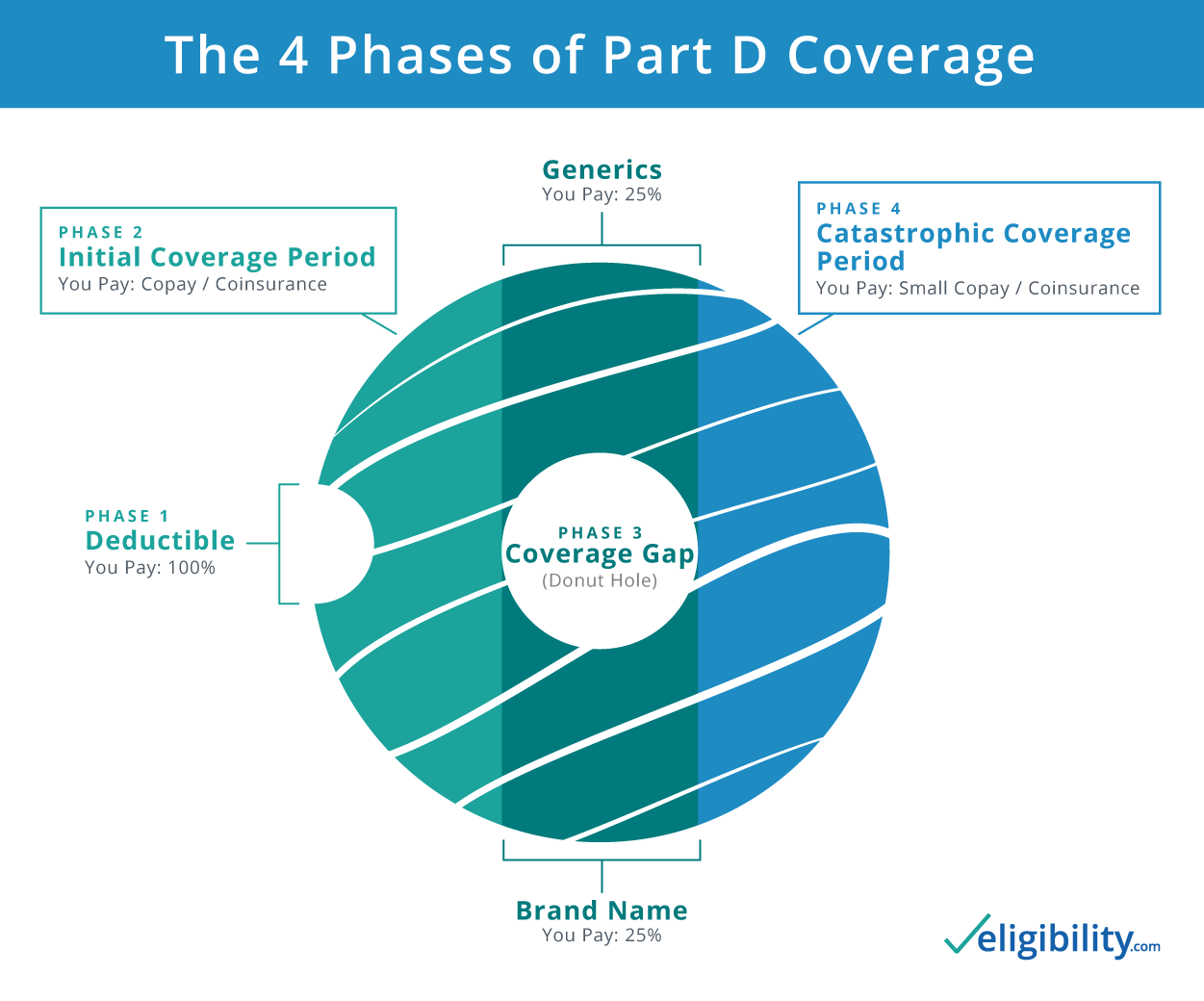

Prior to the ACA catastrophic coverage was a generic term that referred to any sort of health plan with high out-of-pocket costs and limited coverage for routine health needs. Point of Service charges. Catastrophic coverage refers to the point when your total prescription drug costs for a calendar year have reached a set maximum level 6550 in 2021 up from 6350 in 2020.

Read on to discover the definition of the term Medicare Catastrophic Coverage Act - to help you better understand the language used in insurance. But you pay most routine medical expenses yourself. Life Insurance Medical Directors.

Generally the benefit comes in a lump sum payment. Then you will return to the deductible stage on January 1. How much does catastrophic coverage cost.

Not only will your comprehensive health insurance policy cover you for doctors visits when you are sick but it will also cover you for many preventive and regular visits to maintain your health. Consider this as a career path if you are interested in keeping physicians accountable and having justice be balanced and fair towards your colleagues. In all Part D plans you enter catastrophic coverage after you reach 6550 in out-of-pocket costs for covered drugs.

What is a catastrophic cap in insurance. At this point you are out of the prescription drug donut hole and your prescription drug coverage begins paying for most of your drug expenses. You can apply that financial help to any one of the metal tier plans except for the Catastrophic plans.

What does Medicare Catastrophic Coverage Act mean. Only the following people are eligible. Catastrophic limit refers to the maximum amount of certain covered charges set by the insurance policy to be paid out of pocket of a beneficiary during a year.

Catastrophic health insurance is a specific type of health coverage defined under the Affordable Care ActPrior to the ACA catastrophic coverage was a generic term that referred to any sort of health plan with high out-of-pocket costs and limited coverage for routine health needs. The beneficiary is not responsible for any amounts over the catastrophic cap in a given year except for. The catastrophic cap is the maximum out-of-pocket amount the beneficiary will pay each calendar year for TRICARE-covered services.

There are several different types of thi coverage available. Comprehensive health insurance is what it says. What does a catastrophic health plan cover.

Coverage may include stroke heart attack cancer and long-term hospitalization among other critical health issues. Unless you receive Extra Help from Medicare you automatically leave the Coverage Gap and enter the Catastrophic Coverage stage once youve spent a total of 5000 in out-of-pocket drug costs during 2018. These include natural disasters such as earthquakes floods and hurricanes as well as man-made disasters such as terrorist attacks.

What does it mean. However once a person crosses the donut hole they reach catastrophic coverage. Catastrophic health insurance plans have low monthly premiums and very high deductibles.

Catastrophic Coverage is the 4th stage of Medicare Part D drug coverage after the Coverage Gap or Donut Hole stage. Many are designed to supplement existing insurance coverage ensuring that someone is covered in the event of a fire flood earthquake tornado. Catastrophic coverage is a form of insurance which is specifically designed to cover catastrophes.

Once youve reached the. Catastrophic health insurance is a specific type of health coverage defined under the Affordable Care Act. Many are designed to supplement existing insurance coverage ensuring that someone is covered in the event of.

Prior to the ACA catastrophic coverage was a generic term that referred to any sort of health plan with high out-of-pocket costs and limited coverage for routine health needs. What Does Catastrophe Insurance Mean. Bronze Silver Gold and Catastrophic are coverage levels sometimes called metal tiers which represents a plans general approach to sharing costs with you.

Catastrophic health insurance plans generally cover just the basic health benefits and preventive services. What does this mean. In exchange for a low premium youll have a high deductible.

They often have to pay thousands of dollars for prescription drugs until they cross this coverage gap. You pay whichever is higher. This amount is made up of what you pay for covered drugs and some costs that others pay.

They may be an affordable way to protect yourself from worst-case scenarios like getting seriously sick or injured. Catastrophic health insurance is a specific type of health coverage defined under the Affordable Care Act. It offers full or comprehensive coverage for all of your health needs.

Who can buy a Catastrophic plan. What does the Term Comprehensive International Health Insurance Mean. Catastrophe insurance protects businesses and residences against natural disasters such as earthquakes floods and hurricanes and against human-made disasters such as a riot or terrorist attack.

Catastrophic health insurance is an inexpensive coverage option designed to protect you from major medical expenses. It is the amount of money that a person must pay out-of-pocket for health care expenses incurred by a catastrophic illness before the insurer pays bills. Health Insurance Comparison and Offer.

5 of costs for your covered drugs or 370 for generic drugs920 for brand-name drugs. Catastrophe insurance can either be a commercial product sold to businesses or personal insurance sold to homeowners. Catastrophic illness insurance is insurance coverage that protects the insured for a specified duration in the event they develop one of the major health conditions or issues listed in the policy.

Donut Hole Medicare Part D Donut Hole Closing In 2020

/GettyImages-1161339878-c41c3498022b4df2b16b0762dcd7375e.jpg)

The Medicare Catastrophic Coverage Act Of 1988 Mcca

/Blue_Cross_Blue_Shield-c8b7f152cc8646f0bf5d1cd3efae9294.jpg)

The 4 Best Catastrophic Health Insurance Of 2021

Metallic Health Plan Levels Under Obamacare

Donut Hole Coverage Gap Hole Part D Prescriptions Rx Calif

Medicare Part D And Catastrophic Coverage Costs Rules And Support

What Is The Donut Hole In Medicare Part D Coverage

Metallic Health Plan Levels Under Obamacare

/GettyImages-904466048-cae7b7a4c42d41228861be7fa01d2115.jpg)

Catastrophe Insurance Definition

Medicare Blog Moorestown Cranford Nj Senior Advisors

Catastrophic Health Insurance Definitions Plan Costs

Catastrophic Coverage Definition Kin Insurance

Medicare Blog Moorestown Cranford Nj Senior Advisors

Donut Hole Coverage Gap Hole Part D Prescriptions Rx Calif

Medicare Part D And Catastrophic Coverage Costs Rules And Support

Different Types Of Health Insurance Plans

What Is The 2021 Standard Initial Coverage Limit And How Does The Icl Work

Medicare Donut Hole Is Closing In 2020 Eligibility

What Is The Difference Between Catastrophic Versus Non Catastrophic Injuries Diamond And Diamond Lawyers

Posting Komentar untuk "What Does Catastrophic Coverage Mean In Insurance"