Commercial Property Insurance Coverage Questions

The policy terms limits and retention should be tailored to reflect. Policy that covers two.

Pin By Stephen Mazzone On Work Content Insurance Homeowners Insurance Car Insurance

Commercial Property Insurance Module 7 Business Interruption Coverage Homework Questions 7A 1.

Commercial property insurance coverage questions. Whether youre starting a new business or your firm has a lot of time in the industry its vital to know the importance of insuring your building. It is a core coverage in business owners policy BOP insurance. The value of the property you want to insure will determine how much youll have to pay for coverage.

We posed this question to Shelly Maby a Farmers Insurance agent based in Phoenix Arizona. Protecting your business is key to a successful future. This average would be higher if the.

A required component of the commercial property coverage part. Commercial insurance coverage from The Hartford helps protect your business and employees. Answer No matter what type of retail business you own a flower shop an appliance repair shop a dry-cleaning operation a kite store a clothing boutique you get the picture shop insurance may be helpful to help.

How does the BI policy define Net Income for PDI. The three property-casualty coverage CC CP and PLinstitutes are very similar in organization preparation style and exam format. When you go to acquire your commercial property insurance make sure you choose an agent who will ask good questions understand your situation and get you the right coverage for all the activities of your business.

Below are some answers to commonly asked business property insurance questions. A How much of this loss will the insurer pay. In this quiz well be learning all about how the process of ensuring commercial property works.

Commercial property coverage form. A commercial building is insured for 100000 under a commercial property insurance policy with an 80 percent coinsurance clause. Discover what commercial insurance coverage is what types of commercial insurance solutions small businesses need and more.

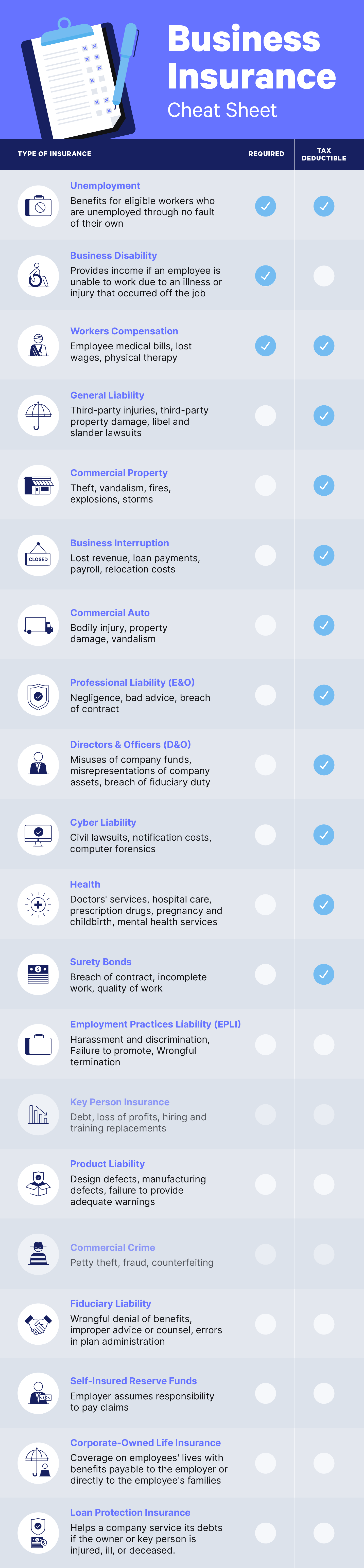

Commercial lines insurance is written specifically to cover losses of business-related property that is not residential. Chapter 13 - Commercial Property Insurance. Commercial property insurance is insurance coverage that protects the business from perils like theft or fire.

While the terms of a policy and explicit coverage vary from policy to policy there are virtually no industry-specific differences. Coverage is provided for the building business-related contents of the building loss of business income physical damage to a commercial auto and commercial general liability casualty losses for bodily injury property. Commercial property insurance protects commercial property from such perils as fire theft and natural disaster.

The building is damaged by fire and the loss is 50000. With this commercial property insurance guide youll know the basics of keeping your firms assets safe and sound. Does business insurance cover robbery.

Commercial property insurance helps protect your business against asset loss. Get a fast quote and your certificate of insurance now. If you are robbed by an employee commercial crime coverage is what would cover you.

Property Insurance Commercial property insurance covers your building and its contents as well as any resulting impact to your business income in the event of damage due to falling victim to fire theft or a natural disaster. Your purchase of an IRMI reference product includes a complimentary subscription to The. Remember commercial property insurance covers only specific premises.

Commercial property insurance helps protect your business property and equipment. Commercial property insurance pays to repair or replace your building business property damaged by a fire storm or other covered event - with rates as low as 37mo. Obviously youre going to be very anxious if you find out.

Get a quote for commercial building insurance from The Hartford today. ISO and the American Association of Insurance Services AAIS. Causes of Loss Form.

Commercial Property Insurance Coverage Questions As the owner of a commercial property one of your biggest concerns will be the possibility of loss or damage to your property. Your standard commercial property insurance policy does not cover flooding. To get a commercial property insurance quote youll have to provide the insurance company with some basic information about your business and the location of the property you want to insure.

Commercial property insurance is used to cover any commercial property. P 73 - 4 Business income insurance covers the reduction in an organizations income when operations are interrupted by damage to property caused by a covered peril. Commercial property policies provide various types of coverage either as part of the base policy or through policy endorsements Endorsements expand or amend a policys coverages and usually increase your premium.

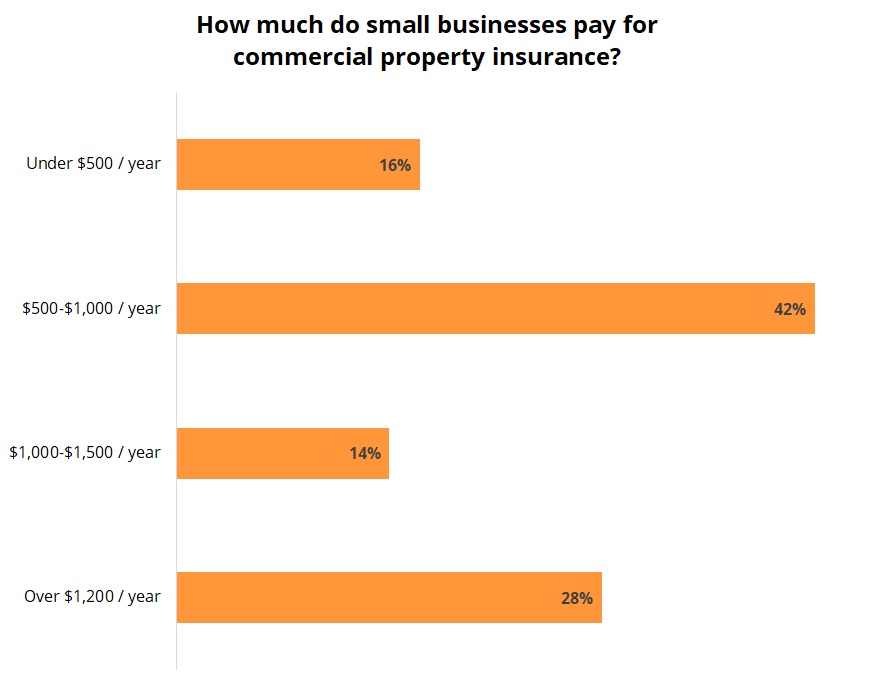

Gather information about your property. Property coverage can be named-peril open-peril or special Business Interruption Insurance. As of 2015 the average cost of commercial property over the past five years for all clients surveyed was 742 per year.

Each focuses on a detailed analysisinstructor of policy coverages and most of the exam questions involve coverage scenarios in which you are. The actual cash value of the building at the time of the loss is 250000. This coverage is important for companies that own or lease a physical location and need tools to operate.

Your purchase of Commercial Property Insurance comes with access to thousands of coverage-line-specific insurance forms and endorsements promulgated by the Insurance Services Offices Inc. Heres what Shelly had to say about insurance coverage for retail shops. Get a free quote for a commercial insurance policy today.

Assume there is no deductible applicable to this loss. Commercial property is defined as any buildings or land which is intended to be used to generate a profit be it from rental income or capital gain. Commercial Property Insurance Part 1.

This amount only accounts for the property insurance portion of the business insurance policy and represents policies that had business personal property for contents and building coverage.

Commercial Property Insurance Cost Insureon

Liability Insurance For Small Businesses Small Business Insurance Workers Compensation Insurance Liability Insurance

Insurance Claim Tips For Mold Damage Claims Pro Usa Property Damage Content Insurance Being A Landlord

Everything You Need To Know About Gasstation Convenience Store Insurance Coverage Get A Free Quote For Grocery Store Gas Station Insurance Best Insurance

How Much Insurance Do I Need To Cover My Business How Much Will It Cost Answers Via Adjusting Today Business Continuity Insurance Loss

Questions To Ask Before Hiring A Public Adjuster Public Questions To Ask Online Communication

The Irs Considers Insurance A Cost Of Doing Business As Long It Benefits The Business Serves Small Business Insurance Business Insurance General Liability

Commercial Property Insurance For Small Business Coverwallet

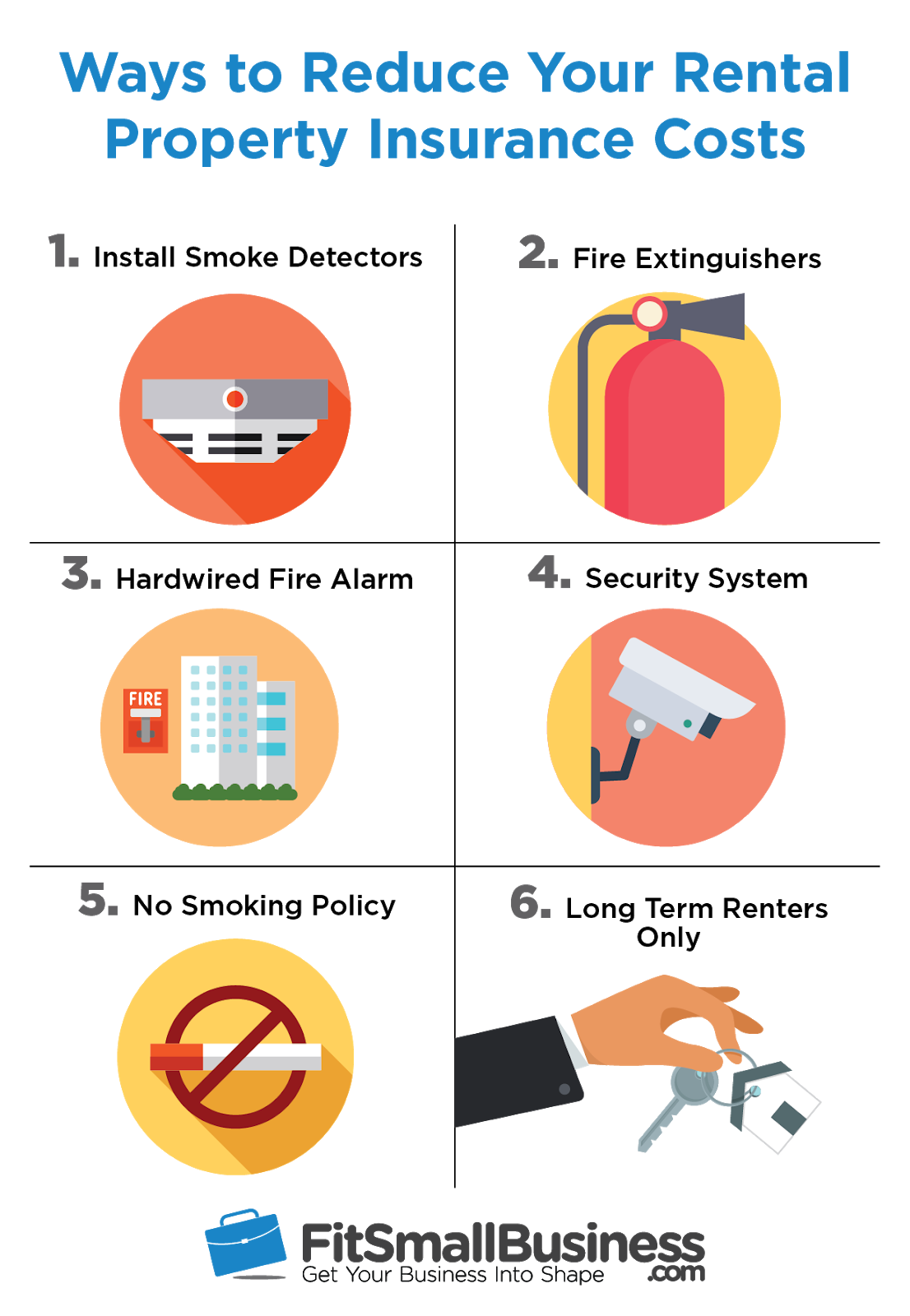

Rental Property Insurance Providers Costs Coverage

During These Uncertain Times An Umbrella Liability Insurance Provides Additional Liability Health Insurance Broker Homeowners Insurance Health Insurance Agent

The Common Exclusions In Homeowner S Insurance Live Trading News Homeowners Insurance Homeowner Commercial Insurance

Property And Casualty Insurance Quiz Question 13 Casualty Insurance Property And Casualty This Or That Questions

The Right Time To Hire A Public Adjuster In Florida Commercial Insurance Insurance Insurance Sales

Do You Know What Your Business Insurance Policy Covers Quiz

Commercial Property Insurance For Small Business Coverwallet

Life Insurance Cheat Sheet Family Title C Graphic Line Shutterstock Com Calculator C Timashov S Life Insurance Calculator Life Insurance Insurance Marketing

Posting Komentar untuk "Commercial Property Insurance Coverage Questions"