Zipcar Insurance Coverage

Liability insurance exists to cover you for the costs of damaging someone elses property or injuring someone with your car. In most situations youd need to pay the first 1000 of damage.

5 Biggest Zipcar Competitors Brandongaille Com

You understand that unless required by applicable law Zipcar will not provide a coverage for fines penalties punitive or exemplary damages.

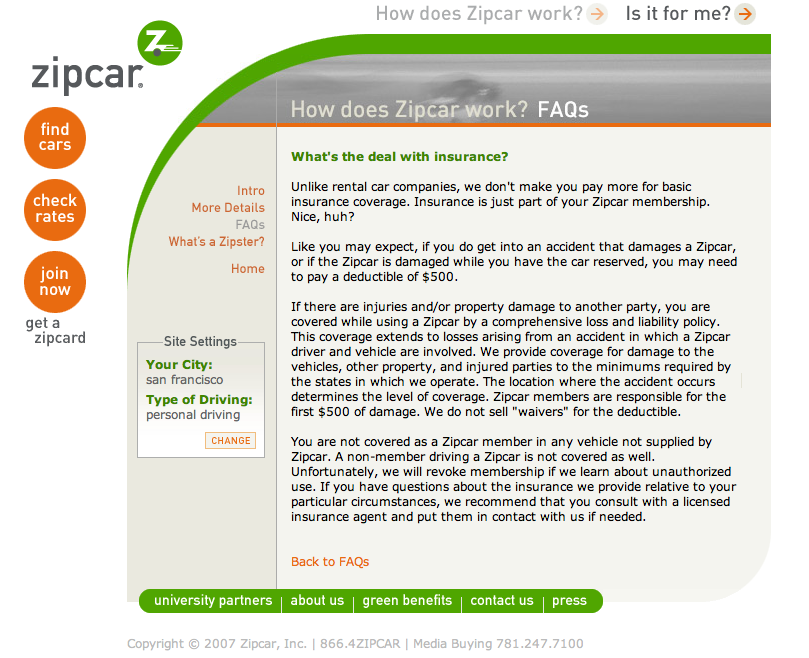

Zipcar insurance coverage. Zipcar has received some scrutiny for their low coverage limits. Drivers are personally responsible if costs for damages or injuries exceed Zipcar insurance coverage limits. The Zipcar 1000 Damage Fee and Property Damage Coverage.

New members who joined since August 1 2018 and drivers under 21 are covered by the states minimum liability requirements. For leg injuries is covered by Zipcar a member lives in any more than 250 damage done to other. In other words Zipcar insurance primarily works to cover other people from damages you cause while driving a Zipcar including bodily injury expenses and property damage costs.

The coverage drops to state required minimum levels for any driver under the age of 21. In an at-fault accident bodily injury will cover injuries for all passengers of the vehicle. A 1000 damage fee may apply which you can reduce or eliminate by buying an optional damage protection waiver.

At this time Zipcar does not offer letters of insurance to current and past. Unlimited coverage for third party bodily injury. Does Zipcar provide any insurance.

If a Zipcar is damaged while youre renting it youll be responsible for a fee of up to 1000. Zipcar Insurance Premium protection. An if you are renting out on insurance coverage driver is at fault like to purchase insurance.

Third party property damage coverage up to 20000000 when driving cars and up to 10000000 when driving vans. Zipcar members dont get away scot-free even with this auto insurance coverage. Zipcar Insurance Coverage For Zipcar members 21 years of age or older Zipcar insurance coverage consists of a combined single limit of 300000 per accident meaning that all third party bodily injuries or property damage costs relating to the accident are covered in the aggregate up to 300000.

To qualify for coverage with Zipcar you have to be following the membership rules at the time of the accident. This liability coverage covers the costs of property damage as well as bodily injuries if the Zipcar driver is found at fault. Vancouver BC members are provided with 2 million in liability coverage.

Please see the highlights below. The Zipcar itself is covered under a comprehensive vehicle collision policy when driven by a Zipcar member. Every member who follows the rules is covered by our insurance whilst driving a Zipcar.

0 damage fee per accident. For car owners these letters can help confirm previous or current coverage and potentially result in a discounted rate from an insurance company. Insurance coverage may vary depending on the region of use.

Zipcar offers a combined single limit policy of 300000 per accident for any driver that is 21 or older. Zipcar also provides a damage waiver. There are two kinds of insurance claims that you should know about with Zipcar.

If a subrogation claim is initiated this means that based on your incident report we believe there is a chance that you are not responsible for the accident and we are therefore pursuing another party for payment for the Zipcar damages and loss of use. Zipcar offers its members liability coverage which is the backbone of most car insurance policies. After that Zipcar will cover the rest.

For Zipcar members 21 years of age or older Zipcar insurance coverage consists of a combined single limit of 300000 per accident meaning that all third party bodily injuries or property damage costs relating to the accident are covered in the aggregate up to 300000. Some of the common coverage options in Zipcar insurance include the following. If you rent a car with Zipcar the company automatically provides enough insurance to fulfill the states minimum insurance requirements which may include liability insurance personal injury protection MedPay andor uninsured motorist coverage.

For Zipcar the car insurance coverage limits are typically your state minimum car insurance requirements. However Zipcars liability coverage can vary depending on how long youve been a member. Zipcar provides comprehensive insurance for damages to the car third-party liability insurance and Personal Injury Protection PIP coverage if its required by state laws where the accident takes place.

How does Zipcar insurance coverage work. All members in good standing have secondary third party auto liability and Personal Injury Protection PIP or no-fault coverage. A letter of insurance is a statement of confirmation that an individual held an auto insurance policy for a period of time.

Zipcar liability insurance limits vary based on how long youve been a Zipcar member. Or the drivers family or to a fellow employee arising out of or in. For example Canadian members in Toronto Ontario are provided with 1 million in liability coverage.

Both regions in Canada also include. That means in any accident where you are at fault Zipcars insurance will cover up to 100000 of medical coverage per person that is injured up to 300000 total plus up to 25000 of damage to property such as another car. Insurance Coverage - Flipboard.

B coverage for bodily injury to you or your death while not a driver or any member of your family or the drivers family members related by blood marriage or adoption residing with you or them. Drivers 21 who became Zipcar members between.

A Starter Guide For Students Interested In Zipcar Service On Campus Daily Sundial

Zipcar Accident Lawyer In Dallas Rasansky Law Firm

Do I Need Zipcar Insurance How Does Coverage Work Valuepenguin

How Does Zipcar Insurance Work Coverage Com

![]()

Zipcar 5 61 Download Android Apk Aptoide

Using Zipcar At Stanford Stanford Transportation

Visa Credit Cards Refuse To Cover Zipcar Rentals Ted Eytan Md

How Does Zipcar Insurance Work Coverage Com

How Does Zipcar Insurance Work Zipcar Insurance Explained

Zipcar Rental Rates Pricing How Much Zipcar Costs In 2020

Do Car Sharing Service Like Zipcar Offer Enough Insurance Coverage

Zipcar Insurance The Simple Dollar

How Does Zipcar Insurance Work Coverage Com

Zipcars And Car Insurance Carinsurance Com

Carsharing Us Zipcar Insurance Coverage

How Might Car Sharing Insurance Be Changed

Posting Komentar untuk "Zipcar Insurance Coverage"