Fdic Insurance Coverage Examples

Money Market Deposit Accounts MMDAs Negotiable Order of Withdrawal NOW Accounts. FDIC coverage includes cash deposits in insured bank accounts.

Ppt Federal Deposit Insurance Corporation Comprehensive Seminar On Deposit Insurance Coverage For Bankers Powerpoint Presentation Id 1390851

Learn how it works and find out the coverage limits for your bank accounts.

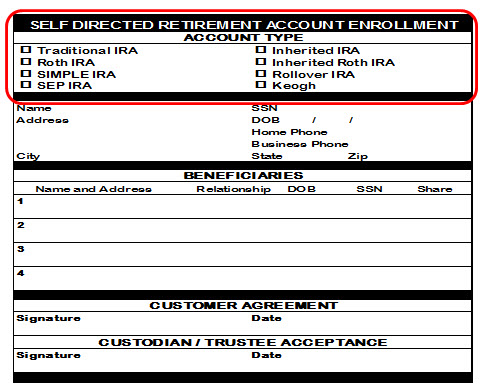

Fdic insurance coverage examples. Examples of a single depositor include an individual a business held as a. Youre single and do your banking in one place. As an example money in your individual taxable account is separate from money in your individual retirement account IRA.

It does not cover other forms of investment or deposits used to buy securities for customers. For example the FDIC will insure a revocable trust account owned by a parent payable upon death to three children up to 750000. The FDIC an independent federal agency protects the money you deposit in checking savings money market CD and retirement accounts at insured banks like Ally Bank.

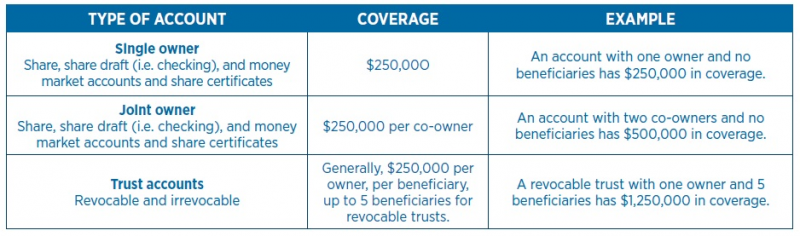

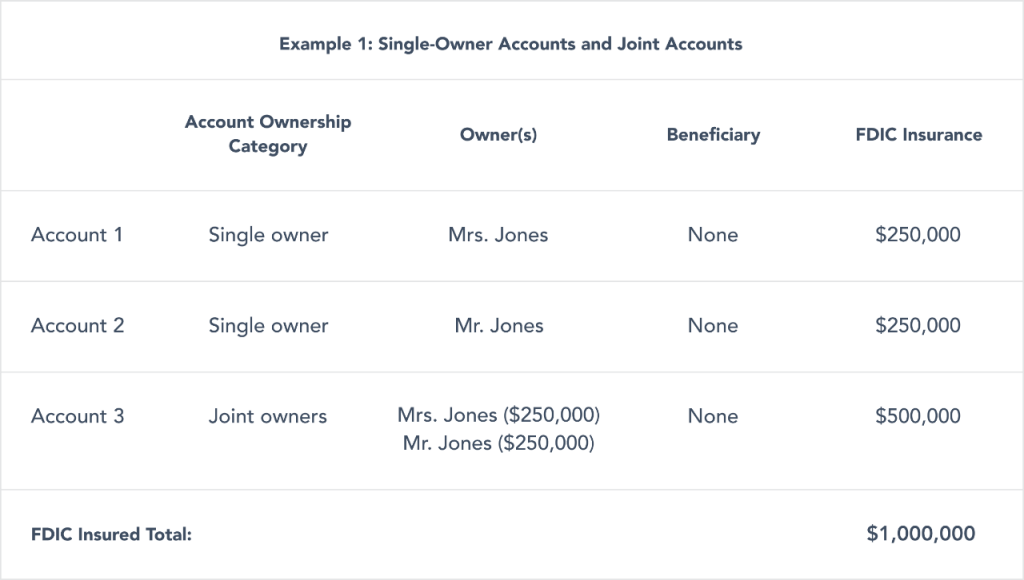

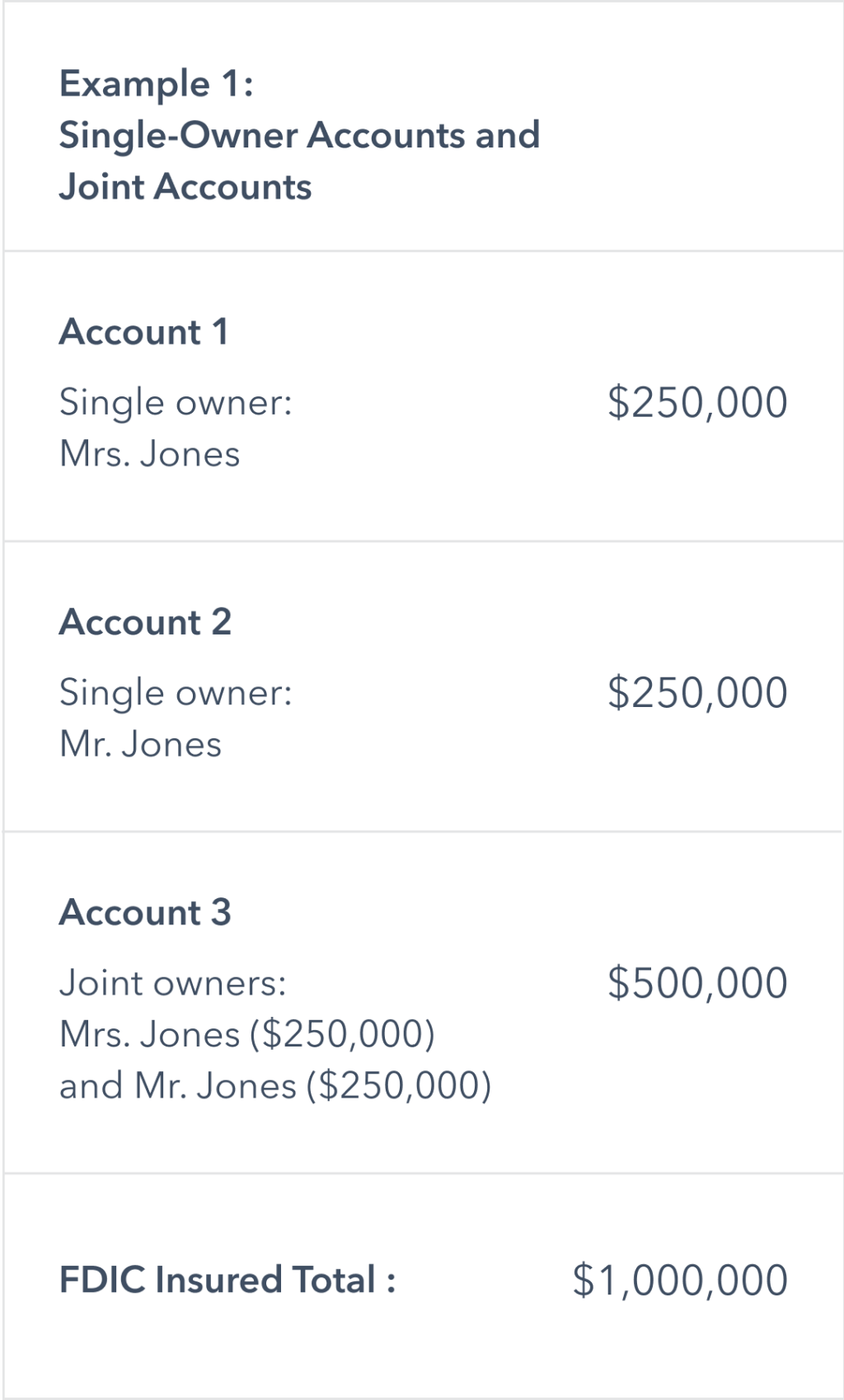

FDIC coverage on a trust does not necessarily equal 250000 per beneficiary per owner. The FDIC insures only up to 250000 of deposits for. In these examples a person as an individual owner joint owner or beneficiary is eligible for FDIC coverage up to 250000 total in each ownership category.

For example if a person has a certificate of deposit at Bank A and has a certificate of deposit at Bank B the amounts would each be insured separately up to 250000. A joint account with hisher spouse for 500000 250000 for each person All of these. The funds you have in deposit accounts in your name alone are insured up to 250000.

A corporate account with 250000. Some examples of what FDIC insurance coverage protects include. A trust account with 250000.

Some examples of FDIC-insured deposits include. The best way to verify that your assets are comfortably under the maximum coverage limits is the FDICs Electronic Deposit Insurance Estimator EDIE tool. For instance what if you have 250000 in your individual account and.

The FDIC covers the traditional types of bank deposit accounts including checking and savings accounts money market deposit accounts MMDAs and certificates of deposit CDs. If she names both her children as beneficiaries you might assume that the entire account balance. FDIC insurance covers depositors accounts at each insured bank dollar-for-dollar including principal and any accrued interest through the date of the insured banks closing up to the insurance limitThe FDIC does not insure money invested in stocks bonds mutual funds life insurance policies annuities or municipal securities even if these investments are purchased at an insured bank.

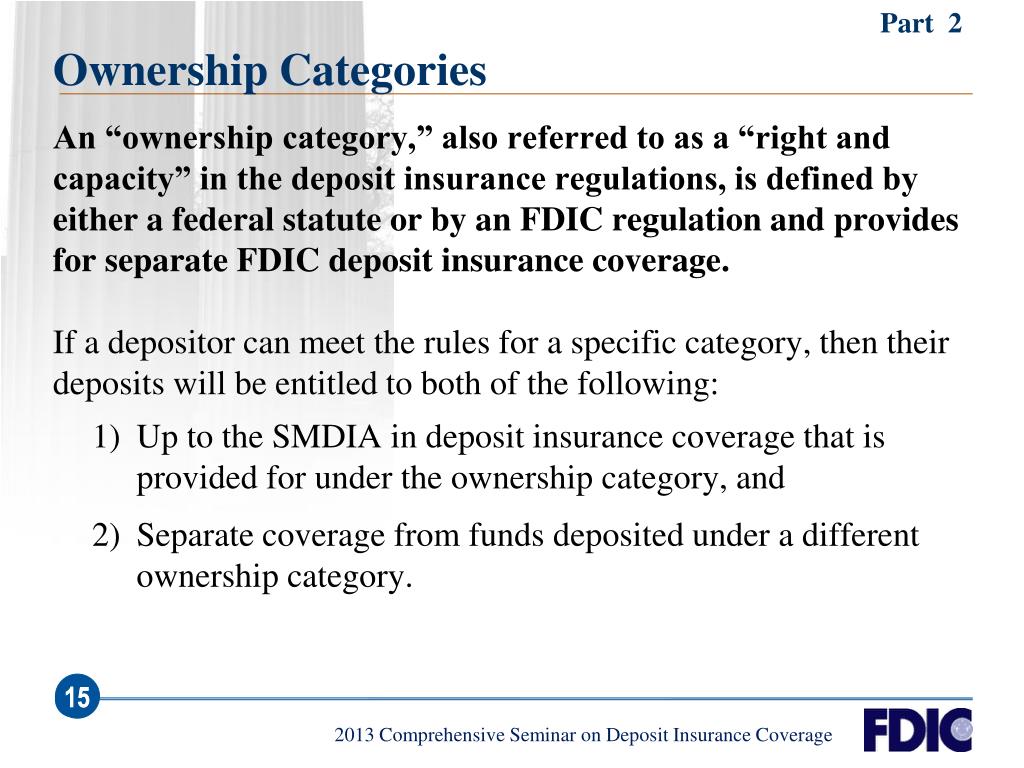

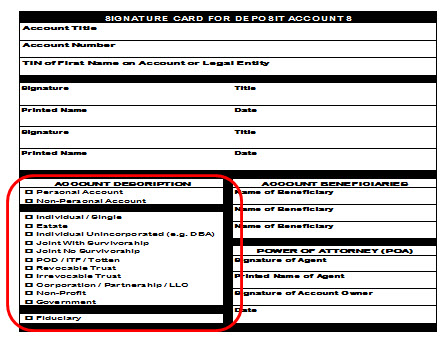

The standard insurance amount is 250000 per depositor per insured bank for each account ownership category. Deposit Insurance Coverage Overview. A a single depositor b at a single banking institution c in each account ownership category.

A personal account with 250000. In this instance the owner of the trust is not counted for the purpose of calculating insurance coverage. Funds deposited in separate branches of the same insured bank are not separately insured.

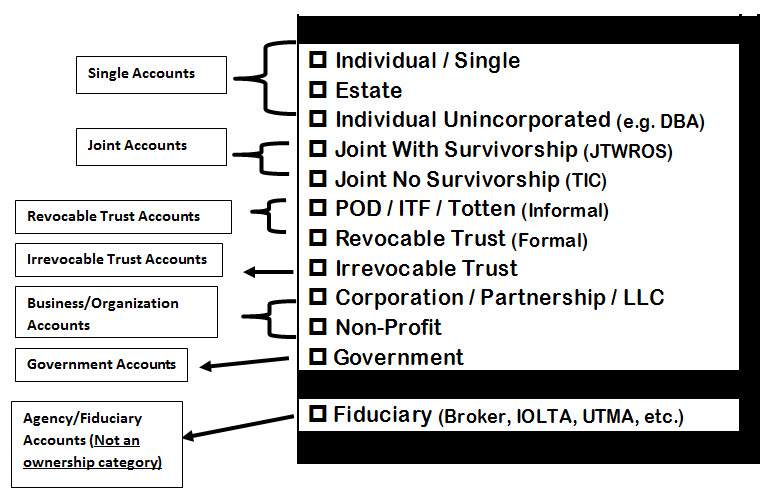

There are limits to the FDIC insurance coverage. 7 hours ago Consider an example. The FDIC recognizes different types of ownership categories that qualify for insurance coverage.

Smiths Apple Pies DDA 230000 John Smith or Mary Smith. Coverage for multiple joint accounts with multiple owners can be complex. No FDIC deposit insurance coverage depends on whether your chosen financial product is a deposit product.

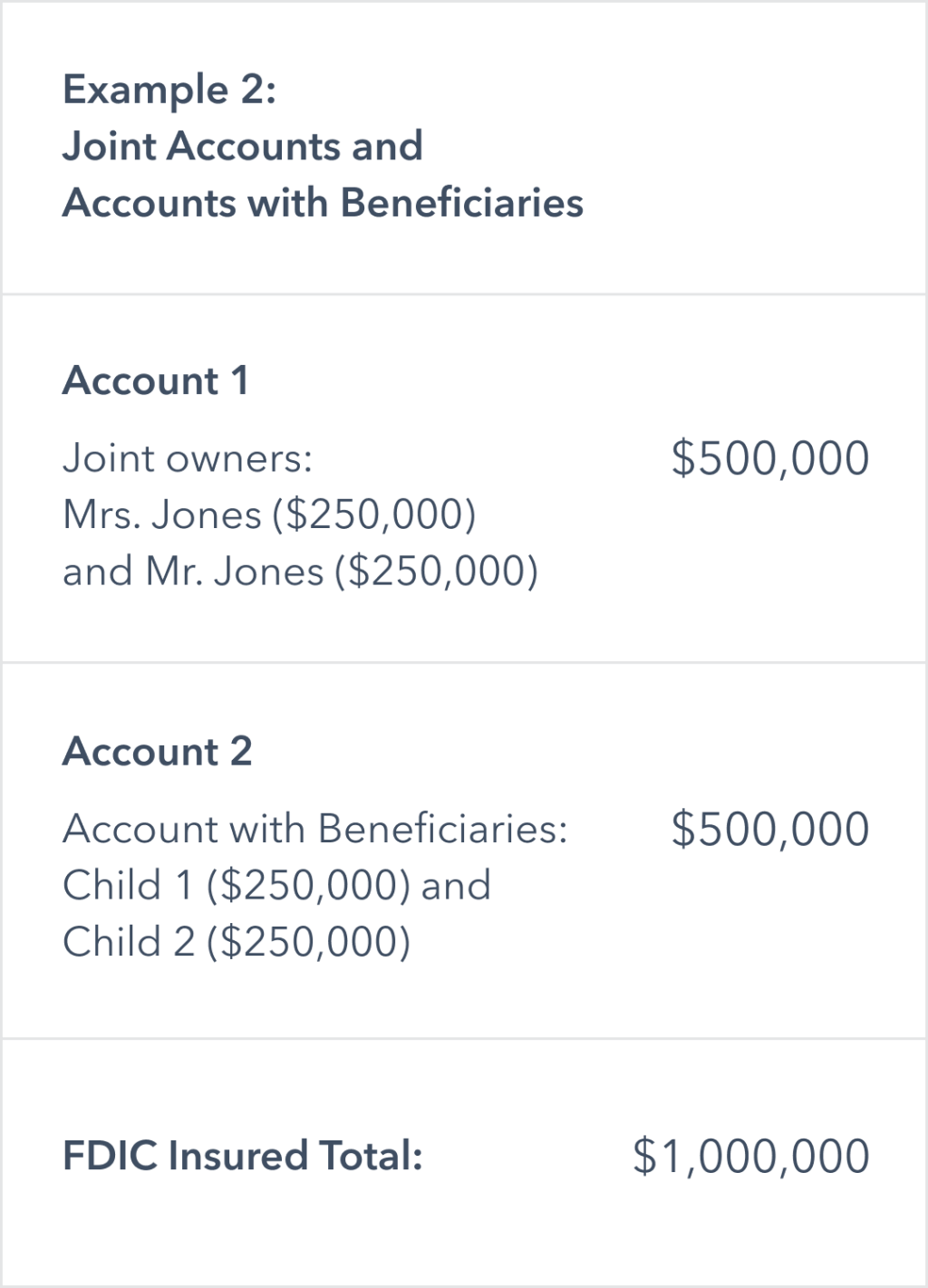

Below is an example of some joint accounts at the same IDI held by three owners. Jones could set up account ownership to maximize FDIC coverage for a total of up to 1000000 in savings for her family. The FDIC is a government agency that insures deposits so you dont lose money if your bank fails.

This calculation is based on the deposit insurance regulations in effect as of July 2011. For example the FDICs deposit insurance determinations for depositors of IndyMac Bank FSB. You dont need to apply or pay for FDIC insurance your money is insured automatically.

For example lets say a mother owns a trust account with a 400000 balance. These examples show how a sample Marcus customer Mrs. The FDIC provides separate insurance coverage for.

What they dont always realize is that the FDIC provides separate insurance coverage for deposit accounts held in different categories of ownership. The standard insurance amount is 250000 per depositor per insured bank for each ownership category. Whats the basic amount of FDIC-insured coverage for each depositor.

This video helps you un. You have 50000 in a checking account 100000 in a savings account and 200000 in CDs for a total of 350000 in deposits. For example in some trusts the limit is calculated by multiplying the number of trustees people who manage the assets in the trust by the beneficiaries person or people who will receive the trust assets 3 and multiplying that number by the 250000 limit.

Governmentaccording to the FDIC no depositor has lost a penny of insured funds since the agencys founding in 1933. Different co-owners and multiple joint accounts Account Title Deposit Type Balance Mary Smith or John Smith. The rules vary but generally speaking the more people involved in a trust the more money the FDIC insures.

IndyMac following its failure in 2008 were challenging in part because IndyMac had a large number of trust accounts for which deposit insurance coverage was governed by complex deposit insurance. FDIC insurance exists to protect your money. FDIC insurance is backed by the US.

Understanding Sipc And Fdic Coverage Ameriprise Financial

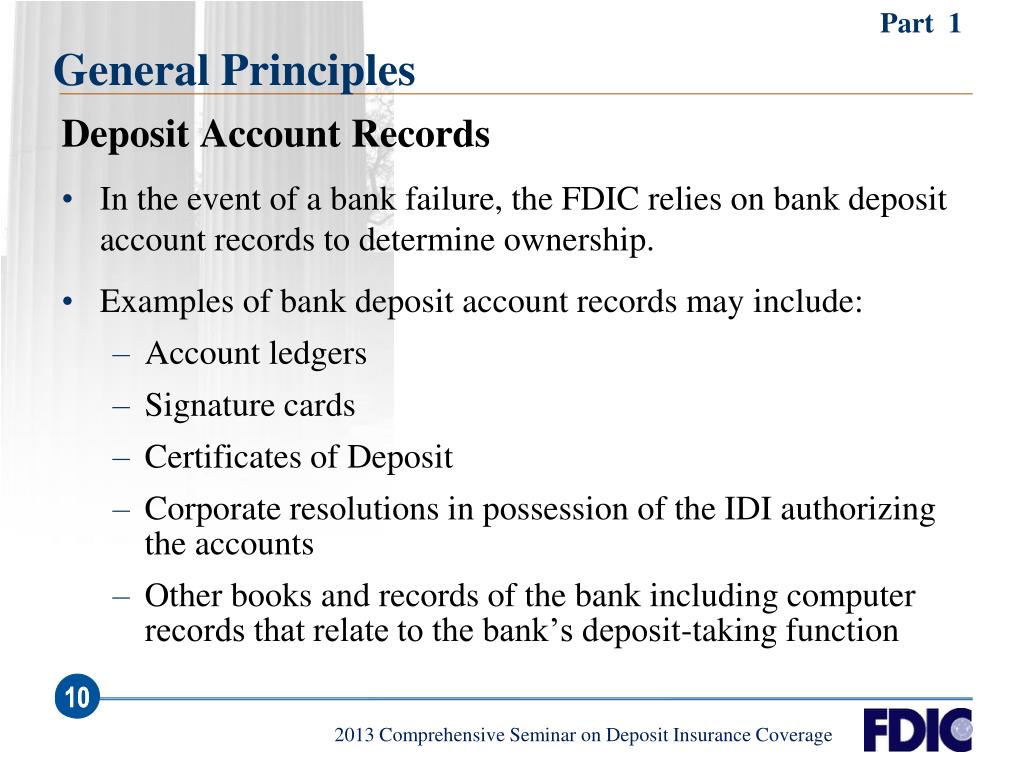

Fdic Financial Institution Employee S Guide To Deposit Insurance General Principles Of Insurance Coverage

How Your Money Is Insured At 3rivers

Maximizing Your Fdic Coverage With Beneficiaries

Federal Deposit Insurance Corporation Advanced Topics In Deposit

Fdic Bank Insurance Marcus By Goldman Sachs

Fdic Law Regulations Related Acts Rules And Regulations

Fdic Bank Insurance Marcus By Goldman Sachs

Federal Deposit Insurance Corporation Advanced Topics In Deposit

Fdic Financial Institution Employee S Guide To Deposit Insurance General Principles Of Insurance Coverage

Maximizing Your Fdic Insurance Cbs News

Ppt Federal Deposit Insurance Corporation Comprehensive Seminar On Deposit Insurance Coverage For Bankers Powerpoint Presentation Id 1390851

Fdic Bank Insurance Marcus By Goldman Sachs

Federal Deposit Insurance Corporation Advanced Topics In Deposit

Fdic Financial Institution Employee S Guide To Deposit Insurance General Principles Of Insurance Coverage

Fdic Vs Sipc Insurance 8 Things You Need To Know Today Chief Mom Officer

Ncua Fdic Insurance Limits How Coverage Is Calculated

Federal Deposit Insurance Corporation Advanced Topics In Deposit

Posting Komentar untuk "Fdic Insurance Coverage Examples"