D&o Insurance Coverage Exclusions

It will have affected everyone who reads this. Sadly no introduction is needed for the coronavirus.

Covid 19 And D O Claims What You Need To Know And Do Now

Many of these exclusions are negotiable.

D&o insurance coverage exclusions. Some will have suffered physically. An exclusion precluding insurance coverage for claims arising from a contract not only applies to claims sounding directly in contract but also to claims sounding in tort as long as they flowed. Here are a few key exclusions to consider in private company DO insurance.

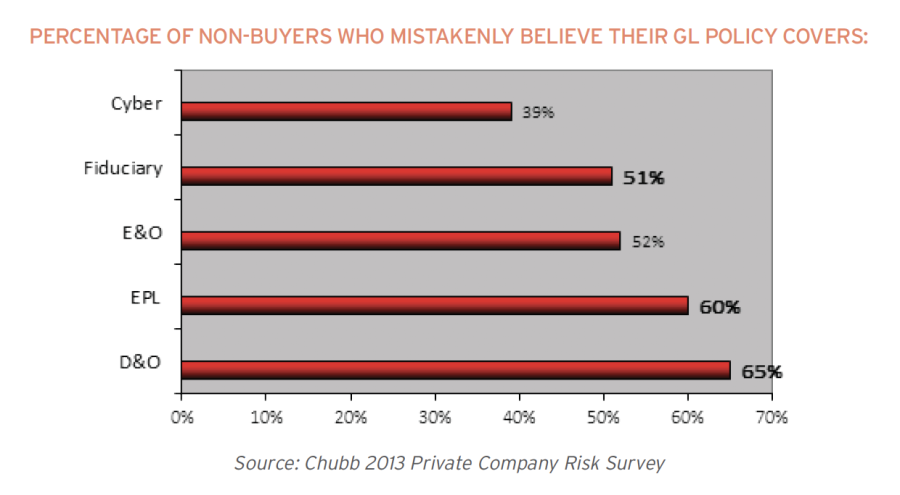

DO Insurance Coverage and Coronavirus. Marc Kamin is a partner with Stewart Smith a Pennsylvania-based law firm specializing in insurance coverage work and litigation. Here are a few key exclusions to consider in private company DO insurance.

Many of these exclusions are negotiable. Avoiding Exclusions Sometimes an article needs an introduction to put the subject in context for the reader. Directors and Officers DO liability insurance offers wide coverage for the directors and officers of a company for alleged wrongful acts committed while performing their professional duties.

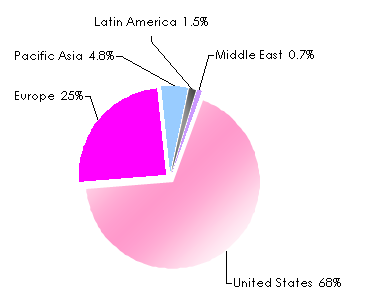

Key DO Insurance Exclusions. However this extensive coverage in the DO liability policy is not without exclusions. For example bodily injury andor property damage would normally be covered under your General Liability policy and would not be written into your DO coverage.

Intentional fraud While insurance carriers will not insure for these types of DO claims the negotiable. Directors and officers liability Insurance also written directors and officers liability insurance. A policy exclusion removes the claim from the scope of the policys coverage.

Often called DO is liability insurance payable to the directors and officers of a company or to the organizations itself as indemnification reimbursement for losses or advancement of defense costs in the event an insured suffers such a loss as a result of a legal action. A larger group will have been emotionally affected. Key DO Insurance Exclusions A policy exclusion removes the claim from the scope of the policys coverage.

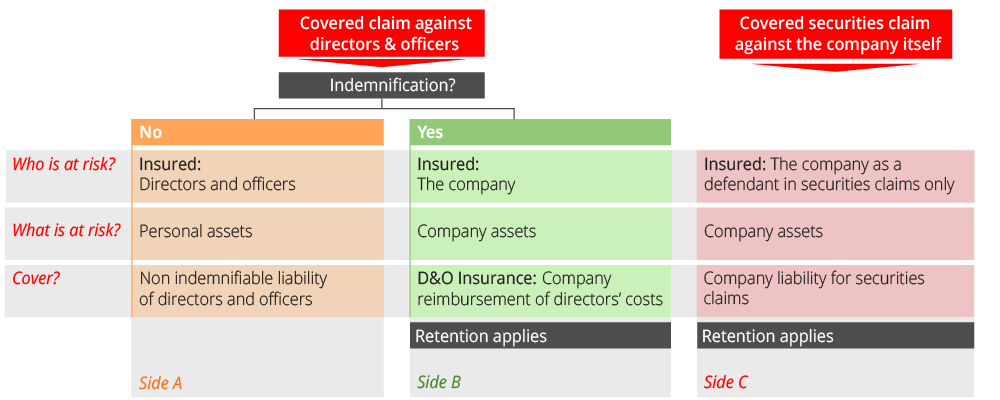

Thus most policies contain exclusions for loss arising from claims arising from bodily injury or property damage as those hazards are typically insured under Commercial General Liability Insurance CGL policies. Coverage is typically excluded if the companys payment for loss or indemnity is covered by other or prior insurance. With that in mind most DO policies contain exclusions to preclude coverage for claims that are typically covered by other types of insurance.

Correct Success - Due Process Bill Cosby and DO Liability Insurance Conduct Exclusions The best source of finance News.

Mistakes To Avoid When Purchasing D O Insurance Adam J Epstein Third Creek Advisors Llc

D O Insurance Directors And Officers Liability Insurance

Know The Common Directors And Officers D O Insurance Exclusions Tanner Ballew Maloof

Private Companies Won T Escape Sec Scrutiny D O Coverage May Be Crucial

Directors And Officers D O Insurance An Overview Landesblosch

Pdf A Common Law Approach To D O Insurance In Fact Exclusion Disputes Semantic Scholar

Kobe Bryant Almost Went To Bulls Before Shaquille O Neal Requested Trade In 2004 Impresora De Camisetas Dibujos Para Remeras Disenos Para Remeras

The Real Deal On Side A Directors And Officers Liability Coverage

D O Insurance Exclusions Red Flags And What To Look Out For

Self Insuring D O Liability Expert Commentary Irmi Com

Directors And Officer S Liability Insurance

A Buyer S Guide To Obtaining Comprehensive D O Insurance Coverage By Holland Knight Issuu

D O Insurance Coverage And Coronavirus Avoiding Exclusions

Know The Common Directors And Officers D O Insurance Exclusions Scurich Insurance Services

D O Insurance Basics Part 1 The Policyholder Perspective

Understanding D O Insurance Exclusions In Passaic Nj

Posting Komentar untuk "D&o Insurance Coverage Exclusions"