Change Insurance Cover Australian Super

Change your cover type. If you do not indicate a change to a type of cover you already have the amount of your existing cover will remain the same.

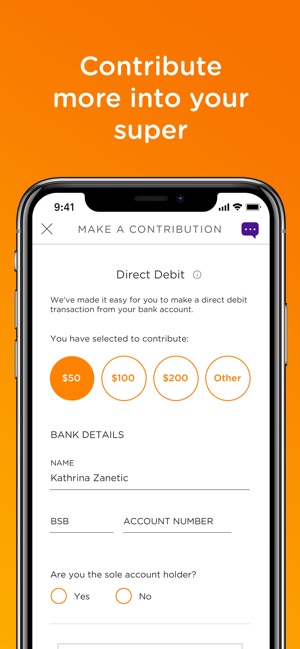

Australiansuper Apps On Google Play

This is a change to the definition of TPD for contributing members who receive a default TPD cover on or after 1 July 2014 and who then make a benefit claim on invalidity grounds you will be assessed against a modified definition of TPD.

Change insurance cover australian super. Most super funds offer life total and permanent disability tpd and income protection insurance for their members. Sourcesupplied holding life insurance in a superannuation fund is about to get trickier. Insurance calculator australian super.

The Insurance in your super guide. You can also apply to change your individual work rating and Income Protection waiting period andor benefit payment period. You still only pay what it costs us to provide your cover.

Below you can choose to opt in to opt out of apply for or change your level of insurance cover in Equip. Life insurance is often referred to as death cover. These changes are aimed at making sure your super savings arent reduced by the cost of your insurance that you may not need or be able to claim on.

The reason for this change is to satisfy new regulatory requirements that govern the insurance cover which. This cover provides a basic level of protection if you die or become ill or injured. Income Protection cover with their super account.

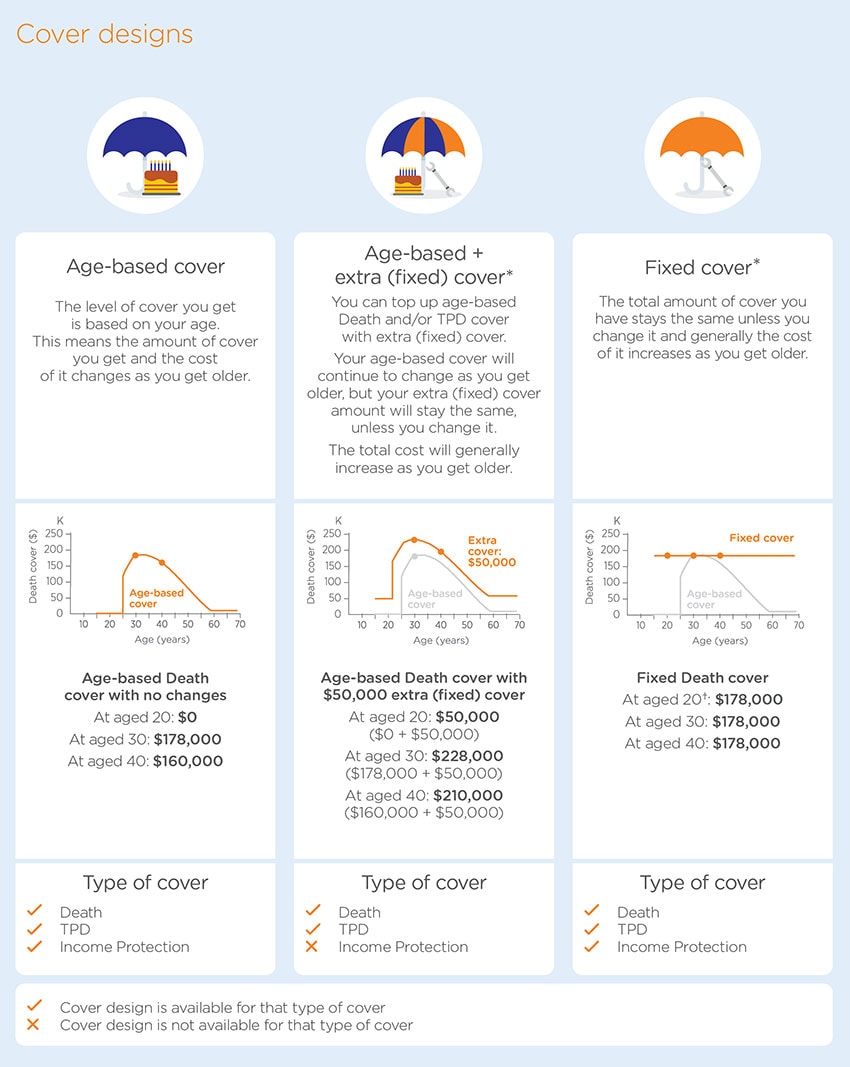

AustralianSuper will only make changes to each type of cover you change on this form. Eligible members receive age-based Death Total Permanent Disablement TPD and Income Protection cover. You can find out more about income protection cover through australiansuper by reading our insurance in your super guide.

Cover will increase to the amounts in the table above. Under the law super funds will cancel insurance on inactive super accounts that havent received contributions for at least 16 months. To help you understand how the new insurance premiums may affect you weve provided some examples of each type of cover below 2.

Insurance changes from 1 March 2021 Were making some changes to insurance cover through HESTA so we can keep it competitively priced and to better reflect the needs of most of our members. Apply for new cover. Tom is 30 when he joins AustralianSuper.

You have the same duty before you extend vary or reinstate your insurance cover. If you wish to cancel all cover under AustralianSuper you should complete Section 1 and 3 of this form and sign the Declaration. You can also cancel all or part of your cover.

The government has made two sets of changes to insurance in superthe Protecting Your Super Package PYSP and Putting Members Interests First PMIF. Follow the simple 3 steps to see the difference an income from super can make. Find out how much insurance cover you may need and how much it will cost.

Members who are 25 or older when they join will keep. Basic cover is age-based and is designed to provide a minimum amount of cover for changing needs as you get older. But for many superannuation is the only place Australians have access to.

Insurance in super is an effective way to protect your future and the future of your family by giving you access to financial support if something happens. In January 2020 we wrote about the significant changes coming to new income protection insurance policies in Australia with some of these changes due to take effect from 1 October this year and at least one measure delayed for 12 months. 20742 0921 page 1 of 12 Use this form to apply for new cover or to start increase reduce change or cancel your cover to suit your needs.

The age-based age but the fixed amount will remain the same. For more information download New insurance premiums - 1 October 2020 PDF 163 KB. Age-based cover is designed to provide a minimum amount of cover for changing needs as.

AustralianSuper will only make changes to each type of cover you change in this form. Note if your cover has a premium loading the premium loading applies as a factor to. Increase your cover maximum limits apply decrease your cover.

Here are some examples that illustrate the change in cost for members in AustralianSuper Plan with basic default cover based on their age work rating and Income Protection benefit payment period. Insurance Alert - Major changes coming to income protection cover from 1 October 2021. Change your Income Protection waiting period or benefit payment period change your work rating.

Most of us are underinsured. It starts once youve turned 25. It changes as you age.

The cost is automatically deducted from your super account. Log into your account or use the Change your insurance form to. Many superannuation plans include insurance as part of their offer.

AustralianSuper doesnt make any profit from the insurance we provide. AustralianSuper provides most members with basic insurance cover with their super account. Also after its transferred your total cover cant exceed the following maximum cover amounts.

This cover provides a basic level of protection if you die or become ill or injured. You may also be eligible for insurance in super without having to take medical tests or provide evidence of good health to the insurer. Fixed cover remains the same unless you change it.

Protection cover you can transfer is 20000 a month. In addition super funds may have their own rules that require the cancellation of insurance on super accounts where balances are too low. Under the governments Putting Members Interests First changes from 1 April 2020 insurance through super cannot be provided to a member if their super account balance has never reached 6000 since 1 November 2019 if the member has not opted in to keep their cover.

Change insurance cover Death and total and permanent disablement TPD cover Cover applies automatically when you meet Equips eligibility and cover conditions unless you have opted out of it previously. This is where the member adds a fixed amount on top of their age-based cover. This means the age-based basic cover he will automatically receive for Death.

Superlifes australian super transfer service. Insurance through your super account may be a tax-effective way to cover the cost of insurance and as the premiums are paid from your super account there may be no impact to your take-home pay. Your cover is age-based so the amount and cost of it will change as you get older.

1 Actual rate of increase varies depending on your age and cover type. And when your super balance reaches 6000. Income protection insurance australian super.

And youre receiving employer contributions age limits and other conditions apply. Life insurance australian super. But if they make any changes to their cover including changing their work rating benefit period or waiting period their cover will no longer increase automatically as they get older.

The aim of the super changes is to prevent costly fees which bank up over time eating up balances on inactive accounts.

Australiansuper On The App Store

Australiansuper Posts Facebook

Super Funds In Sights At Royal Commission Adviser Ratings Adviser Ratings

Super Insurance Insurance Through Super Australiansuper

Change Or Cancel Your Cover Australiansuper

20 Disadvantages Of Life Insurance Through Super Insurance Watch

How To Change Super Funds Canstar

20 Disadvantages Of Life Insurance Through Super Insurance Watch

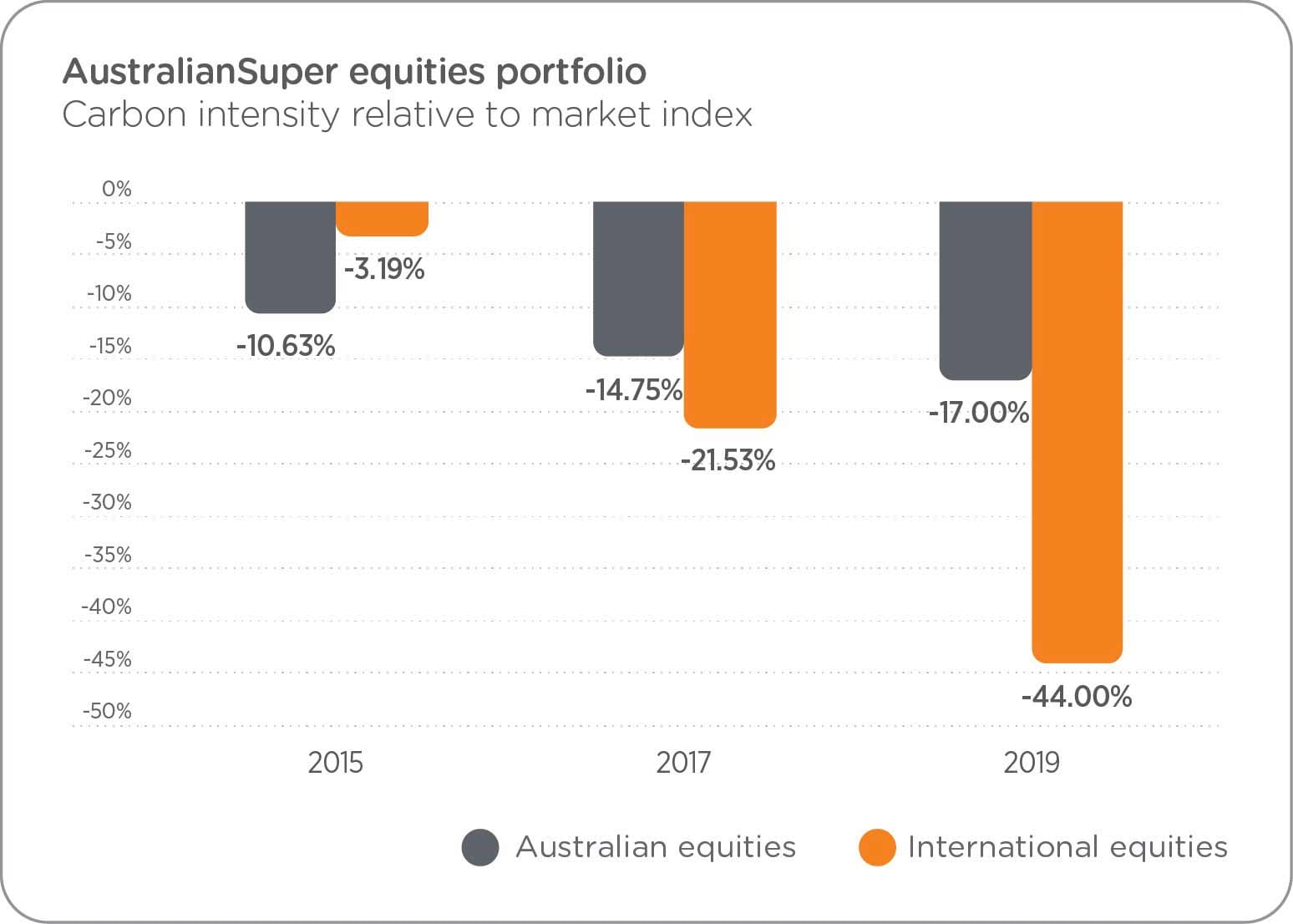

Climate Change Australiansuper

Australiansuper Review Performance Fees Finder Com Au

20 Disadvantages Of Life Insurance Through Super Insurance Watch

Tobacco Free Finance Signatories And Supporters Unep Fi Principles For Sustainable Insurance

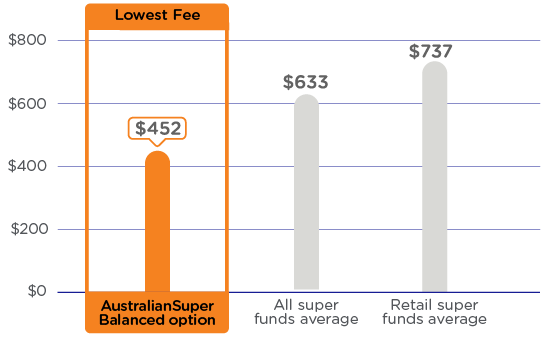

Super With Low Fees Our Fees Costs Australiansuper

Life Insurance Through Super Pros Cons Canstar

20 Disadvantages Of Life Insurance Through Super Insurance Watch

A Positive Year For Your Super Returns Australiansuper

Industry Super Australia Employees Location Careers Linkedin

Australiansuper Productreview Com Au

Posting Komentar untuk "Change Insurance Cover Australian Super"