What Does Combined Single Limit Coverage Mean

Single limit auto insurance coverage allows you one single amount of coverage that can be used as needed for either bodily injury or property damage liability insurance. There are many options for combined single limit liability coverage or CSL.

A combined single limit is the maximum amount your car insurance will pay out for both property damage and bodily injury liability combined.

What does combined single limit coverage mean. Combined Single Limit Liability. In that instance the coverage will be listed as a single amount 500000 for example and all claims for damage to property and injuries will be made against the CSL. Combined single limit policy is when liability coverage can be combined into one lump sum or it can be separated and split into different incidents.

This single limit allows you to pay any property damage or injury expenses no matter how much they are as long as the total. Whether there is property damage injury to other persons and so on the single limit applies to the entire claim payout. Per person limit per occurrence limit.

This one single amount is your maximum limit so the most the insurance company will be obligated to pay for damages resulting from one single accident. For example if the limit is 300000 per accident that is what the insurance. The combined single limit simply states a single dollar limit that applies to any combination of bodily injury and property damage liability claims as compared to split limits where three separate dollar amounts apply to each accident.

Combined single limit plans - These plans are offered in a small number of states where one coverage level can pay for both UMBI and UMPD. If your policy includes a Single Inclusive Limit clause it basically means that the amount of money associated to each of the categories in the insurance policy ie. For example if someone with a policy that has a combined single limit is in an accident with multiple people and the individual with the combined single limit policy is at fault and pursued legally for damages any damages rewarded are paid out of the total pool.

How does this work. Liability is combined into one single limit. Combined Single Limits auto insurance policies may have split limits or combined single limits.

Combined Single Limit Liability Coverage CSL This type of auto insurance coverage is a combination of all the liability limits Bodily injury AND Property Damage. Combined single limit liability is commercial auto insurance coverage that combines bodily injury and property damage. Combined single limit is a type of automobile insurance policy which allows car-owners the ability to cover all damages incurred in an accident under one policy limit.

There is not a split differential between the three main components. Combined Single Limits are mostly purchased by organization but they are sometimes offered for private cars as well. What is Combined Single Limit CSL Liability Insurance.

The combined single limit simply states a single dollar limit that applies to any combination of bodily injury and property damage liability claims as compared to split limits where three separate dollar amounts apply to each accident. This differs from split limit insurance which assigns individual limits on the amount of damages covered for each person injured in an accident and the property damage caused by the accident. A combined single limit is a clause in an insurance property that states that coverage for all aspects of a claim is limited to a single amount.

It is the most the insurance company is obligated to pay for damages because of bodily injury or property damage or both resulting from a single accident. The limit may range from 500000 to 1 million in combined liability coverage. It is also referred to as Combined Single Limit CSL.

While most liability auto insurance is purchased as split liability it is also possible to purchase combined single limits on a car insurance policy. A single limit ties together different kinds of coverage and repayment amounts into a coherent home insurance policy. It is also called the single limit policy that is frequently used with automobile insurance.

Often commercial insurance carriers write policies that group all damages both property and injury into one level of coverage called a combined single limit CSL policy. Combined Single Limit means a liability policy commonly offering separate limits that apply to bodily injury claims and to claims for property damage expressed as. The combined single limit is basically the maximum amount of money the insurance company will pay in case the insuree claims the money.

The benefits of having these types of policies depend on the amount of coverage. This single limit total includes all medical expenses and property damage claims that may arise from an incident that occurs involving the named insured. Combined single limit CSL coverage for 1 million dollars would strictly be under your car insurance policy and pays out only for covered losses under that policy.

Combined single limit is essentially a pool of money from which liability claims are paid. This single limit is the maximum combined total that will be paid out by an umbrella liability insurance policy in the event of a claim. Per person limit per occurrence limit for all injured persons and per.

If the liability coverage on your auto policy is written as a combined single limit there is no differentiation between bodily injury payouts per person per accident or property damage claims. Combined single limits insurance basically combines all of your liability coverage into one lump sum versus liability where coverage is split amongst different incidents. It can also be termed combined single limit CSL.

A combined single limit is exactly what the name implies. An umbrella policy for 1 million dollars will cover you if you have claims against you or are sued and have to pay more than the coverage limits under your auto andor homeowners policies. That could happen while youre waiting for a car to be repaired in an accident you.

Dwelling Personal Property Outbuildings or Additional Living Expenses can be combined in the event that any category exceeds the amount stated for a loss in that area. What does combined single limit mean in auto insurance This makes you look at your car to be protected against something including damage caused by someone else and your car. It covers bodily injury for each passenger for each occurrence and for property damage sustained by the other party.

This type of liability limit is expressed in a single number. For instance a 100000 policy will pay for up to that amount of UM claims regardless of whether or not they are related to bodily injury or property damage.

:max_bytes(150000):strip_icc()/GettyImages-1035834404-ec93fc4955fc43d7af41255df3578d94.jpg)

Combined Single Limits Definition

Bodily Injury Car Insurance Coverage How Does It Work Valuepenguin

Fun Playroom Designs For Kids Cool Kids Rooms Kids Bedroom Inspiration Playroom Design

A Rather Small C4 8 Class Solar Flare Created This Beautiful Light Bulb At 02 30 Ut On October 14 2012 This Appears To Be From An Acti Estrellas Unive

At T Confirms Plans To Launch Warnermedia Streaming Service In 2019 How To Plan Product Launch Android Apps

Google Motos Geniales Motos Choperas Motos

Certificate Of Insurance Template The Reasons Why We Love Certificate Of Insurance Templa Certificate Templates Best Templates Graduation Certificate Template

/squander-money-1183142152-ad7813c7995846e49ad4e5ac4d341b3b.jpg)

Combined Single Limits Definition

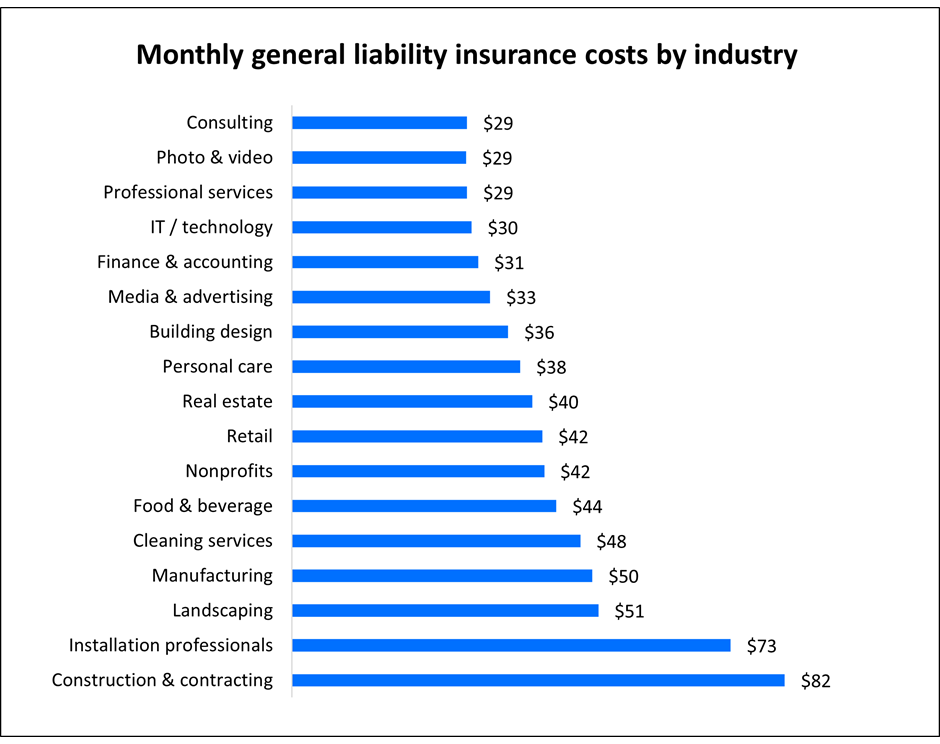

General Liability Insurance Cost Insureon

Clinique Pop Glaze Sheer Lip Colour Primer Lipstick Dillard S Labiales Perfumeria Brillos

Papel Vintage Gratis Para Scrapbooking Invitaciones Tarjetas Manualidades Invitaciones Portadas De Cuadernos

Point Pleasant Revisited Tragedy On The Ohio River West Virginia History Ohio River Point Pleasant

Liability Insurance Progressive Commercial

Sennheiser Hdr 120 Headphone Black In 2021 Sennheiser Headphones Black Headphones Sennheiser

Credit Card Paid Off Here S How A 0 Balance Can Affect Your Credit Credit Card Online Credit Card Credit Card Balance

Liability Car Insurance Guide For 2021 Key Things To Know

Liability Insurance Progressive Commercial

Travel Tips Travel Tips Beat Jet Lag Jet Lag

Posting Komentar untuk "What Does Combined Single Limit Coverage Mean"