Tail Coverage Insurance Example

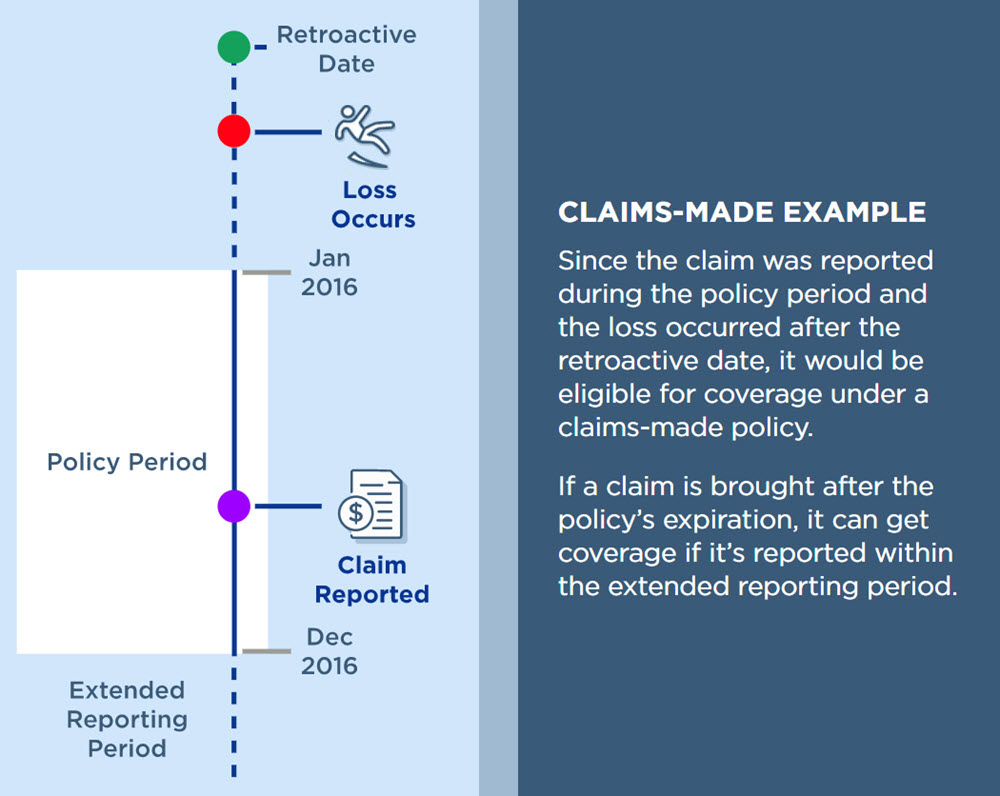

IMRI provides the following example of how tail coverage insurance works. It applies to claims-made insurance policies and typically involves paying your insurer an additional fee.

Bespoke Mclaren 675lt With Mso Parts Is Mesmerising Cars Mclaren 675lt Mclaren Cars Luxury Cars

Your claims-made policy expired on Nov.

Tail coverage insurance example. For some policies like our employment practices liability insurance you can pay for an option to have three years of tail coverage. Tail coverage keeps the insurance in place for losses that have not yet been reported. For example the main partner of a small law firm could be retiring and decide to purchase tail coverage to maintain liability coverage in case lawsuits are filed against them for services provided while the liability policy was still active.

30 regarding a massage session you performed on Oct. The doctor does not renew this coverage. Assume that a claims-made policy with a January 1 2015-2016 term contains tail coverage with a term of January 1 2016-2017.

Client sues you regarding services you performed for him this year. Misrepresentation Directors and officers at a company failed to disclose material facts and provided inaccurate and misleading information to their investors. Example 4 You previously received your coverage from an insurance company that has become insolvent.

When ending one insurance policy and switching to another. There are two things you should be aware of with tail coverage. Prior acts are events that happened before a policy was.

Plaintiffs often do not file a suit until years after a bad outcome so its necessary to protect oneself with tail coverage. See prior acts coverage supra. Tail coverage insurance example.

You are now without any malpractice insurance coverage for that time period covered by the insolvent carriers tail unless. For example even if the firm continues in business and maintains insurance coverage after the attorneys retirement the firm might switch to a new insurance carrier and accept a very restrictive prior acts exclusion or other limiting language in order to save on premiums. One of your clients filed a claim on Dec.

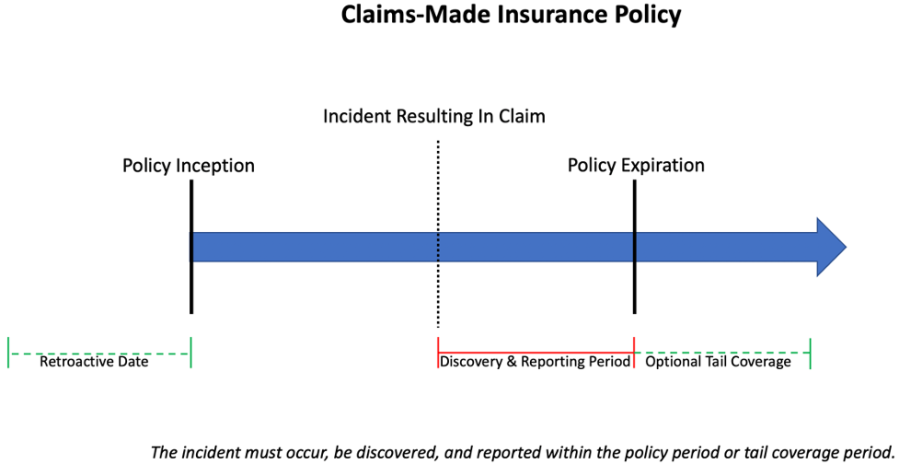

In contrast to a standard policy tail coverage provides protection for medical malpractice claims that are reported after the providers policy expired or was cancelled. Here is an example of how tail coverage works. Tail coverage refers to an extension period of insurance coverage for medical malpractice.

Also assume that the insured did not renew the policy when it expired on January 1 2016. An end to a normal medical malpractice insurance coverage may result due to cancellation by the physician who availed. From the word tail this type of insurance serves as the tail or insurance coverage at the end of a normal medical malpractice policy.

Example 3 You choose to retire and do not yet qualify for free retirement coverage from your insurance company. So for example if in 2020 a set of actions took place that is later challenged in 2021 its the 2021 policy that would respond assuming you still have an active insurance policy in place. In MA the DO insurance policy that responds to a claim is the policy that is in place at the time the claim is made.

Tail Coverage Insurance. Youll find tail coverage in claims-made policies such as professional liability. For example some policies may include a shorter period of tail coverage between 30 and 90 days.

Diaz works for the ACME Medical Group and plans to work for ABC Medical Group beginning 712019. The following are several examples of Management Liability DO claims. Tail coverage requires that the insured pay additional premium.

Malpractice lawsuits do not happen overnight. Doctor As insurance policy is in effect from. For example a surgeon lets their malpractice insurance expire in july and does not renew nor purchase another policy.

On average tail coverage costs two times more than the original term cost at the time of expiration. For example a doctor takes out a malpractice claims-made policy that covers the period from January 1 to December 31 20X1 and which contains tail coverage for an additional year. Tail coverage is an endorsement or an addition to your insurance that allows you to file a claim against your policy after it expired or was canceled.

Hostile Work Environment An airline pilot claimed there were derogatory statements posted by co-workers on the Crew Members Forum an online company bulletin board accessible to all pilots and crewmembers. Also assume that the insured did not renew the policy when it expired on January 1 2016 2. The ERP also known as tail coverage provides for an additional period of time during which the insured can report a claim after its claims-made policy has.

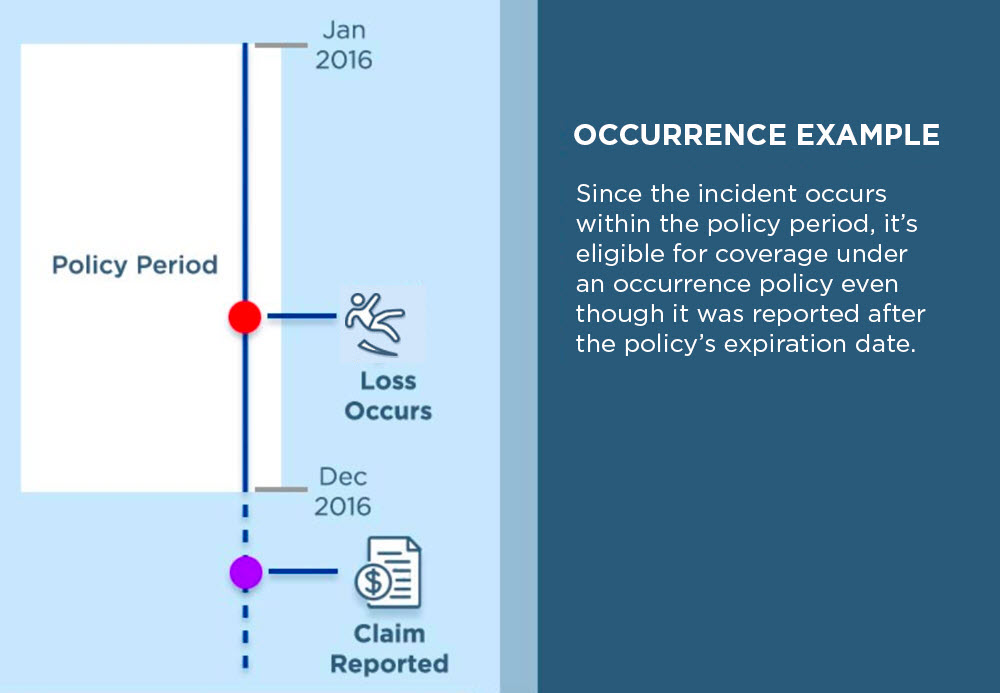

For example assume that a claims-made policy with a January 1 2015-2016 term contains tail coverage with a term of January 1 2016-2017. Cover letter for insurance job with no experienc. What Is a Tail Policy.

Your current policy applies to that claim but only if he sues you when the policy is still active. Said insurance shall provide coverage terms including without limitation the amount of each policys deductible comparable to the Seller. Here is an example of a situation in which tail coverage is needed.

He has been insured by. He finds an interested buyer Bill who requires a tail coverage endorsement with a length of three years minimum. To avoid any gap in coverage for pretransaction conduct GlassHouse purchased tail coverage by endorsing the policy but as GlassHouse later learned the tail coverage endorsement not only extended the reporting period for several years it also reduced the limits for the remainder of the initial policy period from 15 to 5 million.

Think of tail coverage as a liability insurance extension plan. John an agency owner decides to put his agency up for sale. On or prior to the Determination Date the Seller will obtain an extended reporting period Tail Coverage on liability insurance insuring officers and directors of Bank.

30 and you purchased tail coverage. Sample Tail Coverage Scenario Lets say you have a claims-made policy that expires at the end of the year. The following are examples of Employment Practices Liability Insurance EPLI claims.

Most commonly business entities will purchase tail coverage in times of transition. A problem occurs during a surgery in October of 20X1 and the patient sues the doctor in the following February.

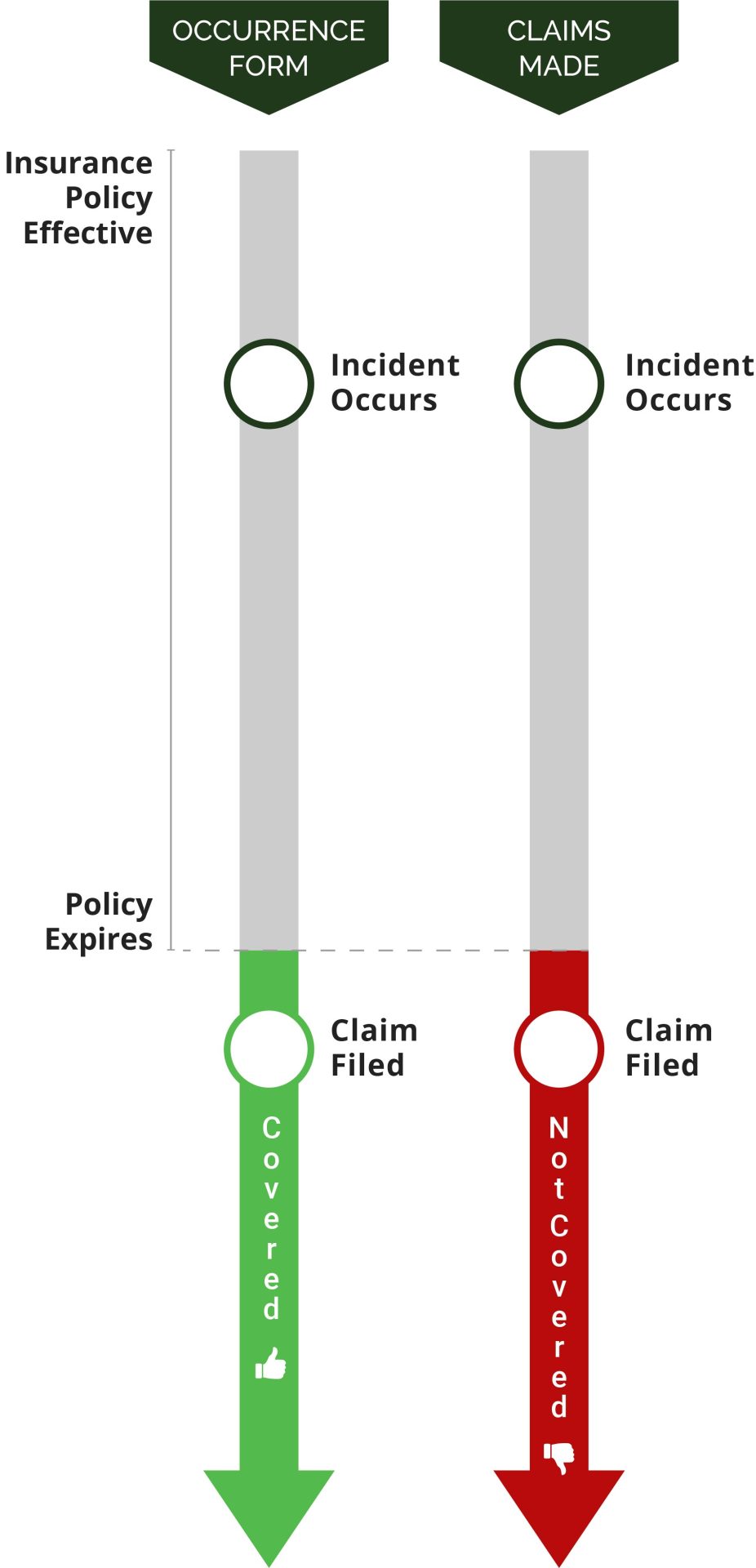

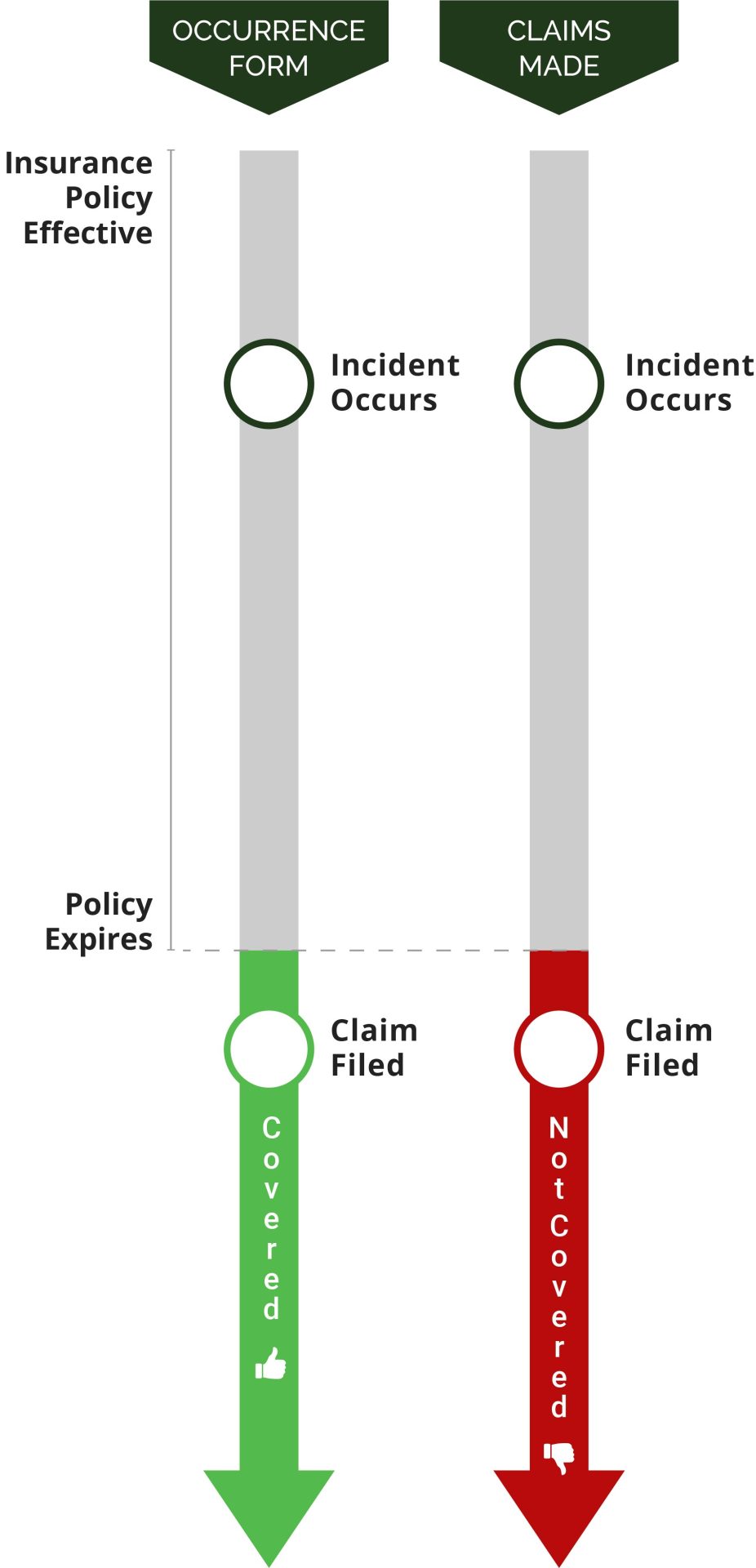

Claims Made Vs Occurrence Insurance Claims Made Policy The Hartford

The Surveys Which Are Made Shows That The Population In The Middle East Is 350 Million Ecommerce Infographic Technology Lessons Digital Marketing Infographics

What Is Tail Coverage Embroker

Tail Insurance Coverage What Is It Landesblosch

Occurrence Form Vs Claims Made Insurance Policy Nacams

What Is Tail Insurance Medpli Professional Liability Insurance

Geico Hawaii Office Homeowners Insurance Home Insurance Quotes Renters Insurance

Claims Made Vs Occurrence Insurance Claims Made Policy The Hartford

Patient Health Questionnaire Form Sample Questionnaire Medical Printables Offer And Acceptance

How To Make A 360 3d Virtual Real Estate Tour With Iphone Android Real Estate Education Real Estate Real Estate Client

Sizing Up Your Pup A Simple 7 Point Inspection From Tip To Tail Puppy Time German Shepard Puppies Dog Insurance

Cornell Supplement Essay Sample Engineering In 2021 Essay Mobile Review Linksys

Occurrence Form Vs Claims Made Insurance Policy Nacams

Risks Covered Under Motor Insurance Policies The Figure Shows The Download Scientific Diagram

Editable Physician Assistant Employment Agreement Terms Of Agreement Physician Assistant Emp Contract Template Physician Assistant Continuing Medical Education

Why We Chose Trupanion Pet Insurance For Our Dogs Pet Health Insurance Pet Insurance Best Pet Insurance

What Is Tail Coverage Embroker

Tiliqua Rugosa Shingleback Bobtail Stump Tail 15 Australian Blue Tongued Skink Cute And Docile P Reptiles And Amphibians Blue Tongue Skink Amphibians

Root Cause Analysis Templates Analysis Business Analysis Report Template

Posting Komentar untuk "Tail Coverage Insurance Example"