Homeowners Insurance Dwelling Coverage Too High

If thats the case your lender may require you to fill that coverage gap with standalone windstorm insurance. Say a person has a 100000 Coverage A dwelling limit.

Renewing Annual Home Insurance Evaluating Your Home Insurance

The cost of dwelling coverage may seem high at first blush.

Homeowners insurance dwelling coverage too high. It is best to reassess your dwelling value with your agent every 3 to 5 years to ensure your homes replacement cost keeps in line with rebuilding costs. New homeowner closing on a new build next week. After all it covers your actual house the place you live.

If you have a reason to believe your replacement cost is higher then speak with your insurance agent and raise the amount of your dwelling coverage. The more valuable your stuff is the more property coverage you need. For that reason dwelling insurance might be more expensive than you like.

I got quite a shock recently when I opened my annual renewal invoice for my homeowners insurance. Why is my dwelling coverage so high. Extended dwelling coverage is an additional amount of dwelling insurance you can purchase to cover a total loss that exceeds your standard dwelling coverage.

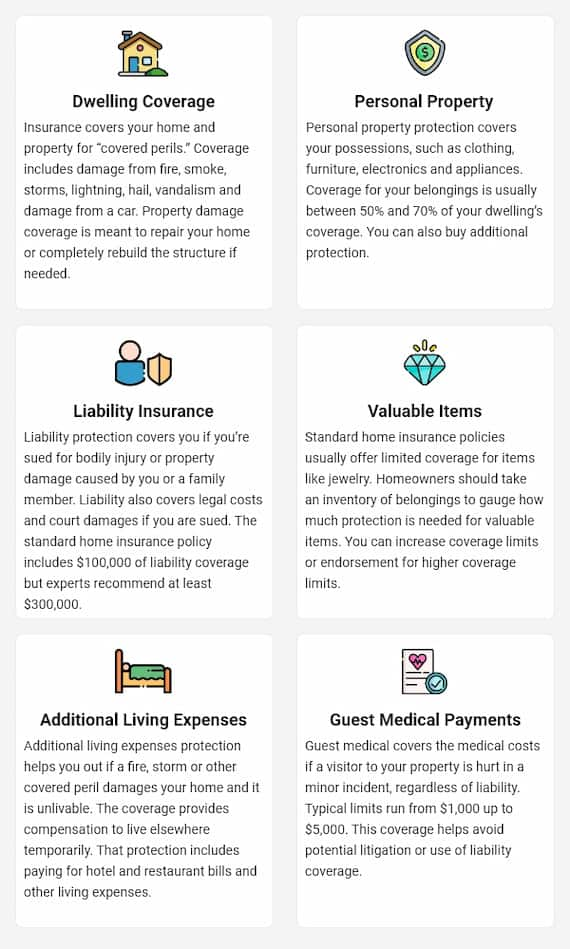

This coverage protects your home you live in plus any attached structures your garage for example from perils listed in your insurance policy. The Coverage A dwelling limit represents the total amount your insurer will pay out to replace your home if it were totally destroyed. But remember this insurance coverage can make you whole if you experience a major loss.

That means there is up to 100000 available to rebuild their home in the event of a loss. It covers repairing or rebuilding your home due to a covered peril. Your dwelling value on your home insurance policy can increase due to one of three factors.

Dwelling Coverage or Coverage A is the primary coverage on the homeowners condo owners or dwelling fire policy. Some of these include vandalism theft windstorms and more. But to know if that is true or not you need to know the main reasons this value goes up.

Too many claims can make you a high-risk homeowner. Most likely the highest coverage limit in your homeowners insurance policy dwelling coverage pays to rebuild your home if it burns down is destroyed by a tornado is crushed by falling trees or otherwise damaged by covered hazards. Dwelling coverage also known as dwelling insurance or Coverage A is the part of your homeowners insurance that helps pay to rebuild or repair the physical structure of your house in the event its damaged by a covered peril like a fire windstorm or a lightning strike.

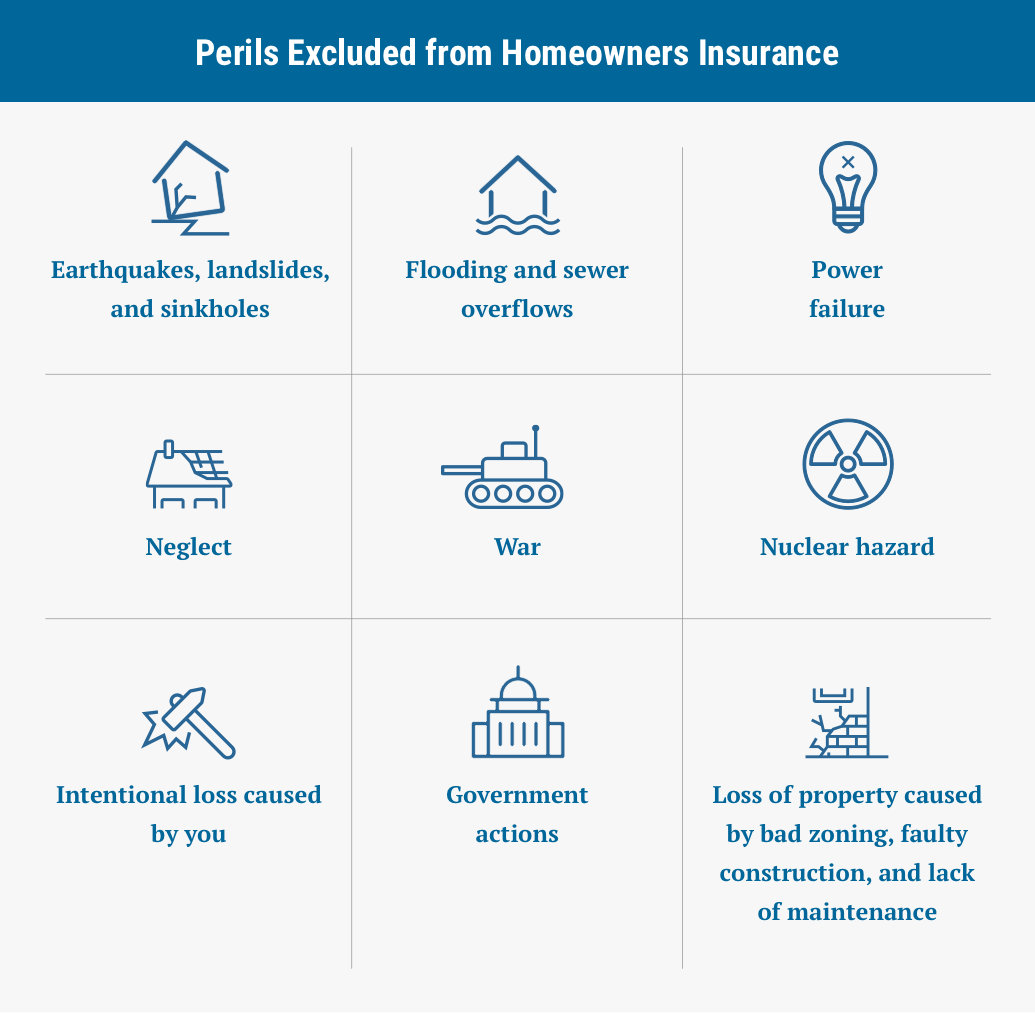

Standard homeowners insurance however does not cover damage from floods or earthquakes. To the insurance company this means you are more likely to file future claims. The price was hiked far more than I believed was reasonable.

Coverage A or dwelling coverage is the central coverage included in a homeowners policy and will generally have the highest limit of types of coverage on your policy. Dwelling coverage protects the structural components of your home from damage and covers in the event of damage to the home that impacts walls floors ceilings home systems and more. Personal property coverage covers your belongings from theft fire and other losses but only up to a certain amount or their replacement value as they diminishes over time.

Its not hard to see that dwelling coverage is indeed the most important part of your homeowners insurance policy. Homeowners insurance typically covers damage from heavy winds but insurance companies in exceptionally high-risk coastal areas may exclude wind from your policy. Inflation insurance inspection and the cost of reconstruction.

Dwelling insurance also known as dwelling coverage or Coverage A is the portion of your homeowners policy that covers repairing or rebuilding your home after its damaged by a covered peril such as fire. You may not have enough personal property insurance if you own high-value jewelry watches expensive artwork or other expensive things. Dwelling coverage sometimes called Coverage A is the portion of your home insurance policy that pertains to the cost of rebuilding and repairing your home in the event that it is damaged or destroyed in a covered peril such as wind hail lightning or fire.

Most companies include a 25 replacement guarantee meaning they will cover up to 25 higher than the dwelling limit on your declarations page in the event of a total loss. This is a yearly coverage increase by a certain percentage and over time can throw your dwelling value out of whack. This could in the insurance company dropping you and may result in.

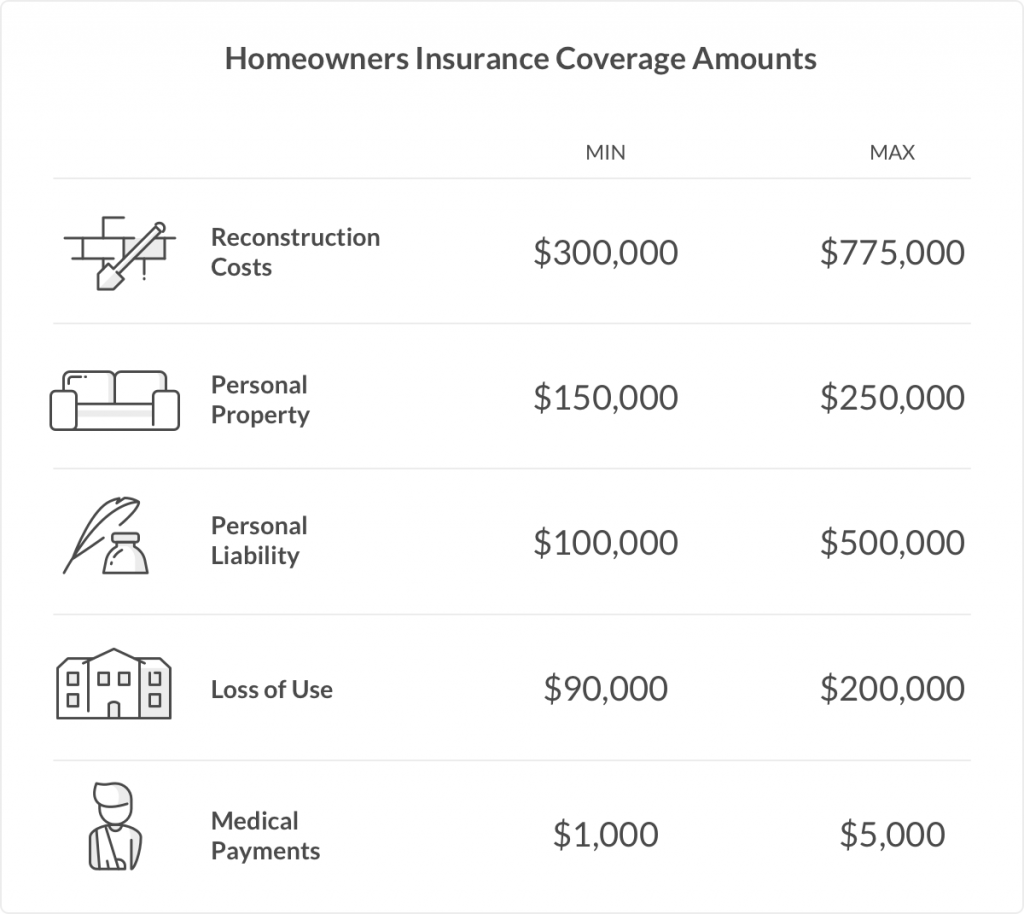

But the fact is that you may choose from a variety of ways to cover your house. The covered perils or causes of loss can be found in your policy. At minimum coverage C should be 20 percent of your dwelling coverage.

Dwelling coverage includes all attached structures such as a garage or porch as well as built-in appliances such as a water heater should. Almost every homeowners policy these days has some type of replacement cost coverage for the dwelling. Dwelling coverage refers to the coverage in your basic HO3 homeowners policy that covers your home or in insurance lingo dwelling.

I have a quote from Geico where the dwelling coverage is 357000 and a quote from the builder insurance company where the dwelling coverage is 275000. Homeowners should be keenly aware that the replacement cost of their home could be much higher than that amount. So if your home is insured for 308000 you should have at least 61600 for your personal property.

This can come in handy in situations where rebuild costs are unusually high such as when a widespread wildfire affects numerous homes and drives up the costs of labor and construction materials. You may decide that your dwelling value the value insurance places on the physical house is too high. Experts generally recommend insuring for your homes full replacement value.

Dwelling coverage too high. What to do if you cant get homeowners insurance because of claims. Do you have any examples of how your dwelling value affected a loss you had.

Homeowners Insurance How It Works And What S Actually Covered

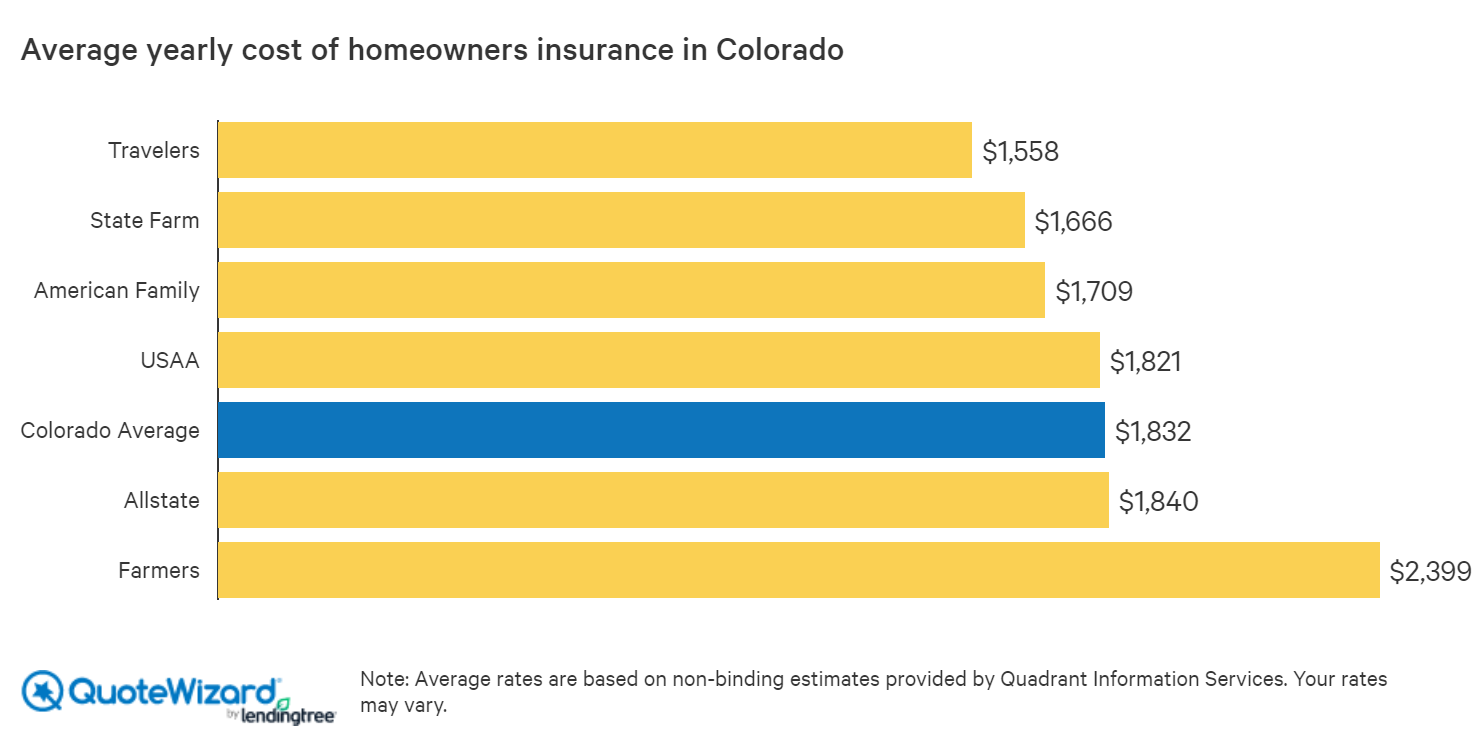

Best Home Insurance Rates In Colorado Quotewizard

How To Choose The Best Homeowners Insurance Money

Homeowners Insurance Guide Home Insurance Homeowners Insurance All About Insurance

What Is A Homeowners Insurance Deductible Valuepenguin

Insurance Ads Life Health Life Insurance Banner Banner Ads Web Template Psd Download Here Graphicr Insurance Ads American Life Insurance Life Insurance

What Makes You Ineligible For Homeowners Insurance

A Home Warranty And Home Insurance What S The Difference

6 Best Homeowners Insurance Companies Of October 2021 Money

How To Buy Homeowners Insurance Insurance Com

What Makes You Ineligible For Homeowners Insurance

6 Best Homeowners Insurance Companies Of October 2021 Money

How Much Homeowners Insurance Do I Need

What If I Can T Get Home Insurance Quotewizard

What Does Homeowners Insurance Cover

What Is Dwelling Coverage Insuropedia By Lemonade

Beginners Guide To Homeowners Insurance In Florida Part 1 Augustyniak Insurance Group In Jacksonville Florida

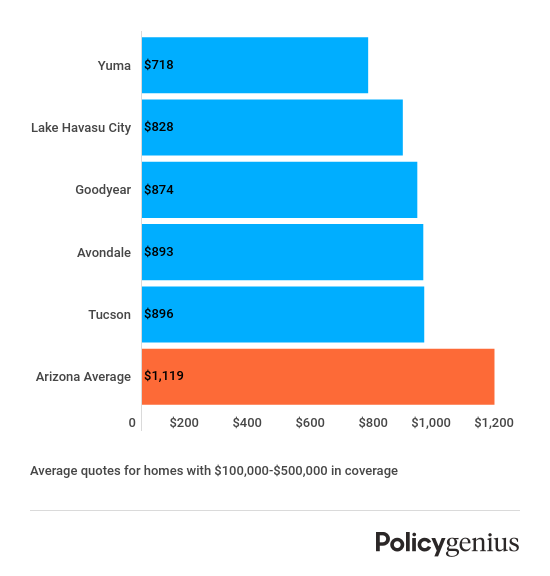

Homeowners Insurance In Arizona Policygenius

Homeowners Insurance Discounts To Lower Your Home Insurance

Posting Komentar untuk "Homeowners Insurance Dwelling Coverage Too High"