Default Insurance Cover Australian Super

The Australian Securities and Investments Commission ASIC estimates that 10 million super accounts have insurance attached of which 85 have default cover. It is usually no more than 100000 or.

Changes To Insurance Legislation Impacting Insurance Vicsuper

It offers a range of low-cost.

Default insurance cover australian super. Costs and benefits of default group insurance. Up to the automatic acceptance limit. The benefits to having default group insurance in superannuation include.

Insurance on inactive super accounts. AustralianSuper offers a number of membership categories and because everyones insurance needs are different the type of cover available will vary depending on the nature of work people do employment arrangements their age education and eligibility. Outside of super cover generally continues as long as you pay the premiums.

But its your life so you can choose what works for you. See the Accumulation Account Insurance Guide pdf for details. We also arrange transfer of your existing cover and offer income protection up to 6000 a month with no medical underwriting.

Premiums vary depending on a range of factors including whether your insurance is automatically linked to your super account on a default basis or. You have not previously cancelled your cover or your cover with REI Super had ceased and. UniSuper is an industry super fund and one of Australias largest super funds with more than 450000 members.

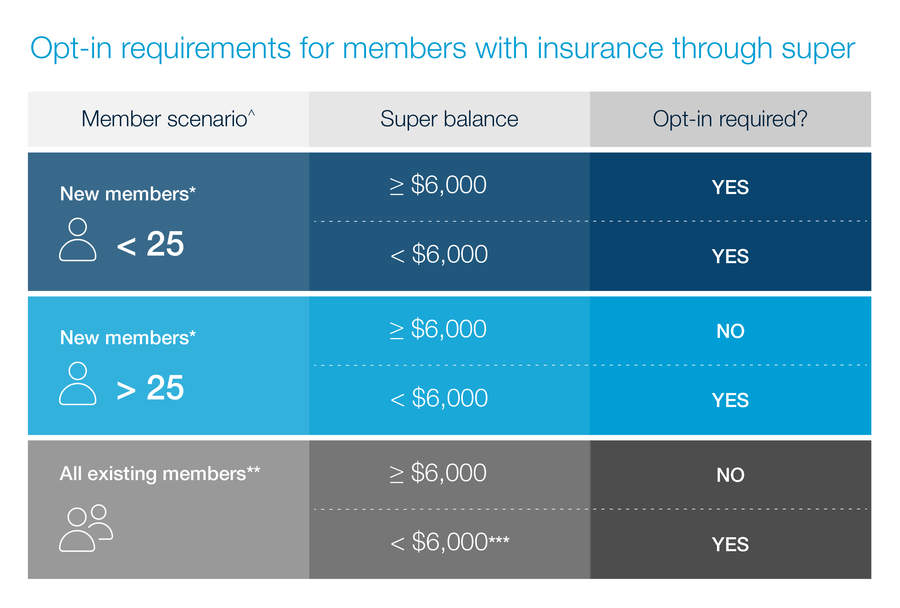

According to ATO rules every employer is obliged to make super guarantee payments on behalf of eligible employees and the default fund is where those payments will go unless an employee has nominated a super fund. Excluding default insurance where a person has 6000 or less in their account including new starters in the workforce. The default amount you may be covered for depends on your age account type and eligibility.

This cover provides a basic level of protection if you die or become ill or injured. Age-based cover is designed to provide a minimum amount of cover. If you dont know which division youre in you can check by logging.

Under the law super funds will cancel insurance on inactive super accounts that havent received contributions for at least 16 months. The choice is yours. Life cover in super is typically only for relatively small amounts though you can opt to increase your cover with financial research firm Rice Warner stating in its Underinsurance in Australia 2020 report that the median default life insurance cover within super meets approximately 65 to 70 of the basic cover needs of average households.

This may not be sufficient to cover all your financial commitments with some financial advisers suggesting a young family with a large mortgage living in a capital city would need at least 1 million to cover their financial commitments in the event the main income-earner dies. Check in with your super funds to find out whether you have default insurance cover whether itll disappear in July and whether it is right for your needs. You are aged 25 and above and your account balance has reached 6000 or more at least once and.

Different terms and conditions apply to our different divisions. Under the governments Putting Members Interests First changes from 1 April 2020 insurance through super cannot be provided to a member if their super account balance has never reached 6000 since 1 November 2019 if the member has not opted in to keep their cover. However and this is a big however the funds default death cover meets a much lower.

For more on life insurance inside super and how it works see the following SuperGuide articles. Underinsurance in Australia 2014 a 94-page report published over the past week by Rice Warner Actuaries estimates that the median default cover provided by super funds cover meets 60 per cent of the life insurance needs for average households. Find out about default cover Default insurance for Personal members.

UniSuper default insurance cover. Death and TPD cover is provided for people who elect their super funds default investment option. The easiest way to know if youre affected is to open and read any letters emails or SMS messages you receive from your super fund but if youre not receiving those its important you identify the fund and make.

Life cover usually ends at age 70. Group insurance in super is an important safety net for millions of Australians who may not otherwise take out or hold life insurance cover. AustralianSuper provides most members with basic insurance cover with their super account.

TPD insurance cover in super usually ends at age 65. Greater insurance coverage for a larger proportion of the Australian population thus helping to reduce Australias well documented underinsurance issue in some instances default group insurance in superannuation improves access to insurance for. The default cover you automatically receive depends on your age employment arrangements and account balance.

Insurance in super is offered as a default recognising that many wont choose to take out cover in some cases because of behavioural biases or may be limited from accessing cover for example because of medical history. The Government is proposing to alter the default insurance cover arrangements from July 2019 by. There are many types of life insurance benefits available in the market.

Generally most super funds only offer default death cover of between 100000 to 400000. Requiring new members aged under 25 years to opt in for insurance cover with their super fund. Your default insurance cover will start once you satisfy the following.

Our Insurance in your super guide contains terms and conditions about insurance including costs your eligibility for cover how much you can apply for when cover starts and stops and limitations or exclusions. We offer default Life and TPD Insurance cover of 250000 thanks to Hannover Re. Eligible members receive age-based Death Total Permanent Disablement TPD and Income Protection cover.

It can be a costly mistake to assume that your super funds default insurance cover is adequate for your circumstances. Want more less none. Underinsurance in Australia 2014 a 94-page report published over the past week by Rice Warner Actuaries estimates that the median default cover provided by super funds cover meets 60 per cent of the life insurance needs for average households.

Life Insurance Through Super Pros Cons Canstar

Stapling In Super What The Changes Mean For You Choice

Life Insurance Through Super Pros Cons Canstar

Superannuation Costs Fees What Do Super Funds Charge Canstar

Important Changes To Insurance In Superannuation

Income Protection Through Super Iselect

Where To Find Your Member Number Sunsuper

Australiansuper Review Performance Fees Finder Com Au

4 Different Ways To Purchase Life Insurance Tal

Insurance In Superannuation Insurance Cover Unisuper

Australiansuper Review Performance Fees Finder Com Au

Australian Super Complying Fund Letter

Super Insurance Insurance Through Super Australiansuper

Changes To Insurance Within Super For Low Balance Accounts Bt

Australiansuper Productreview Com Au

Australiansuper Overview Superguide

Australian Super Complying Fund Letter

Posting Komentar untuk "Default Insurance Cover Australian Super"