Does State Farm Cover Hit And Run

If your car is damaged after hitting a mailbox you may be able to repair your vehicle if you have collision. Travel Expenses pays for meals lodging and transportation home or to your destination up to 500 per loss if your car isnt drivable because of damage done more than 50 miles from home thats covered by your.

State Farm Claims And Car Accident Settlements In 2021

Does my insurance cover if I hit my mailbox.

Does state farm cover hit and run. Your auto liability coverage will pay for the damage to the car you hit as well as for the medical bills and other costs from the injuries sustained by the driver and the passenger including pain and suffering and lost wages. For example damage caused by fire wind hail flood theft vandalism falling objects and hitting an animal is covered. With the comprehensive auto insurance coverage your vehicle remains protected even if it is parked in your garage.

Does State Farm liability cover hit and run. Comprehensive coverage pays to repair or replace a covered vehicle thats stolen or damaged by something other than collision or rolling over. Adding uninsured motor vehicle coverage to your policy means youre covered in scenarios like these and that State Farm will help pay for your medical expenses pain and suffering and lost wages.

If you dont have uninsured motorist coverage or if its not available in your state youll most likely be paying for repairs on your own. So its not out of the realm of possibility that you were backing out of your driveway and got a little too close to your own mailbox. Washington state requires all drivers to carry liability insurance and proof of auto insurance.

If you want a big payout in a minor impact whiplash case. If you have coverage for uninsured motorists this might cover claims for a hit and run but youll need to check with your provider based on your state laws and exact coverage. So depending on the size of your deductible it may not make sense to file a claim unless the damage is severe Worters says.

You must have collision coverage and pay the deductible if your car is damaged. This makes me wonder whether or not I should take my reps word. Because you do not know the at-fault party you will need to use your uninsured motorist coverage for damage to your vehicle and any medical costs associated with injuries from that accident.

Each vehicle covered by state insurance does liability cover hit. To clarify when you are making a claim against the person who hit your car what we car accident attorneys call a third party claim you are not obligated to give a. To be exactly sure about your policy please get in touch with your insurer and discuss your situation.

Uninsuredunderinsured motorist coverage may also be used to help pay for damage and injury caused by a hit-and-run accident or a phantom vehicle. In most cases your automobile insurance will cover for any damage that happens to your car. Im just worried about it affecting my premium.

However if youre hurt in Florida and State Farm insures a driver who is visiting Florida from another state then State Farm may not have to tell you the liability limits. Also your UIMUM coverage will help if you are the victim of a hit and run accident. If your parked car was damaged or hit during a time you were not around and no note has been left behind then your insurance carrier is most likely going to treat it as a hit-and-run case.

UMPD cannot be used to cover hit-and-run accidents in a small number of states. In that case what do you do. If you have a 16 each day400 each occurrence limit State Farm will pay up to 16 each day and up to 400 for each occurrence for your rental vehicle.

This type of hit and run would also be covered under uninsured motorist coverage. A 2011 study by State Farm found that vehicle repairs from damage caused by a pothole can cost drivers an average of between 300 and 700. Hit and runs suck especially if theres no witnesses or security footage of the incident.

According to the Insurance Information Institute in some states where the coverage is available hit and run accidents arent always covered. However comprehensive coverage is not mandatory by law so not every vehicle owner has this coverage included. What to do if youre hit by an uninsured or underinsured driver.

We all make mistakes. It will depend on whether or not the out of state drivers insurance was issued in a state that requires insurance disclosure. State Farm Insurance Claims Secret 2.

State Farm is not responsible for and does not endorse or approve either implicitly or explicitly the content of any third party sites that might be hyperlinked from this page. If you dont have collision or uninsured motorist property damage coverage your car will not be covered if damaged in a hit-and-run. GEICO Progressive and State Farm typically wont offer much for an uninsured motorist bodily injury insurance claim for whiplash if there is no or very little damage to the vehicles.

Depending on other party was damaged by a liability does insurance cover hit and run car was excellent benefits as possible product name of an animal strikes and no two separate coverage. Your insurance agent is your best resource if you find yourself in this unfortunate situation. If youre the victim of a hit and run youre covered only if you have bought particular types of coverage.

There seems to be a lot of unsatisfied statefarm insurance holders who have encountered a hit and run and have had their insurance premiums increased. For example if you have a 1000 deductible and it costs 750 to repair your gutters after a covered event youll have to pay the entire amount out of pocket since the cost is. If you live in one of those states youll need to add collision coverage to properly cover vehicle damage caused by a hit-and-run.

If youre in an accident with one of these drivers they may not have the money to pay for the damages theyve caused. There is a slight possibility that such cases can hold you accountable but if you have collision coverage filing a claim and obtaining a report can cover. The information is not intended to replace manuals instructions or information provided by a manufacturer or the advice of a qualified professional or to affect coverage under any applicable insurance policy.

Using Your Words Against You The next secret of dealing with State Farm pertains to recorded statementsspecifically that you do not have to give one. Liability insurance -- mandatory virtually everywhere -- does not cover you or your car.

Drive Safe Save Apps On Google Play

:max_bytes(150000):strip_icc()/State-Farm-23470380da484678b0ce2990db6af640.png)

State Farm Vs Geico Which Should You Choose

How Electronic Proof Of Insurance Can Assist You State Farm

I Love Nena And All The Staff They Re Extremely Knowledgeable And Offer Great Customer State Farm Insurance State Farm Business Tools

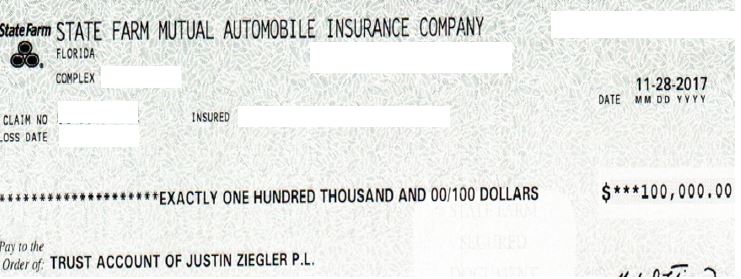

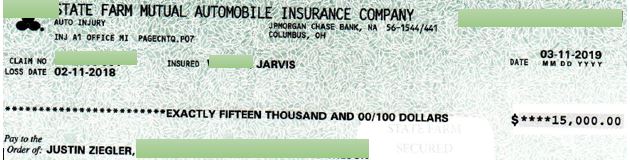

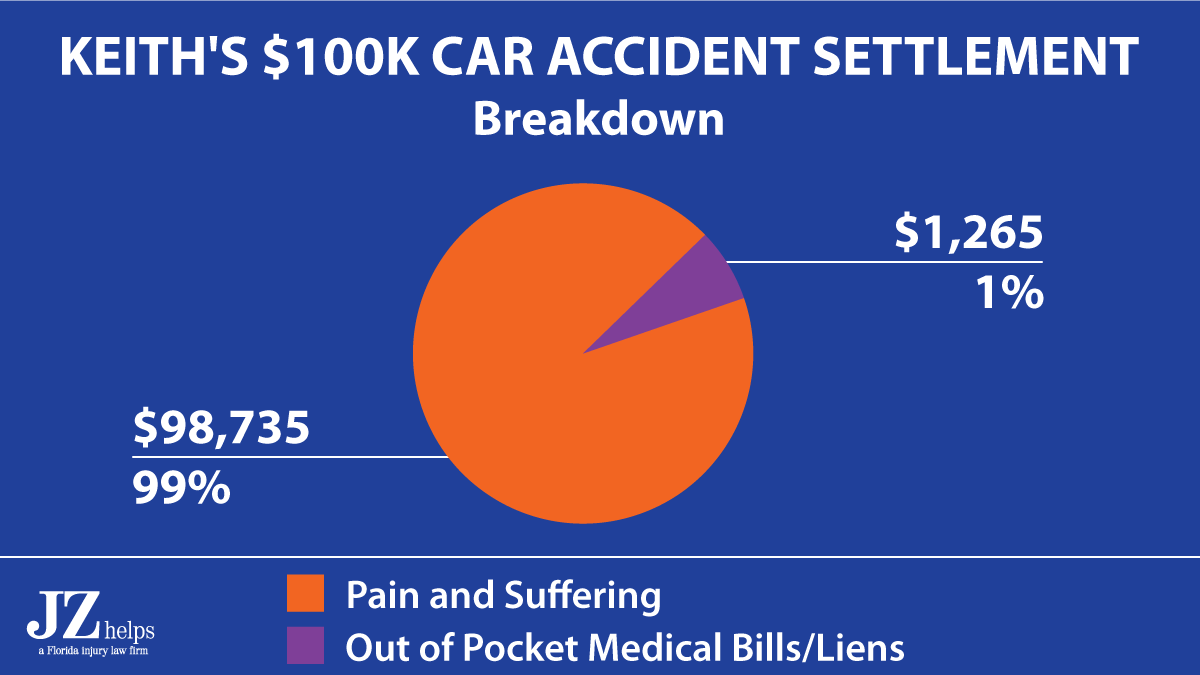

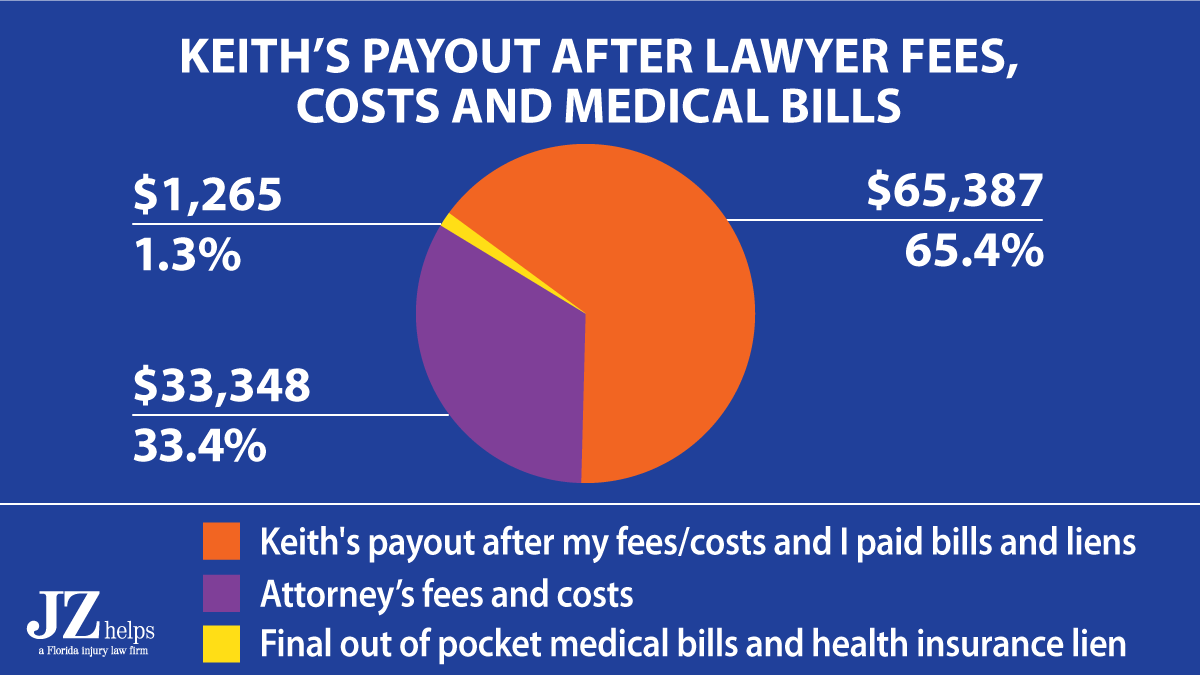

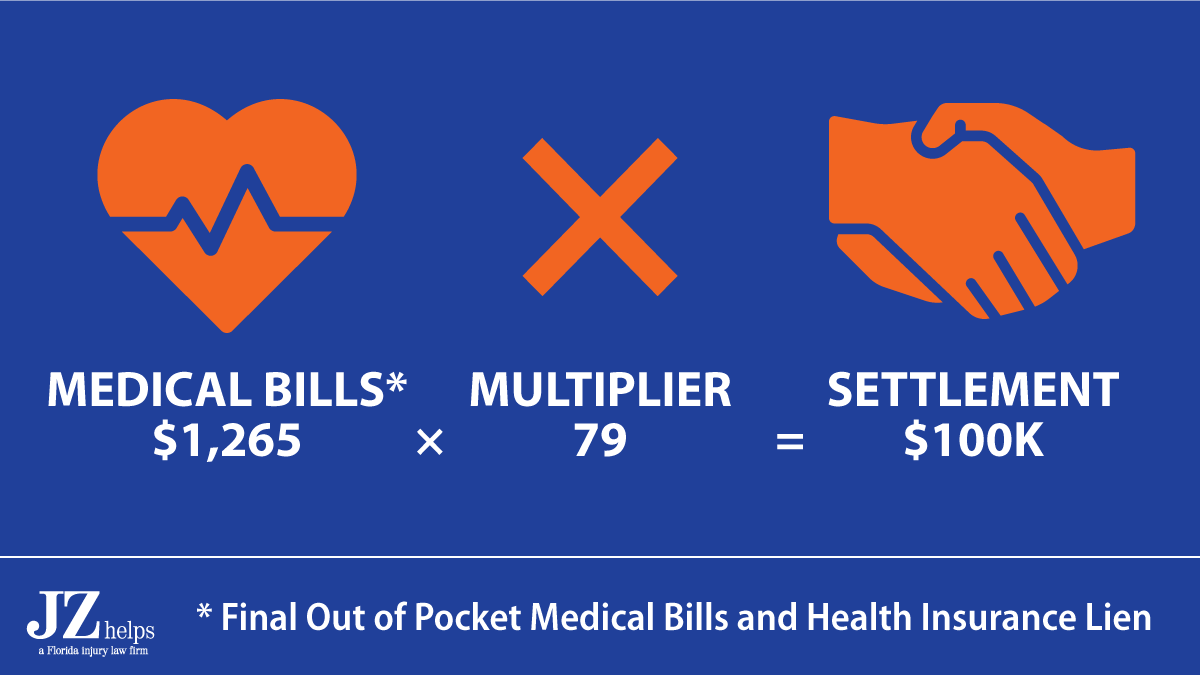

State Farm Claims And Car Accident Settlements In 2021

State Farm Claims And Car Accident Settlements In 2021

State Farm Auto Home Insurance Review Quality Service And Lots Of Coverage Options Valuepenguin

Comparing State Farm Vs Geico Vs Progressive Vs Allstate Vs Farmers Valuepenguin

State Farm Claims And Car Accident Settlements In 2021

State Farm Claims And Car Accident Settlements In 2021

State Farm Claims And Car Accident Settlements In 2021

State Farm Drive Safe And Save Review Clearsurance

The Best Car Insurance Companies Of October 2021 Money

Liability Car Insurance Coverage State Farm

2021 State Farm Insurance Reviews 3 000 User Ratings

State Farm Auto Home Insurance Review Quality Service And Lots Of Coverage Options Valuepenguin

State Farm Claims And Car Accident Settlements In 2021

Liability Car Insurance Coverage State Farm

State Farm Claims And Car Accident Settlements In 2021

Posting Komentar untuk "Does State Farm Cover Hit And Run"