Accidental Insurance Cover In Pmjdy

Claim processedpayment awaited Rejected Claims. Claim Procedure under Accidental Insurance.

Pradhan Mantri Suraksha Bima Yojana And Jeevan Jyoti Bima Yojana Accident Insurance Bima Life Insurance

Circular of Rupay Insurance Programme for 2017-18.

Accidental insurance cover in pmjdy. The policy provides the benefits to you for Accidental Death and Permanent Total Disability. Under PMJDY the claim under Personal Accidental Insurance shall be payable of the RuPay Cardholder have performed a minimum of one successful financial or non-financial customer transaction at any Bank Branch Bank Mitra ATM POS E-COM etc. 2 lakh for PMJDY accounts opened after 2882018.

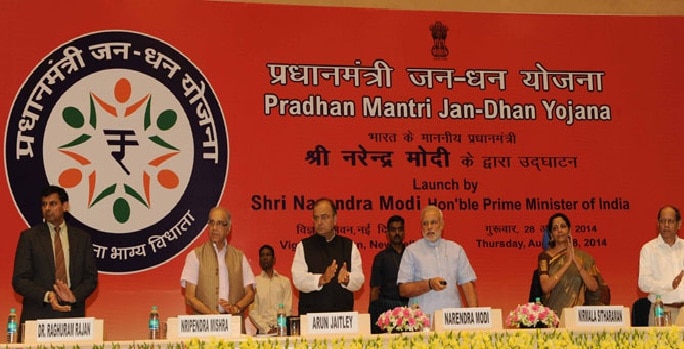

Enhancement in overdraft facilities OD limit doubled from Rs 5000- to Rs 10000-. On 28th August 2014 Prime Minister Narendra Modi announced a life cover of Rs. Security of money along with interest.

2 lakh is for PMJDY accounts opened after 28082018. Accidental insurance cover of Rs. In 2018 the government launched PMJDY 20 with enhanced features and benefits.

Increase in upper age limit for OD from 60 to 65 years. Does the Personal Accident policy cover natural death suicide or death due to some. The increased coverage amount of Rs.

Special benefits attached to the scheme are. If both husband and wife who are opening accounts under PMJDY are eligible for Accidental Insurance Cover of Rs100 lac and overdraft facility. For the new RuPay cardholders who have opened their new PMJDY account after 28th August 2018 the accidental insurance cover has been raised from the existing Rs.

A minimum monthly remuneration of Rs 5000 to business correspondents who will provide the last link between the account holders and the bank. Addendum - PMJDY Claim Procedure. 30000 for account holders under this scheme.

How to Check the. This insurance cover provides coverage for. Who will pay the premium.

You get to avail an overdraft facility after 6 months. 30000 which is available subject to fulfilment of eligibility conditions. No minimum balance required.

Accidental Insurance cover of Rs100 lac will be available to all account-holders. It provides accidental insurance cover upto Rs100 lac without any charge to the customer. 10000 to eligible account holders is available.

Now you can protect yourself with Personal Accident Insurance against accidental injuries caused by all kind of accidents. STATEMENT OF CLAIMS UNDER PMJDY FOR RUPAY CARD LINKED ACCIDENTAL INSURANCE COVER OF RS. For getting the life insurance cover in PMJDY accounts opened between 15082014 to 26012015 now extended to 31012015 for the first time will get the benefit.

Accidental Insurance Cover is Rs100 lac and no premium is charged to the beneficiary -- NPCI will pay the premium. However for withdrawal of money from any ATM with Rupay Card some balance is required to be kept in account. Government has started a scheme called Aam Admi Bima Yojana The individuals covered under this scheme will get Rs 30000 as life cover and Rs70000 as accident cover.

RuPay Card Insurance Free accidental insurance cover on RuPay cards increased from Rs. So Personsfamilies who are included in AABY are not eligible for PMJDY life cover. An overdraft OD facility up to Rs.

Under the new version the government decided to shift focus from every household to every unbanked adult and free accidental insurance cover on RuPay cards doubled to Rs 2 lakh for PMJDY accounts opened after August 28 2018. Circular of Rupay Insurance Programme for 2019-20. Accidental insurance cover of Rs100 lac iii.

The bank account comes with a RuPay debit card with a built-in accidental insurance cover of Rs. PMJDY is a nationwide scheme launched by the Government of India which aims to ensure financial inclusion of every person who does not have a bank account in India. Life Cover under PMJDY - Guidlines.

2 lakh to new PMJDY accounts opened after 2882018 is available with RuPay card issued to the PMJDY account holders. 3241 crore Jan Dhan accounts have been opened with more than Rs 81200. Accident Insurance Cover of Rs1 lakh enhanced to Rs.

Credit facility can be extended in the existing account if it is being operated satisfactorily. Existing account holders can get issued a RuPay Card in his existing account to get benefit of accident insurance. What is Accidental Insurance Cover.

1 lac to Rs. Accidental Insurance. Circular of Rupay Insurance Programme for 2018-19.

Issuance of RuPay Debit Card with inbuilt Rs 2 lakh personal accident insurance cover. Life insurance cover up to Rs. This scheme consists of an accident insurance cover of Rs.

If both husband and wife who are opening accounts under PMJDY are eligible for Accidental Insurance Cover of Rs100 lac and overdraft facility of Rs5000- in both the accounts separately. Main pillars of the PMJDY are-Banking the Unbanked Securing the Unsecured and. 1 lakh to Rs.

What are the direct special benefits attached to PMJDY. 1 lakh and a Rupay card. Ad Search Online Insurance Schools - Find results on Seekweb.

FAQ - RuPay Insurance Program. This limit has been raised to Rs 200 lac for new PMJDY accounts opened after 28082018. Addendum - RuPay Insurance Program FY 2016-17.

100000- as on. You would earn interest on the deposit. E Under the expanded coverage from every household to every adult accidental insurance cover for new RuPay card holders to be raised from Rs 1 lakh to Rs 2 lakh to new PMJDY accounts opened after 28818.

OD upto Rs 2000- without conditions. No conditions are attached to the active PMJDY accounts holders availing the overdraft facility up to Rs. Ad Search Online Insurance Schools - Find results on Seekweb.

In this direction the Pradhan Mantri Jan DhanYojana PMJDY sets out to provide a basic Bank account to every family who till now had no account. This scheme provides all banking services like remittance credit insurance pension savings and deposit accounts to the poor and needy section of our society. Benefits of having a PMJDY account.

You would be provided with an accidental insurance cover up to Rs. Free accidental insurance cover on RuPay cards also increased from Rs 1 lakh to Rs 2 lakh for accounts opened after August 28 2018.

Pradhan Mantri Jan Dhan Yojana Close To 65 Lakh Jan Dhan Accounts Opened In Haryana The Financial Express

Pradhan Mantri Jan Dhan Yojana Pmjdy National Portal Of India

Free Rs 2 Lakh Insurance For Jan Dhan Accounts Fixed Basic Income For All Indians Likely Highlights Of Budget 2017 India Com

1 767 Claims Of Accidental Insurance Settled Under Pmjdy Business Standard News

Jan Dhan Yojana Pmjdy Account Gives Up To Rs 1 3 Lakh Accidental Death Insurance Rs 5 000 Overdraft Facility Too Zee Business

Pm Jan Dhan Yojana Apply Online 2021 Registration Form

Pmjdy Is A National Mission On Financial Inclusion Encompassing An Integrated Approach To Bring About In 2021 Financial Inclusion Accident Insurance Way To Make Money

Pradhan Mantri Jan Dhan Yojana Pmjdy National Mission For Financial Inclusion Completes Six Years Of Successful Implementation

Seven Years Of Pmjdy Orissapost

Pradhan Mantri Jan Dhan Yojana Want Rs 30000 Insurance Cover Fulfilled By Lic Find Check Eligibility Zee Business

Pradhan Mantri Jan Dhan Yojana Pmjdy National Mission For Financial Inclusion Completes Seven Years Of Successful Implementation

Pradhan Mantri Jan Dhan Yojana New Update Pmjdy Benefits Life Insurance And Accident Coverage Youtube

Pmjdy All About Pradhan Mantri Jan Dhan Yojana 2021

Accidental Claim Pmjdy Jan Dhan Yojana Pm Jan Dhan Yojana

Pmjdy All About Pradhan Mantri Jan Dhan Yojana 2021

Seven Years Of Pradhan Mantri Jan Dhan Yojana

Pmjdy Pradhan Mantri Jan Dhan Yojana Provides Insurance Cover Of Rs 2 Lakh Along With Many Other Benefits

Pradhan Mantri Jan Dhan Yojana Rs 30 000 Life Insurance

Posting Komentar untuk "Accidental Insurance Cover In Pmjdy"