Types Of Cyber Insurance Coverage

It breaks down the services into three categories. Cyber insurance from Nationwide.

Cyber Liability And Data Breach Coverage Employment Practices Liability Property Insurance False Pretense Coverage Car Dealership Car Dealer Insurance

Cyber insurance has had a unique evolution having developed in the specialty insurance markets but rapidly becoming a standard product for all types of organizations.

Types of cyber insurance coverage. Data compromise protection identity recovery protection and CyberOne protection which protects against and repairs damage caused by a computer attack or virus. We offer three cyber insurance coverages and services. Most cyber policies will contain a similar combination of coverage elements and the basic insuring agreements will offer coverage to the full policy limits but most policies are flexible and allow organizations to choose the type of coverage they need.

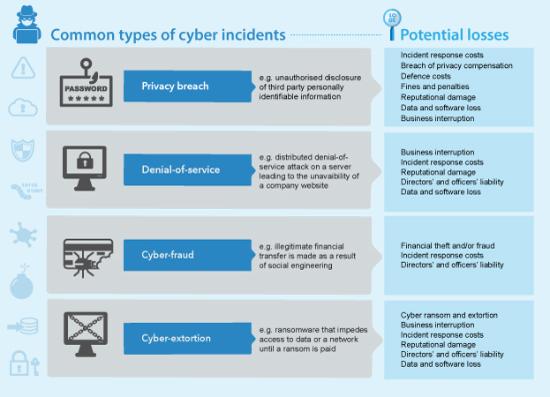

Cybersecurity insurance is designed to mitigate losses from a variety of cyber incidents including data breaches business interruption and network damage. Nationwide offers several different types of cyber insurance coverage. It also covers the cost incurred in responding or defending various regulatory investigations.

Cyber insurance can include both first-party and third-party coverage. The cyber insurance market is segmented on the basis of component insurance coverage insurance type organization size and end users. Costs associated with Legal and Regulatory Actions- This refers to covering of all the costs which are associated with drafting notification legal advice given to concerned regulatory bodies.

The equally important second step is determining what types of cyber insurance a business requires. Most cyber insurance policies will include first and third-party coverage. Cyber liability insurance is the coverage a business needs to recover from a cyberattack data breach or any form of a malicious attack on its cyberspace.

Cyber Insurance Market Research Report by Insurance Coverage Cyber Liability and Data Breach by Organization Size Large Enterprises and Small Medium-sized Enterprises by Component by Insurance Type by End User by State California Florida and Illinois - United States Forecast to 2026 - Cumulative Impact of COVID-19. The third deals with companies that provide technology services and products. A robust cybersecurity insurance market could help reduce the number of successful cyber attacks by.

The first two deal with risks relating to a Data Breach. It takes care of the cost for this recovery while also covering every legal claim resulting from the attack. Data compromise protection which includes credit monitoring and services provided by a public-relations firm.

AIG has all of the same options plus a 247 cyber claims hotline where. Choosing to add cyber insurance coverage is an important first step. This session will cover third party cyber liability exposures and corresponding coverages as they arise in response to dynamic threats to electronic networks and data.

The level of coverage required is going to vary depending on the unique needs of your organization as well as the provider from which you are purchasing the insurance. Hiscoxs cyber insurance includes coverage for liability extortion business interruption and data recovery. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

Your information privacy and operations are all at risk and cybersecurity insurance can protect your business from these risks through network security coverage privacy liability coverage network business interruption coverage media liability coverage and errors and omissions coverage. 123 Types of Coverage. The answer is different for every business but its determined by considering the kinds of threats the business faces and the costsconsequences of those threats.

Cyber liability insurance policies usually include two coverages. What Are the Types of Cyber Insurance Coverage. Generally cyber insurance is designed to protect your company from these primary risks through five distinct insuring agreements.

First-party coverage and third-party liability coverage. TYPES OF CYBER INSURANCE COVERAGES. With this coverage your policy covers loss of business crisis management and cyber extortion.

The three main types of Cyber Liability Insurance Coverage are Cyber Security Cyber Liability and Technology Errors and Omissions Insurance. Nationwide together with Hartford Steam Boiler HSB offers cyber security coverages and services to small business owners. Cybercrimes and attacks could impact the day-to-day operations of your business resulting in lost revenue.

Examples of cyber insurance coverages include but are not limited to. Hiscox also has optional coverage for cybercrime cyber deception and social engineering. Business Interruption Extortion.

Take a look at the various types of coverage that may be included in each. 1 promoting the adoption of preventative measures in return for more coverage. The most prominent cyber risks are privacy risk security risk and operational risk.

Companies of every size are vulnerable to cyberattacks. 10 rows First-party coverage covers you and your business in the event of damages losses or claims.

Enhancing The Role Of Insurance In Cyber Risk Management En Oecd

Pin On Actualidad Nuevas Tecnologias

Ciber Security Risk By Knowledgevault Online Tech Cyber Security Cyber Attack

Reasons To Buy Builder S Risk Insurance In 2021 Commercial Business Insurance Business Insurance Insurance

Cyber Insurance Market Worth 20 4 Billion By 2025 Exclusive Report By Marketsandmarkets Risk Analytics Growth Marketing Marketing Data

Cyber Liability Insurance Liability Insurance Business Liability Business Insurance

Cybercrime Rises Get Cyber Insurance Cyber Cyber Threat Insurance

Understand Your Cyberliability Threat By Having The Mid State Group Perform An Assessment Today Business Insurance Risk Management Business

Cyber Insurance Liability Coverage Quotes From Embroker

Cyber Insurance Faq Cyberwatching

What Is Small Business Insurance Business Insurance Small Business Insurance Commercial Business Insurance

A Breach Of Your Systems Or Loss Of Private Information Is Only One Type Of Cyber Liability Exposure Fa Business Insurance Online Insurance Liability Insurance

Types Of Policies Available To Nursing Home Business Insurance Center Business Insurance Home Insurance Nursing Home

5 Of The Biggest Property Insurance Risks And How To Handle Them As A Small Business Owner Info Risk Management Business Interruption Insurance Fun To Be One

Learn About Cyber Insurance Policy Pinc Insurance Corporate Insurance Insurance Policy Insurance

Health Iot Cybersecurity Risks And Opportunities For Insurance Aluance Digital Cyber Security Health Device Healthcare Companies

Posting Komentar untuk "Types Of Cyber Insurance Coverage"